On May 17, Swiss luxury giant Richemont Group announced its financial data for the fiscal year ending March 31, 2024. The Group achieved solid underlying performance despite adverse foreign exchange fluctuations, a high comparative base, and ongoing macroeconomic and geopolitical uncertainties. Driven by its jewelry brands, the Group’s revenue grew by 3% at current exchange rates (8% at constant exchange rates) to €20.616 billion, with operating profit reaching €4.8 billion, a 13% increase at constant exchange rates.

In China, sales in the mainland, Hong Kong, and Macau markets grew by 7% following the lifting of travel and health restrictions at the beginning of the fiscal year. Japan experienced the highest growth driven by strong tourist demand, particularly from Chinese tourists.

As of the close of trading on May 17, Richemont’s share price rose 5.38% from the previous day to CHF 144.85 per share, with a cumulative decline of 6.46% over the past 12 months, and a latest market value of CHF 84.988 billion.

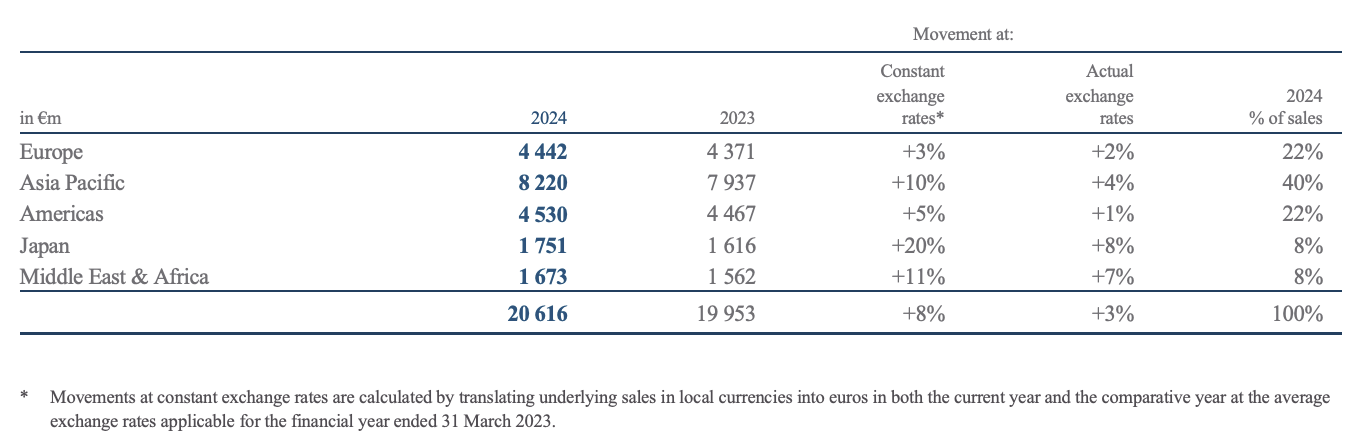

By Region

At current exchange rates, sales increased in all regions and nearly all channels except for online retail. In absolute terms, the Asia-Pacific region showed the most significant growth, with the Americas slightly ahead of Europe.

In China, sales in the mainland, Hong Kong, and Macau markets grew by 7% following the lifting of travel and health restrictions and the resumption of travel in these markets at the beginning of the fiscal year. The United States emerged as the Group’s largest national market. In percentage terms, Japan led the growth, driven mainly by strong tourist demand, particularly from Chinese tourists.

Additionally, the Group stated that sales performance in the Asia-Pacific region was weak in the fourth quarter (January-March 2024) due to a challenging comparative base. However, higher growth in all other regions offset this weakness. Richemont predicts that a sustained recovery in Chinese market demand will still take some time. The Group also noted that as multiple growth drivers emerge, the customer demographic structure is becoming increasingly balanced. Furthermore, Richemont is focusing on local customers in different geographic regions by enhancing direct customer engagement to improve the Group’s adaptability and competitiveness in various market environments.

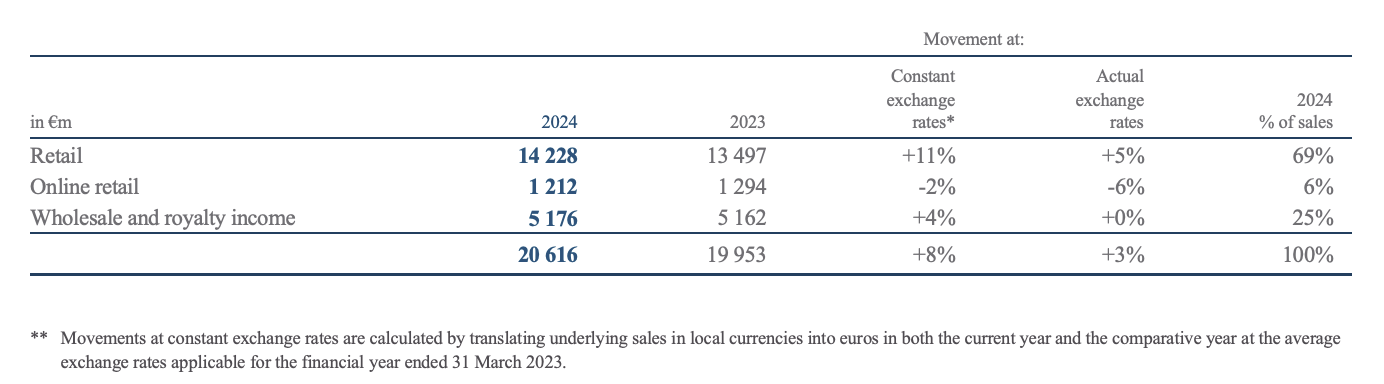

By Channel

The Group’s direct retail stores performed the strongest, with a 5% growth rate (11% at constant exchange rates), proving the success of its direct-to-customer strategy. Retail sales accounted for 69% of the Group’s total sales.

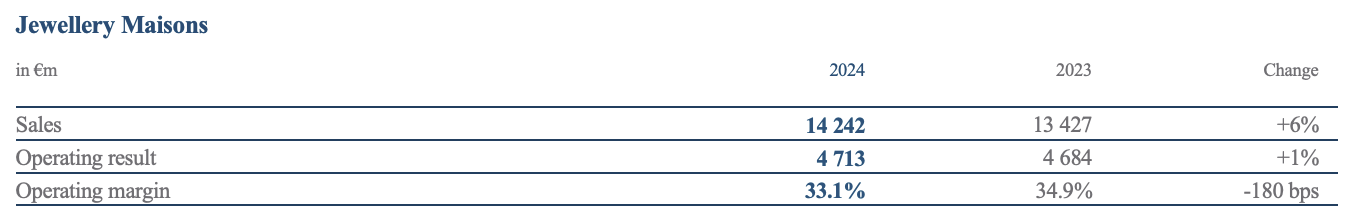

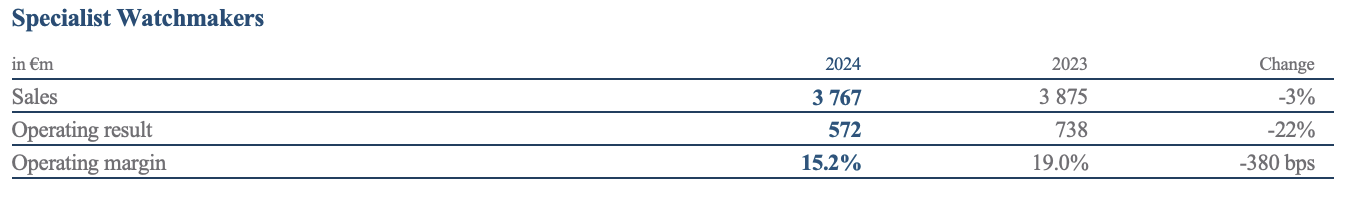

By Department

- At current exchange rates, the Jewelry Maisons division, including Buccellati, Cartier, and Van Cleef & Arpels, surpassed €14 billion in total sales, marking a 6% increase. The Group attributed this growth to the performance of products across various price points and markets, with Buccellati achieving a significant double-digit sales increase. To support the robust growth of these three brands, Richemont increased investments in manufacturing, distribution, and communication during the reporting fiscal year.

- Due to the strong Swiss franc, the Specialist Watchmakers division demonstrated strong financial performance, although sales decreased by 3% at current exchange rates (2% growth at constant exchange rates) to €3.8 billion. A. Lange & Söhne and Vacheron Constantin performed particularly well. Overall, retail channel sales in this division were strong, with retail and online channels accounting for 60% of the division’s total sales.

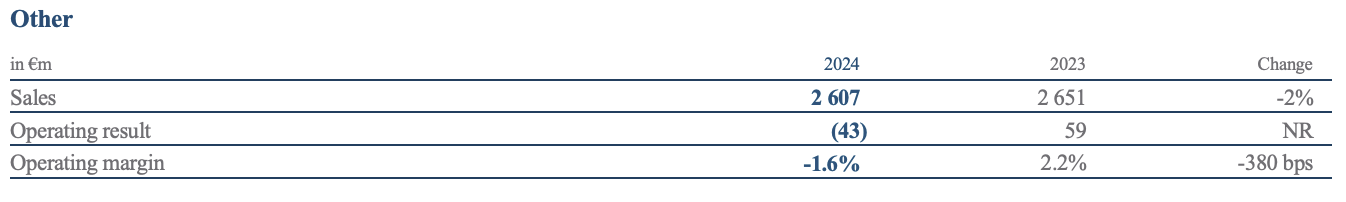

- Other business areas recorded a loss of €43 million. However, the fashion and accessories brands achieved breakeven, driven by a focus on creativity and increased sales, including double-digit growth for the Alaïa brand. Notable performances included the steady growth of Peter Millar and Delvaux, the highly acclaimed first collections from new creative directors at Chloé and dunhill, and the success of Montblanc‘s high-end series.

Richemont Group’s Brand Portfolio

Acquisitions and Developments

During the reporting period, Richemont Group highlighted recent efforts to strengthen its brand and operational portfolio. On January 31, 2024, the Group completed the acquisition of a 70% stake in the renowned Italian luxury footwear brand Gianvito Rossi, further enhancing its fashion and accessories portfolio. On May 7, 2024, Richemont announced an agreement to acquire 100% of the Italian jewelry brand Vhernier, adding to its existing jewelry division. The Group expects to fully leverage the potential of Gianvito Rossi and Vhernier over time. Since the acquisition of Buccellati in 2019, its sales have increased four and a half times.

Additionally, after parting ways with UK luxury e-commerce company Farfetch, Richemont’s brands and luxury e-commerce group YOOX-NET-A-PORTER (YNAP) continue to develop on their own platforms using proprietary technology. Richemont is working to find a new majority shareholder for YNAP to best realize its potential, while also considering alternative plans to achieve its luxury new retail (LNR) vision. Ongoing platform reconstruction and solution design efforts are crucial to this goal. Richemont is currently in discussions with potential buyers and expects to disclose more information by the end of the year.

*Note: In December last year, Richemont announced the termination of the agreement to sell a majority stake in YNAP to Farfetch and Symphony Global.

Personnel Changes

The Board of Directors appointed Nicolas Bos, the current CEO of Van Cleef & Arpels, as the newly created CEO of Richemont Group, effective June 1. He will also join the Senior Executive Committee. Richemont stated that with the Group’s expansion, combined with its shift towards a retail-driven and jewelry-centric model, Nicolas Bos will lead the Group into its next phase of development. In his new role, he will directly and indirectly oversee all brands, functions, and regions, with a particular focus on jewelry brands, finance, and human resources.

Nicolas Bos joined Richemont in 1992, initially working at the Cartier Contemporary Art Foundation in Paris. In 2000, he joined Van Cleef & Arpels as Creative and Marketing Director for High Jewelry. In 2009, while continuing as Creative Director, he also became Vice President of the brand and was appointed President of Van Cleef & Arpels Americas in 2010. In January 2013, Nicolas Bos was appointed Global President and CEO of Van Cleef & Arpels. Since September 2019, he has also overseen Buccellati’s business operations.

ESG Initiatives

In the reporting fiscal year, Richemont further consolidated its ESG approach, completing the development of a Group-wide ESG management system to ensure consistent and coordinated execution of ESG priorities across brands, regions, and functions. The Group also established the Richemont Sustainability Online Academy to enhance internal expertise. In 2023, Richemont received an A- rating from the Carbon Disclosure Project for its ongoing efforts to reduce the environmental impact of its operations and supply chain. Additionally, the Group is committed to providing inclusive work environments across its brands and regions, earning global gender equality certification from the Equal Pay Foundation this year.

Note: At time of writing, 1 Swiss Franc ≈ 1.0998 USD

| Source: Richemont Group’s official website and financial report

| Image Credit: Richemont Group’s official website

| Editor: LeZhi