China cosmetics group Proya (SH:603605) released its 2023 third-quarter report. The revenue increased by 21.36% year-on-year to CNY 1.62 billion, and the net profit attributable to the parent company increased by 24.24% year-on-year to CNY 246 million. In the first three quarters, Proya achieved a total revenue of CNY 5.249 billion and a net profit of CNY 746 million, with year-on-year growth of 32.47% and 50.60%, respectively.

Proya attributed the revenue growth to the year-on-year increase in online channel revenue and the rapid growth of the “Second Growth Curve Brand.”

As of the closing on October 24th, the group’s stock price rose by 8.39% to CNY 100.8 per share, with a total market capitalization of approximately CNY 40 billion.

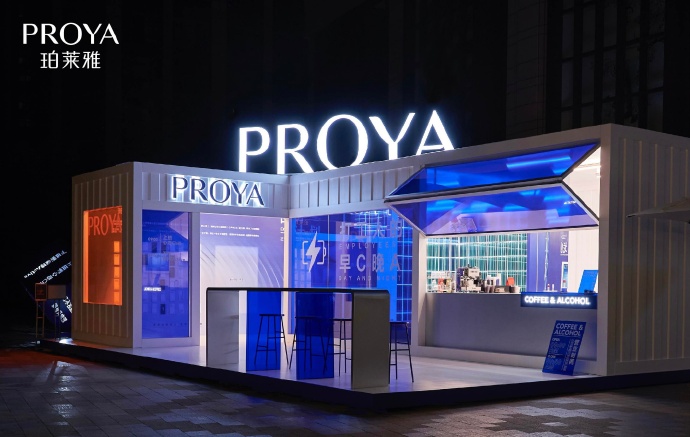

As a new domestic cosmetics industry platform, Proya mainly owns popular skincare brands Proya and Hapsode, makeup brand Timage, hair care brand Off&Relax (OR), and high-efficiency skincare brand CORRECTORS, among others.

In terms of product categories, in the third quarter, Proya’s revenue from skincare products (including cleansing), beauty and makeup products, and hair care products were CNY 1.37 billion, CNY 197 million, and CNY 51 million, accounting for 84.6%, 12.2%, and 3.1% respectively.

Entering the third quarter, Proya’s product prices continued to rise. The average selling price of skincare products (including cleansing) was CNY 64.36 per unit, a year-on-year increase of 57.05% and a month-on-month increase of 15.63%. The average selling price of beauty and makeup products was CNY 101.29 per unit, a year-on-year increase of 37.19% and a month-on-month increase of 9.23%. The average selling price of hair care products was CNY 103.66 per unit, a year-on-year increase of 82.28% and a month-on-month increase of 17.85%.

This also drove Proya’s sales gross profit margin to reach a new high since going public. From 2019 to 2022, the sales gross profit margin was 63.96%, 63.55%, 66.46%, and 69.70%, respectively. In 2023, the sales gross profit margin has been 71.18%, with the third quarter reaching 72.66%.

In addition, the group disclosed the latest shareholding information. As of the end of September 2023, Proya’s founder, Hou Juncheng, still holds the largest stake, approximately 34.5%. The second largest shareholder is Hong Kong Central Clearing Limited, holding approximately 19.5%, with a reduction of 12.28 million shares in the third quarter. Co-founder Fang Yuyou holds approximately 15.0%, with 17.04 million shares frozen.

Previously, Proya released an announcement disclosing the specific details of the dispute involving the freezing of shares held by the company’s general manager, Fang, and mentioned that the related matters stemmed from a “property division dispute among family members.”

| Source: Official Financial Report

| Image Credit: Group’s Official Website

| Editor: LeZhi