Following the release of its latest quarterly financial report, Nike Inc., the American sportswear giant, held an analyst conference call in which Chief Financial Officer Matthew Friend outlined the guidelines for the upcoming CEO, and discussed two key areas for future breakthroughs: “Running” and the “Sub-$100 market.”

Additionally, regarding Nike’s third-largest market—China—Matthew Friend shared more detailed data and localization strategies.

In September, Nike announced the return of retired executive Elliott Hill to serve as President and CEO, replacing John Donahoe, who stepped down on October 13.

Prior to this leadership transition, Nike had been experiencing months of sluggish sales, largely due to slowing innovation and an ill-timed retail strategy.

Key financial data for the first quarter of fiscal 2025, released on October 1 (covering the period up to August 31), showed sales dropping by 10% year-over-year to $11.59 billion, slightly below analysts’ expectations of $11.65 billion. Net profit fell 28% year-over-year to $1.05 billion.

After the financial report’s release, Nike’s stock fell by about 6% in after-hours trading. By October 9, Nike’s stock had already dropped around 26% year-to-date.

Regarding first-quarter performance, Matthew Friend admitted that while sales aligned broadly with forecasts from three months earlier, actual volume fell short of expectations. He noted that an increase in average selling prices partially offset the lower volumes. NIKE Direct, Nike’s direct-to-consumer channel, saw traffic decline more than anticipated, particularly in digital channels and its partner stores in Greater China, where the drop was particularly pronounced.

In the first quarter, sales in Greater China fell 4% year-over-year to $1.666 billion (down 3% in constant currency terms), making China Nike’s third-largest market by revenue share.

During the call, Matthew Friend provided additional data on Greater China: in constant currency terms, sales through Nike Direct channels fell 16% year-over-year, with a 34% drop in digital channel sales and a 4% decrease in store sales, while wholesale channel sales grew 10% year-over-year.

In terms of profitability, earnings before interest and taxes (EBIT) decreased by 4% year-over-year.

Matthew Friend remarked, “This summer, traffic across all our channels was generally weak. When we examine our business performance, the industry, and the broader environment, we see that Nike is not immune to the challenges currently faced by Chinese consumers.”

“We have seen improvements in full-price sell-through by carefully managing inventory over the past few quarters, but in this quarter, promotions increased due to lower traffic and broader industry trends.”

Despite these challenges, Friend emphasized that Nike remains the top sports brand in China. “When we deliver the best stories and products to local consumers, we stand out in the market, both against global and local competitors.”

“This summer, we generated significant social media buzz by telling the story of Nike athlete Zheng Qinwen, China’s first Olympic tennis champion.”

In a previous call, Matthew Friend highlighted that Nike’s core problem was an imbalance in the product mix—between classic product lines and new releases. The key to solving this was controlling the supply of classic lines while increasing innovation in new products.

In the latest call, he revealed that top-tier innovations and high-performance products continued to resonate with local consumers, with standout products this quarter including the Pegasus 41, Alphafly, and Sabrina 2. Additionally, the enthusiastic response to the newly launched Kobe Tribute Protro series demonstrated that Kobe Bryant remains one of the most beloved athletes in China.

“Chinese consumers do have strong demand for classic lines. However, our focus remains on innovative new products and high-performance items. Compared to other regions, innovation products represent a larger proportion of our business in China.”

Friend concluded by saying, “Looking long-term, although we have lowered short-term expectations for the remainder of this year in China, the sports industry there is a growth market. Sports participation is on the rise, and we remain optimistic about Nike’s long-term prospects in the Chinese market.”

“We believe that from a retail perspective, our investments in the market and the way we present our products through partner stores give us a unique opportunity to showcase our brand in ways we cannot replicate elsewhere.”

“We are focused on the capabilities we are building, particularly products tailored for the Chinese market, digital channels, and supply chain improvements, so that we can continue to serve local consumers at the speed required by this market.”

Nike Pegasus 41

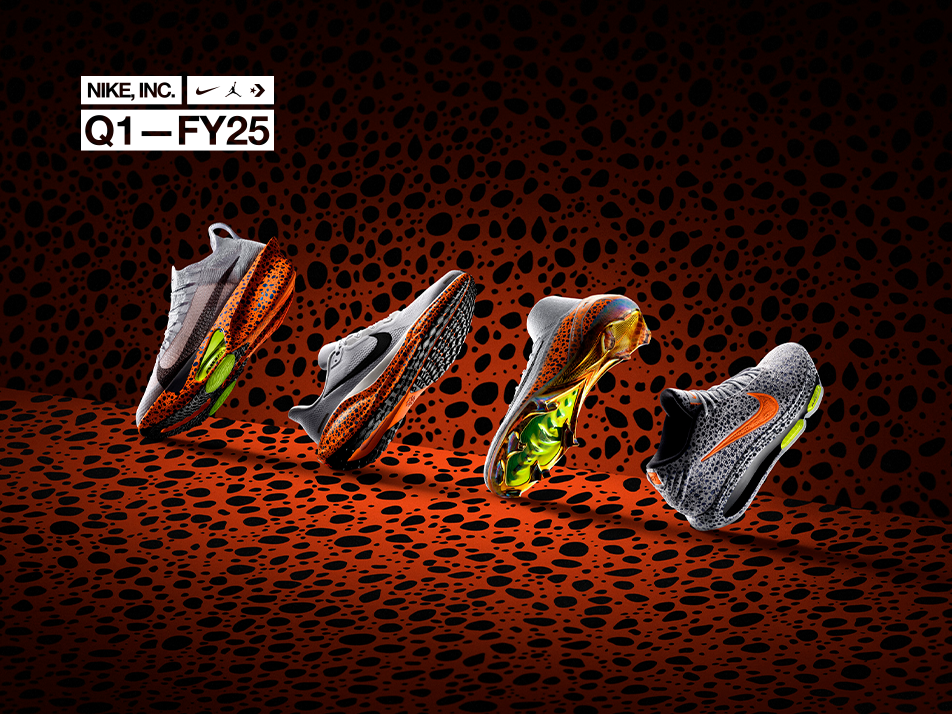

During the meeting, Matthew Friend shared two major areas of opportunity for Nike: “Running” and the “Sub-$100 market.”

He shared the latest data related to “Running”:

- In the first quarter, sales of both men’s and women’s running shoes saw positive growth for the first time in several quarters. This included several series that expanded rapidly over the past 12 months due to strong sales growth, such as the Alphafly series, which nearly tripled in size.

- The launch of Pegasus 41 demonstrated the impact Nike can have when introducing new ideas on a large scale, achieving double-digit growth compared to last year’s Pegasus series. And this is just the beginning; the brand is expanding the series with additional models, including Peg Trail, Peg Plus, and the upcoming Peg Premium, which will feature full-length NIKE Air technology in spring.

- Future order trends are strong, with footwear sales for spring 2025 expected to achieve double-digit year-over-year growth.

“We are particularly excited about the momentum in our running products. It’s an area our team has focused on for over a year. We acknowledge losing market share in the running specialty channel. Four years ago, we reduced investment in that channel, and we have since seen a loss of market share.“

“This has been one of our toughest challenges in recent years, but it is also one of our biggest opportunities,” Friend added. “We are most optimistic about the full product lineup of running shoes and apparel that we will be launching over the next few quarters.”

Friend also shared that he recently participated in a half marathon and witnessed Nike’s extensive involvement in the event.

“Nike is a running company, a running brand, and earning the support of runners is critical to Nike. So, we are committed to reinvesting in this space and working with partners to change the trajectory of this business. The proof points and indicators show that momentum is building, and this is a signal of confidence for us.”

Additionally, Friend highlighted the opportunity in the sub-$100 product range. The team has been using Speed Lane to bring these products to market faster.

For years, Nike has had an Express Lane for quick-turn replenishment and hyper-localized designs. Over the past year, Nike has established a new way of working through the Speed Lane, utilizing advanced digital tools to accelerate product testing and production with key manufacturing partners.

Friend candidly acknowledged that Nike had forfeited billions of dollars in sales in recent years but said that partners are excited about the new products coming in this space.

Nike Alphafly Series

| Source: Official Financial Report, Conference Call

| Image Credit: Corporate Website

| Editor: LeZhi