On January 16, before the market opened, Swiss luxury giant Richemont, the parent company of Cartier, Van Cleef & Arpels, Jaeger-LeCoultre, Vacheron Constantin, and other high-end jewelry and watch brands, announced its financial results for the third quarter of the 2025 fiscal year (ending December 31, 2024). At both constant and actual exchange rates, Q3 sales grew by 10% year-on-year to €6.2 billion, setting a record high.

Sales in the Chinese Mainland, Hong Kong, and Macau markets collectively declined by 18% year-on-year last quarter. While the market has not yet returned to growth, this represents a significant improvement compared to a 27% decline in the first half of the fiscal year.

For the nine months ending December 31, 2024, Richemont’s sales grew by 4% year-on-year at constant exchange rates to €16.2 billion, and by 3% at actual exchange rates.

Driven by better-than-expected performance, Richemont’s stock soared after the market opened. As of 10:00 AM on January 16, its share price rose by 15.68% from the previous day’s closing price to CHF 161.55 per share, giving the company a market capitalization of CHF 95.5 billion.

As of December 31, 2024, Richemont’s net cash position, excluding YNAP’s €200 million net cash, rose to €7.9 billion (compared to €6.8 billion in the same period of 2023).

(Net cash position refers to the net balance of a company’s cash and cash equivalents at a specific point in time.)

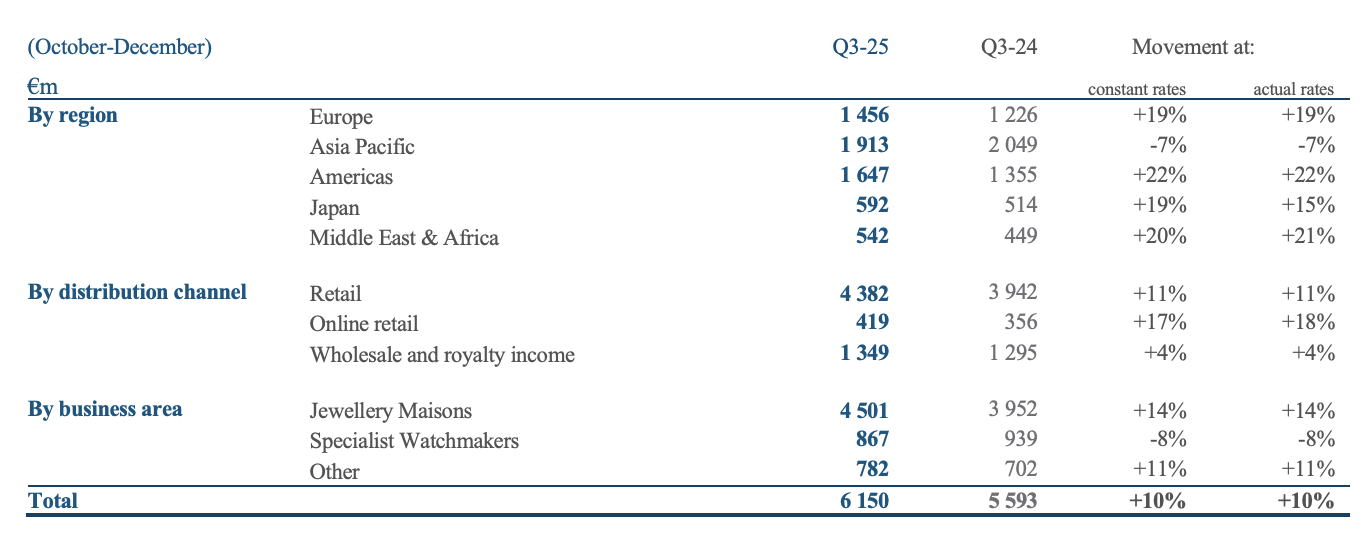

Please refer to the chart below for the following breakdown.

By Business Segment

In Q3, all Richemont business segments showed notable improvement compared to the first half of the fiscal year:

- Jewelry: Sales for the jewelry division—which includes Buccellati, Cartier, Van Cleef & Arpels, and Vhernier—rose by 14% year-on-year, a significant improvement from the 2% growth recorded in H1. This result builds on a 12% increase in the same period last year. Iconic jewelry and watch collections from each brand performed well, while new product launches during the holiday season also achieved great success. Sales grew across all channels and nearly all regions, with Europe and the Americas contributing the most to the increase.

- Specialist Watchmakers: Sales improved in all regions except Asia-Pacific. The year-on-year decline narrowed from -16% in H1 to -8% in Q3. The Americas, Middle East, and Africa achieved significant double-digit growth during the quarter.

- Other Businesses: Sales rose by 11% year-on-year, driven by strong performance at pre-owned watch retailer Watchfinder & Co. Fashion and accessories brands Alaïa and Peter Millar continued their growth momentum, while the consolidation of Gianvito Rossi from February 1, 2024, contributed to a 7% year-on-year increase in sales for this segment.

Note: Richemont operates in three key business areas: jewelry (Buccellati, Cartier, Van Cleef & Arpels, and Vhernier); specialist watchmaking (A. Lange & Söhne, Baume & Mercier, IWC Schaffhausen, Jaeger-LeCoultre, Panerai, Piaget, Roger Dubuis, and Vacheron Constantin); and other businesses, including fashion and accessories brands (Alaïa, Chloé, Delvaux, dunhill, Gianvito Rossi, Montblanc, Peter Millar [including G/FORE, Purdey, and Serapian]), as well as the pre-owned luxury watch platform Watchfinder & Co.

By Market

In Q3, all regions except Asia-Pacific achieved double-digit growth:

- Asia-Pacific: Sales declined by 7% year-on-year due to an 18% drop in the Chinese Mainland, Hong Kong, and Macau. However, the region’s overall performance improved, with a decline narrowing significantly compared to an 18% drop in H1. Most other Asian markets delivered positive results, with South Korea achieving double-digit growth.

- Europe: Sales rose by 19%, fueled by increased domestic demand and spending by tourists, particularly from North America and the Middle East. All major markets in Europe posted growth, with France, Switzerland, and Italy standing out.

- Americas: Sales increased by 22% year-on-year, driven by strong local demand across all business segments.

- Japan: Continued spending by both tourists and domestic consumers led to a 19% year-on-year increase in sales.

- Middle East and Africa: Sales rose by 20%, driven by growth in the UAE and increased tourist spending.

By Channel

In Q3, all distribution channels achieved growth:

- Retail: Sales increased by 11% year-on-year, with nearly all regions contributing to the growth. Jewelry accounted for 71% of retail sales.

- Wholesale and Royalty: Sales grew by 4%, driven by strong performance in the jewelry and other business segments, offsetting declines in the specialist watchmaking division.

- Online: Sales grew by 17%, led by jewelry and other businesses, including fashion and accessories brands and the pre-owned watch platform Watchfinder & Co.

Richemont’s luxury e-commerce business, YOOX-NET-A-PORTER (YNAP), has been classified as a “discontinued operation.” Its assets and liabilities are now listed as “held for sale.” In Q3, YNAP’s sales fell by 15% year-on-year at constant exchange rates (down 14% at actual exchange rates). For the nine months ending December 31, 2024, YNAP’s sales also dropped by 15% at both constant and actual exchange rates. In October 2024, Richemont announced an agreement to sell 100% of YNAP to German luxury e-commerce platform Mytheresa.

|Source: Richemont official website and financial reports

|Image Credit: Richemont official website

|Editor: Wang Jiaqi