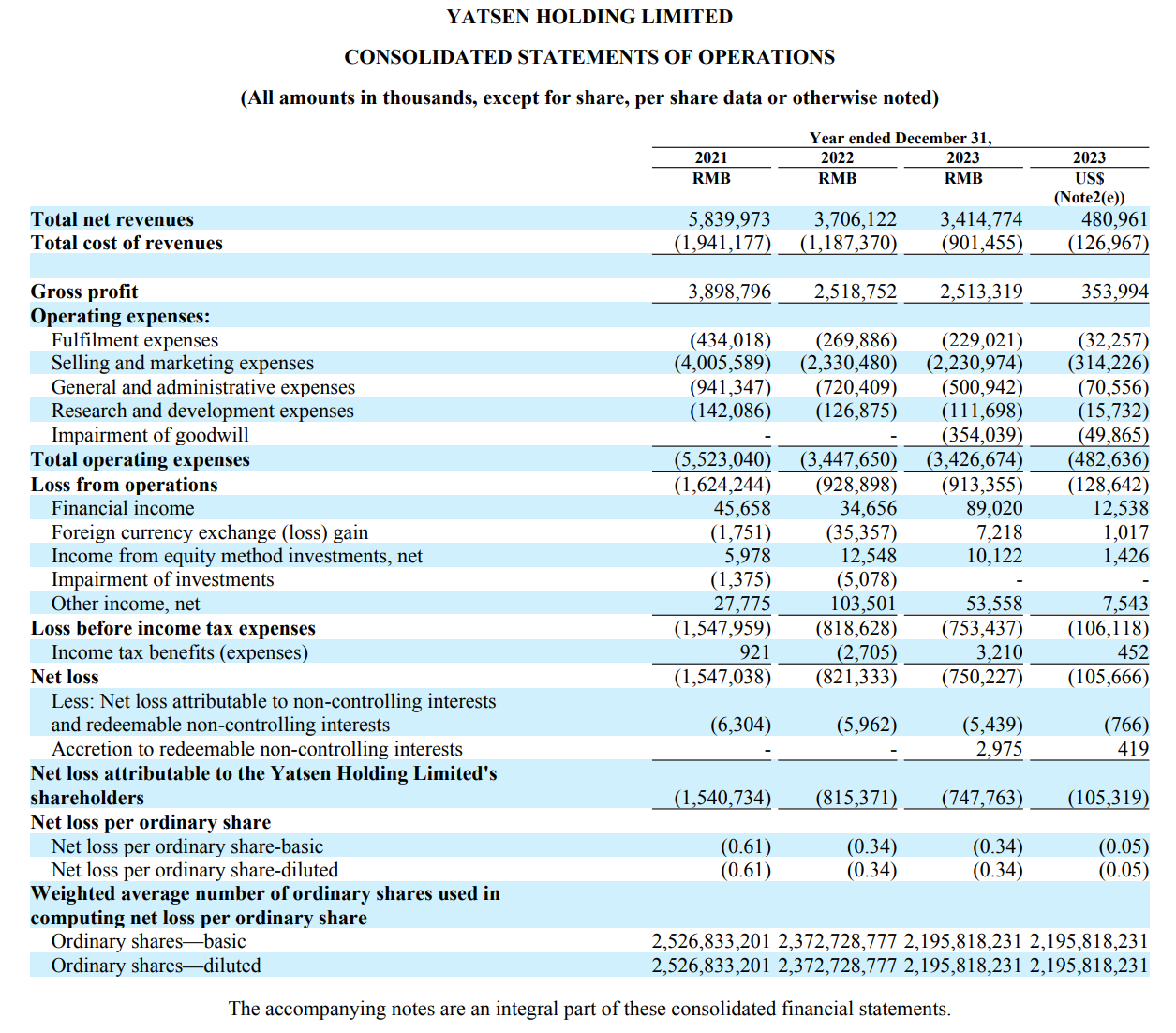

On April 26, Yatsen Holding, the parent company of Chinese cosmetics brand Perfect Diary, released its annual financial report for fiscal year 2023: revenue reached RMB 3.41 billion, a decrease of 7.9%, but gross margin increased from 68% in the same period last year to 73.6%, setting a new annual high. Net loss was RMB 750 million, continuing to narrow the loss margin.

Yatsen Holding launched a five-year strategic transformation plan at the beginning of 2022, aiming to cultivate a portfolio of brands with high differentiation and efficient products to drive sustainable growth. This includes two main initiatives:

1. Balancing the revenue structure, supporting the growth of skincare brands and reshaping the business model of cosmetic brands, and investing in R&D to establish a strong new product line;

2. Reducing costs by implementing stricter pricing and discount policies, and optimizing the supply chain.

By category, revenue from the cosmetics business declined from RMB 2.415 billion in the same period last year to RMB 1.973 billion, but the growth in skincare largely offset the decline in cosmetics.

Yatsen Holding attributed the decline in cosmetics to “increased industry competition from domestic and international brands, a reduction in the number of offline experience stores, and the company’s decision to limit discounts and promotional activities, which affected the sales of cosmetic brands.” Thanks to the brand positioning and product supply of Galénic, DR.WU (mainland China operations), and Eve Lom, the skincare business remained robust, with revenue increasing by 11.4% year-over-year to RMB 1.38 billion, accounting for 40.5% of total revenue, up from 33.5% in the previous year.

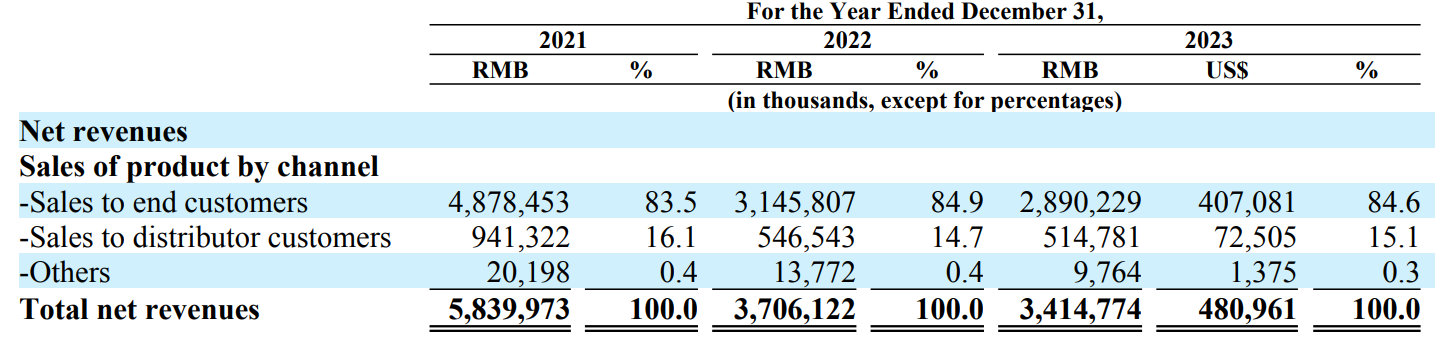

By channel, revenue from direct-to-consumer sales was RMB 2.89 billion, accounting for 84.6% of total revenue; revenue from distribution customers was RMB 514 million, representing 15.1%; other channels accounted for 0.3%.

Yatsen Holding stated that in order to achieve the sustainable growth strategy set for 2024 and beyond, it plans to improve the return on investment across all major sales channels, increase product gross margins, and diversify sales channels including content platforms such as Douban, new e-commerce platforms, and third-party distributors and other beauty-focused offline retail stores.

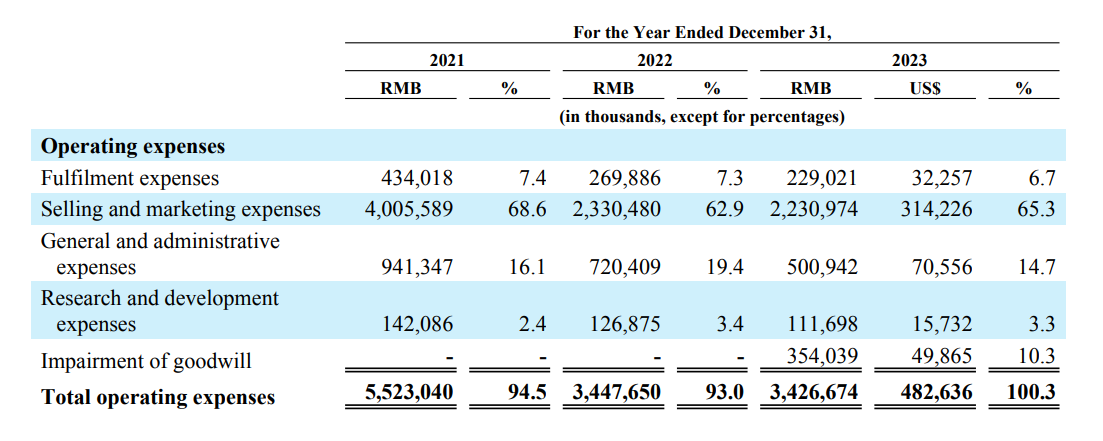

Thanks to cost-cutting strategies, Yatsen Holding’s operating expenses decreased from RMB 3.447 billion in the same period last year to RMB 3.426 billion, with sales and marketing expenses dropping from RMB 2.33 billion to RMB 2.23 billion.

It is noteworthy that in 2023, Yatsen Holding spent RMB 110 million on R&D, raising the annual R&D expense rate from 2.4% in 2021 to 3.3%, applying for 203 patents globally, including 91 invention patents and 57 granted invention patents.

As of the close of trading on April 26 on the NYSE, Yatsen Holding’s stock price was $4.84, up 8.27% from the previous trading day; as of May 4, before the Luxeplace.com article was published, Yatsen Holding’s stock price was $4.30, with a market value of $467 million.

| Source: Annual Report, Yahoo Finance

| Image Credit: Annual Report

| Editor: LeZhi