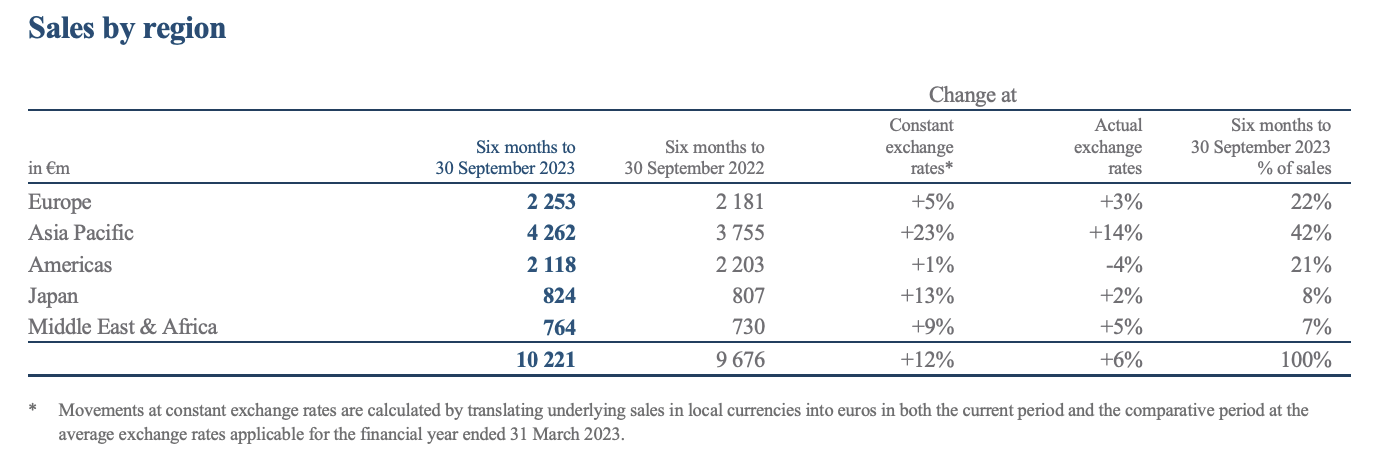

Swiss luxury conglomerate Richemont released its interim financial data for the 2024 fiscal year, ending September 30, 2023: Sales and operating profit from ongoing operations were €10.2 billion and €2.7 billion, respectively. Driven by nearly all regions and distribution channels, sales grew 6% year-over-year at actual exchange rates (all data hereafter is calculated at actual exchange rates). The Asia-Pacific region led the growth with a 14% increase, contributing 42% of sales; the Jewelry Division showed robust performance with a 10% increase; direct retail channels grew 9%, accounting for 69% of the group’s sales.

Johann Rupert, CEO and Chairman of Richemont, noted, “Despite the global economic slowdown and geopolitical insecurity negatively impacting demand, the full impact of rising interest rates has not yet become apparent. It’s no surprise to us that the market will slow down and across all asset classes, because that’s the purpose.”

The report specifically highlights the “higher growth expected from China.” In the first quarter of FY 2024, there was a 90% increase compared to the same period last year, and a 23% increase in the second quarter; compared to the same periods in FY 2020, 2022, and 2023, the compound annual growth rates were 48%, 22%, and 50%, respectively, with an average annual compound growth rate of 10% over the past four years.

Rupert emphasized that Chinese tourist spending is a bright spot, but the recovery of China’s luxury goods industry has been more moderate than some had anticipated.

Speaking in a post-earnings analyst call, he said, “We had predicted that the Chinese market’s recovery would take longer than most market analysts and competitors expected. This has proven correct, although we are beginning to see some signs when they travel to Hong Kong, Macau, or even Japan, the market is still there, just missing the previously positive factors.”

“In the medium term, I am not worried about our customers’ disposable income. They are just being a bit cautious,” he added.

Bernstein analyst Luca Solca commented, “Richemont joined the ‘moderation club’ in the second quarter, but is in a front position.”

Market-wise, except for the Americas, sales increased in nearly all channels and regions. Growth primarily stemmed from the reopening of the Chinese market, driving a 14% year-over-year increase in sales in the Asia-Pacific region.

Overall, the Chinese market, Jewelry Division, retail, and online retail collectively contributed 74% to Richemont’s sales.

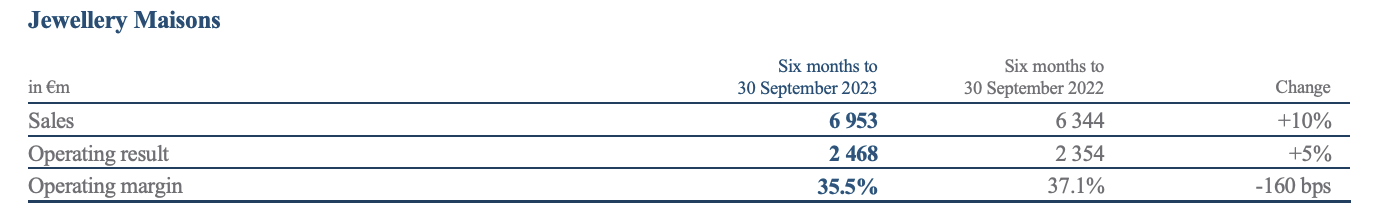

By division, jewelry brands Buccellati, Cartier, and Van Cleef & Arpels continued to maintain their industry-leading positions.

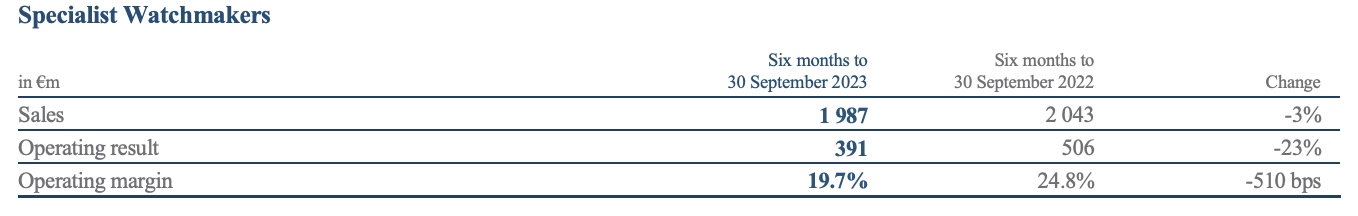

Specialist watchmaking sales declined by 3% year-over-year to €2 billion, but notably, its direct retail channel achieved high single-digit growth, currently accounting for 57% of the division’s sales. A. Lange & Söhne and Vacheron Constantin continued to lead in performance.

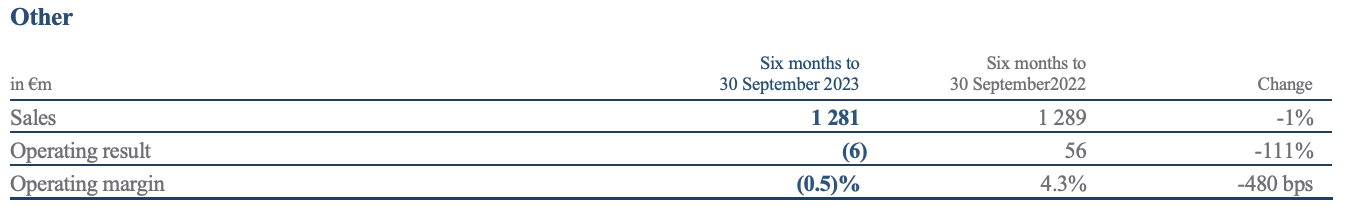

Particularly noteworthy are the retail achievements and the outstanding performances of Alaïa, Delvaux, and Peter Millar, as well as the successful redesign of Montblanc‘s leather goods collection.

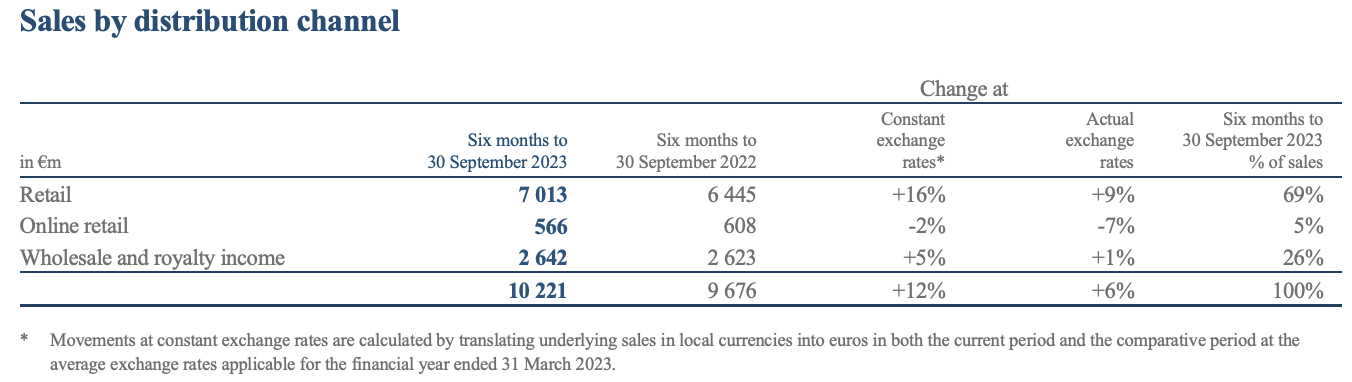

Channel-wise:

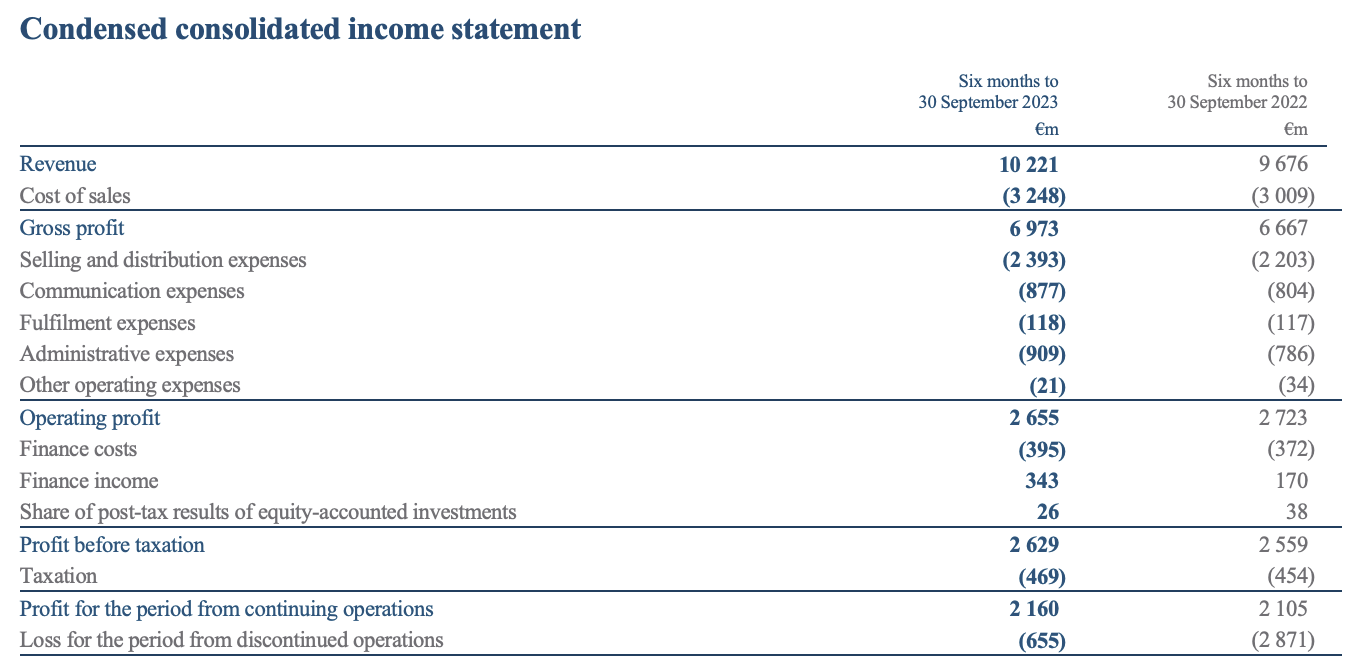

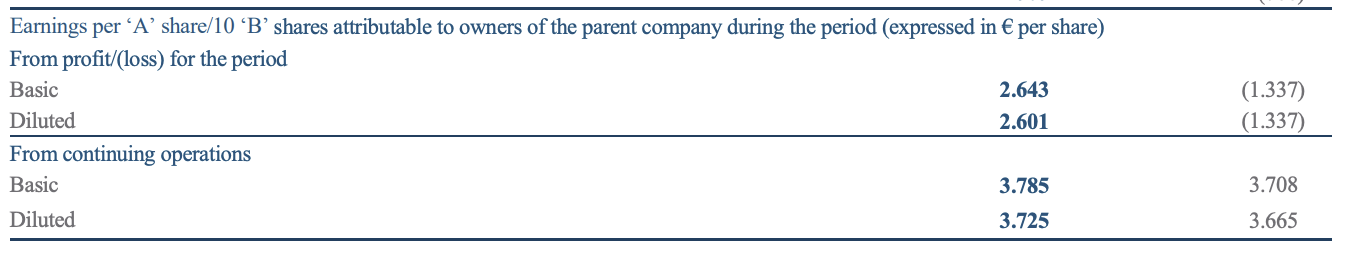

Other major financial data from the report:

Amid the current uncertain macroeconomic climate, Richemont reported a robust net cash position of €5.8 billion. Additionally, Richemont made an additional non-cash write-down of €500 million on its loss-making Yoox-Net-a-Porter e-commerce business.

A Citibank analyst noted that Richemont’s operating profit for the first half-year fell by 2% year-over-year to €2.6 billion, about 8% lower than expected, which “is likely to lead to a high single-digit percentage downgrade in full-year expectations.”

Following the earnings release, Richemont’s performance in the financial markets was as follows:

| Source: Richemont press release, official financial report, Reuters, Yahoo Finance, The Financial Times (UK)

| Image Credit: Richemont official website

| Editor: LeZhi