Following the openings in Beijing’s Sanlitun and Chengdu’s Taikoo Li, Goldwin, a high-end outdoor sports brand, recently launched its third store in China at the Jing’an Kerry Centre in Shanghai.

Goldwin Store at Jing’an Kerry Centre, Shanghai

Since the 1970s, with the rise of Japan’s outdoor sports market, Goldwin Group gradually acquired the distribution rights for brands such as Champion, The North Face, Helly Hansen, and Icebreaker.

In 2003, Goldwin Group collaborated with Eiichiro Homma, founder of the Japanese outdoor brand nanamica, to launch The North Face Purple Label, a sub-line created specifically for the Japanese market. The success of this line significantly boosted The North Face’s (hereinafter referred to as TNF) brand recognition and influence in fashion trends at the time.

In this exclusive interview with Luxe.co, we had the opportunity to speak with Takao Watanabe, President of Goldwin Inc., who has been with the company for many years and witnessed the global success of TNF Purple Label.

When asked to compare the outdoor sports markets in China and Japan, he reflected on his experience managing TNF, stating: “What took Japan 25 years to achieve might take China only 5 years.”

Takao Watanabe, President of Goldwin Inc.

Goldwin Group has witnessed the full development cycle of Japan’s outdoor sports market, from its early stages to mass market adoption, and eventually to the rise of high-end niche segments. Based on thorough analysis, the group decided to reposition Goldwin as a high-end performance and fashion sports brand targeting a global niche market, launching the ‘Goldwin500’ strategic goal — aiming for a global sales revenue of 50 billion yen by 2033.

Notably, China has become the most critical strategic market for Goldwin in this global strategy.

Why is the brand focusing on China? Why did it choose to enter the Chinese market through a joint venture?

What makes Goldwin unique? Why is the brand positioned as high-end?

How will the high-end segment of the outdoor sports market evolve in the future?

With these questions, we had an in-depth conversation with Takao Watanabe and explored Goldwin’s newly designed flagship store.

Goldwin Store at Jing’an Kerry Centre, Shanghai

Why does Goldwin focus on developing the Chinese market? Why did they choose to enter through a joint venture?

“In Japan’s already mature market, it has become increasingly difficult to launch new products. In contrast, China’s purchasing power is significantly stronger, and the market is much larger. The demands of the Chinese market and its consumers should be viewed as part of global demand,” said Takao Watanabe frankly.

The sheer size and continuous allure of the Chinese market have become a powerful attraction, drawing outdoor and sports brands from around the world. As more players enter this highly competitive market, the intensity of competition will undoubtedly escalate.

Is Goldwin ready to face the competition in the Chinese market? We posed this challenging question to Watanabe, a seasoned veteran with over 40 years of industry experience.

“The outdoor industry in China is currently in a high-growth phase, similar to the stage Japan was in around the year 2000.”

Watanabe joined Goldwin in 1982 and began focusing on The North Face around 2000. At the time, only a niche group of “nature lovers” knew about the brand. Watanabe infused the brand with elements of fashion and lifestyle, completely reforming products, stores, and marketing. This effort grew TNF’s presence in Japan from 5 billion yen in sales to the current 100 billion yen, with combined sales in Korea reaching 200 billion yen annually.

The North Face Purple Label Line

“In China, we expect to achieve such results in just five years. By then, outdoor brands will be integrated into more people’s daily lives. If I had to say, we are at the start line of lifestyle integration for outdoor brands in China, and I am excited about the immense potential of this market.”

As for the fierce competition in China’s outdoor sports market, Watanabe sees it as a “great opportunity.” He shared with Luxe.CO:

“The entry of more international brands into the Chinese market demonstrates their optimism about the growth potential in China. I believe global brands are all anticipating what the Chinese market can offer.

For Goldwin, as I mentioned earlier, the key is highlighting our unique brand identity through differentiation from other brands. Whether it’s through store design, product development, or brand communication, clearly defining our uniqueness is the opportunity for Goldwin moving forward.”

Goldwin Fall 2024 Collection

70 Stores in 10 Years: “Localization Strategy is Key and Also the Most Challenging”

In December 2021, Goldwin opened its first store in China at Beijing’s Sanlitun. It wasn’t until August 2024 that they opened their second store in Southwest China at Chengdu’s Taikoo Li. Both stores are located in iconic commercial areas near many other outdoor and fashion brands.

Goldwin Store at Beijing Sanlitun

Their latest store, opened at Shanghai’s Jing’an Kerry Centre, is surrounded by brands like Wilson and Peak Performance, with HOKA located across from it.

Traditionally, international brands have entered the Chinese market through distribution agents. However, Goldwin chose to partner with local companies through a joint venture this time.

In March 2024, Goldwin formed a joint venture with Suzhou Vision Retail Co., Ltd. (SGAR) to oversee the production and sales of Goldwin’s products in China.

Goldwin plans to open an average of 4.5 stores annually, aiming to reach 70 stores within 10 years.

This ambitious plan shows the company’s confidence in the potential of both the Goldwin brand and the Chinese market.

According to the financial report for the fiscal year ending in March 2024, under Watanabe’s leadership, Goldwin Group recorded net sales of 126.9 billion yen (approximately USD 846.66), a 110.3% year-on-year increase, with a net profit of 24.28 billion yen (approximately USD 161.66 million), a 115.7% year-on-year increase.

Of this, Japan’s domestic market accounted for 95.3% of sales, with overseas markets, including China, contributing only 4.7%.

Goldwin’s recently announced “Five-Year Mid-Term Plan” outlines its “Goldwin 500” strategy, aiming to strengthen the brand’s global expansion with a target of 50 billion yen in sales by fiscal year 2033. In fiscal year 2023, Goldwin’s brand sales were 3.2 billion yen.

Watanabe stated: “Since 2020, we have reexamined our mid- to long-term strategy, making Goldwin’s overseas expansion a top priority.”

Beyond Japan, Goldwin adopts a global niche market strategy. In this context, “China is seen as the most important market with potential. We believe that over the next decade, China will play a significant role in our growth strategy.”

According to the report, Goldwin’s target for China’s market is to reach net sales of 30 billion yen (approximately RMB 1.473 billion) by fiscal year 2033, with a 70% direct retail rate and an operating profit margin of 20%. This revenue would represent 60% of Goldwin’s overall overseas target of 50 billion yen.

During his visit to China, Watanabe toured cities like Beijing, Shanghai, Shenzhen, and Chengdu. He predicts that the outdoor lifestyle will extend to more lower-tier markets in China.

Goldwin Store at Chengdu Taikoo Li

Luxe.co: During your visit to China, what are your observations about the Chinese market and its consumers?

Takao Watanabe: In terms of market positioning, there are significant differences between Japan and China. Chinese consumers are more interested in and eager to purchase brands like ours.

Moreover, given the strong performance of premium brands in China, it’s clear that Chinese consumers appreciate and understand high-end products. With a growing affluent population, these factors contribute to the success of high-end brands in China.

As for how large the market could grow, I can’t provide specific numbers. The global apparel market is around 300 trillion yen, with Japan accounting for about 1/30th of that, or roughly 10 trillion yen. Of that, around 5% of consumers prefer high-end outdoor brands, representing about 500 billion yen.

To answer the question, compared to the Japanese market, China has a greater growth potential, and this trend is also emerging globally.

Luxe.CO: What challenges do you face in understanding the Chinese market?

Takao Watanabe: The biggest challenge with the Chinese market is its vast geographical size. From first-tier cities to fifth-tier cities, people grow up with different traditions and lifestyles, so China cannot be generalized as one market.

I visited Beijing, Shanghai, Shenzhen, and Chengdu, and each city left me with different impressions. From the streetscapes to residents’ ways of thinking, the differences are significant, and locals take pride in their unique lifestyles.

Therefore, we need to segment the vast Chinese market into smaller regions, identifying high-potential markets. By starting with local residents’ feelings, habits, and cultures, we can create brand communication strategies they can relate to. Driving brand growth through localization is key, and it’s also the most challenging aspect.

Luxeplace.com: Why did you choose to enter the Chinese market through a joint venture?

Takao Watanabe: The primary condition for cooperation is shared interests. For instance, Mr. Jiang Wei, a VIP customer at our Beijing store, provided valuable feedback on our products and brand. In other words, he was initially one of our customers and developed a strong interest in our brand, leading to the partnership.

Additionally, Jiang has extensive expertise in the outdoor brand sector, having successfully managed various American, European, and Chinese outdoor brands, including TNF. Goldwin Group has collaborated with TNF for over 40 years, establishing it as a distinctive brand in Japan.

We share a similar mindset with Mr. Jiang, making him the ideal partner for cultivating our brand in the Chinese market.

Goldwin Fall 2024 Collection

The Next Wave in the Outdoor Sports Market: High-End, Aesthetic, and Niche?

In China’s highly competitive market, consumer trends shift more rapidly and intensely than in any other region globally, and the outdoor sports market is no exception.

When discussing the fierce competition in the Chinese market, Takao Watanabe shared his unique insight: “Ultimately, Goldwin is not targeting the global mass market, but rather the global niche high-end market—becoming a smaller-scale yet influential brand that resonates deeply with many consumers.”

When asked what qualifies an outdoor sports brand to be positioned as a high-end brand, Watanabe explained that high-end brands in the market generally fall into three categories:

“In the sports sector, there are many premium brands. For example, Moncler started as a ski wear brand and even provided uniforms for the Olympics. During the Tokyo Olympics, Goldwin also supplied gear for many athletes. Then, there are brands that started in the outdoor category and later achieved high-end positioning.

Our goal is to become a ‘distinct third-pole’ brand.”

Building a high-end brand image requires more than just cutting-edge technology, an efficient supply chain, and excellent sales performance. The key lies in whether a brand possesses a unique perspective and whether it has constructed a distinctive aesthetic and core philosophy. This ultimately determines how deeply a brand can connect with consumers on a meaningful level.

Watanabe candidly told Luxe.CO, “We need to surpass our competitors, especially in design.”

“Besides us, there are many companies globally known for their ‘manufacturing excellence.’ However, Goldwin has its own unique aesthetic philosophy,” Watanabe added.

What exactly, then, is this unique aesthetic philosophy?

Stepping into the newly opened store at Shanghai’s Jing’an Kerry Centre, one can experience this philosophy more tangibly and comprehensively:

The store’s decor uses three types of natural materials inspired by Japanese aesthetics. In warm tones, it showcases the Japanese concept of “harmony between man and nature.”

Many details in the store resonated with consumers, with some even inquiring about the specific fragrance used in the store on Goldwin’s official social media accounts.

Goldwin Store at Jing’an Kerry Centre, Shanghai

The new store features various collections, with a highlight being the OAMC x Goldwin Fall/Winter 2024 capsule collection.

OAMC, founded by Luke Meier, former creative director of Supreme, is a streetwear brand. The collaboration blends classic menswear with a technical style, and thanks to Goldwin’s support, the fabric meets dual requirements. For instance, as experienced in the store, the collection’s fabric combines the softness of cotton with water-repellent functionality.

OAMC x Goldwin Fall/Winter 2024 Capsule Collection

During the store’s grand opening, Luxe.CO also interviewed Eiichiro Homma, founder of nanamica. After collaborating with Goldwin Group to launch The North Face Purple Label, he has been actively involved in managing the Goldwin brand since 2016, further elevating the fusion of high functionality and fashion.

Goldwin has also launched a Lifestyle line aimed at urban everyday life, thanks to designer Shunsuke Ishikawa, founder of MARKAWARE. His minimalist American design has been integrated into outdoor apparel.

Goldwin Fall/Winter 2024 Outdoor Collection

In 2022, Goldwin introduced the Goldwin 0 series, a conceptual and innovative experimental project that brings together diverse design talents. The series, supported by talents like Julia Rodowicz, a fabric specialist from Balenciaga, and emerging functional fashion designer Jean-Luc Ambridge, showcases the possibilities of combining high-performance materials with fashion design.

With the dual backing of talent and creativity, Goldwin’s unique aesthetic as an outdoor sports brand manifests across its products and stores in a multidimensional and refined manner:

Thoughtfully crafted silhouettes, intricate design details, the use of exclusive in-house developed fabrics, the integration of fashion into everyday life, and the restrained use of colors…

All of this reflects the unique aesthetic philosophy that Takao Watanabe has crafted for Goldwin, described as “elegant, delicate, precise, and minimalist.”

Goldwin 0 Spring/Summer 2024 Collection

Luxe.CO: What are the unique requirements of a high-end outdoor brand according to Goldwin’s understanding?

Takao Watanabe: Functionality is paramount, and products must meet the highest global production standards. Internally, we develop materials from scratch, which is a given.

Beyond that, it’s crucial to offer products that combine fashion and sports for the global younger consumer group. Goldwin adheres to four key aesthetic principles—‘elegant, delicate, precise, and minimalist’—while creating designs that are widely accepted and able to transcend time and occasion.

In addition, sustainability is another important aspect. Through our products, we want users to experience the beauty of sustainability, which will set us apart from other global brands.

Luxeplace.com: How large is the potential market for such a positioning in China?

Takao Watanabe: In the Chinese market, those who resonate with our ‘third-pole’ brand positioning—combining sports, fashion, performance, and innovation—are primarily those with a preference for fashion, which is a relatively niche group, around 3%. In Japan, this translates to a market of approximately 300 billion yen. In China, the figure could be ten times or more, making it a trillion-yen-level market, although it’s still hard to quantify with exact numbers.

Innovation in Fabric Research: Goldwin’s Industry Responsibility

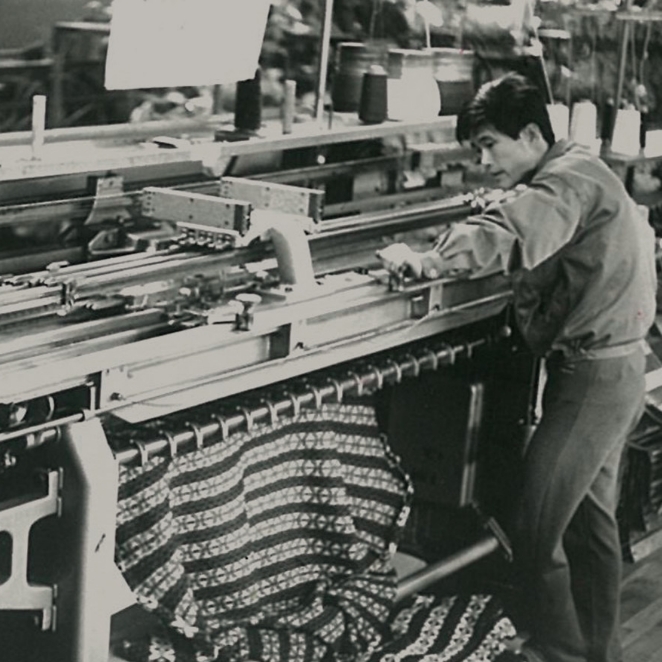

Goldwin’s origins date back to 1950 when its predecessor, Tsuzawa Knit Fabric, was founded by Tosaku Nishida. In 1952, the company began shifting its focus towards sportswear.

Goldwin Founder Tosaku Nishida

Tsuzawa Knit Fabric Factory

In 1963, the factory transformed into the brand Goldwin, with the name symbolizing the “Gold Winner” at the Olympics. During the 1964 Tokyo Olympics, 80% of the athletes wearing Goldwin gear won gold medals, marking a historic opportunity for the brand.

Around that time, Japan’s ski market was booming. The founder of Goldwin traveled to countries like Norway and Denmark to learn advanced techniques and created ski sweaters adapted to Japanese body types. This laid the foundation for Goldwin’s ski legacy, which is still highly regarded today.

In the 1970s, Goldwin entered a licensing agreement with French ski brand Fusalp, and by the 1980s, it became the sponsor of national ski teams from Sweden, the UK, and Japan, earning a reputation as a “specialist in ski apparel.”

Goldwin’s Olympic Sponsorship Apparel

Beyond skiing, since the 1970s, Goldwin has secured the distribution rights for international outdoor brands such as Champion, The North Face, Helly Hansen, and Icebreaker.

For decades, one of the reasons Goldwin has maintained its industry-leading position in its home market and continued to win consumer favor is its exceptional high-performance fabrics.

As early as the 1960s, Goldwin collaborated with international manufacturers to create ski gear tailored to human anatomy. Over the years, Goldwin has partnered with functional fabric companies like GORE-TEX and Perseverance Mills to develop high-performance materials.

At the same time, Goldwin has also strengthened its in-house R&D capabilities.

In 2017, Goldwin established the Goldwin TECH LAB at its original headquarters, renovating the old factory to create high-tech laboratories. These include the Exercise Research Room, which can simulate various weather conditions to study fabric performance, and the Mother Factory, which produces high-performance and experimental garments while exploring the latest manufacturing techniques.

Exercise Research Room at Goldwin TECH LAB

In terms of environmental responsibility, Watanabe mentioned during the interview that the company has been collaborating with Japanese biotechnology company Spiber to develop a new sustainable fabric—Brewed Protein™, a bio-based material. This “next-generation material” offers excellent performance and sustainability, potentially becoming an alternative to traditional materials.

Goldwin’s Collaboration with Spiber to Develop Sustainable Fabrics

Luxe.CO: Goldwin has consistently demonstrated keen foresight throughout its brand history. In your opinion, what is the key to staying at the forefront of the outdoor sports market?

Takao Watanabe: Goldwin has a 74-year history, making it a long-established company. Today, Goldwin Group operates as a distributor of various domestic and international sports brands in Japan.

One of the company’s core competencies is research and development. The R&D center at our original headquarters in Toyama focuses on fabric development, sewing techniques, and product manufacturing, all starting from scratch. Every brand under Goldwin stems from this development center, which is why it remains a key strength of Goldwin.

In addition to the R&D center, Goldwin operates several retail brands that span outdoor sports, track and field, swimming, rugby, and more.

Beyond brand development, the group also has two companies responsible for retail development, which focus not only on product development but also on direct-to-consumer sales. Through the process of product development and retail, Goldwin has cultivated highly independent production techniques, enabling it to meet the needs of different markets.

Goldwin’s aesthetic can be summed up as “elegant, delicate, precise, and minimalist.” By incorporating this philosophy into its designs and leveraging over 70 years of technical expertise, Goldwin continues to utilize its extensive network of overseas partners, rich experience, and technological prowess to stay at the forefront from development to finished products.

Luxe.CO: What do you see as Goldwin’s responsibility to the outdoor sports industry in the future?

Takao Watanabe: I believe the outdoor sports market has a powerful ability to convey information and inspire significant changes in lifestyles.

As the world faces the challenge of solving various social issues in the future, we have both the responsibility and the opportunity to guide the correct relationship between people and nature, and among individuals themselves.

To achieve this, we must operate with the perspective of protecting the planet, becoming a company that enhances market demand while possessing outstanding design capabilities. Our goal is to foster growth among our customers and the market, ultimately becoming a brand that resonates with people.

Goldwin Fall 2024 Collection

Conclusion

Goldwin’s accelerated expansion in the Chinese market sends a clear signal:

As the outdoor sports market continues to heat up and consumers gain a deeper understanding of it, competition among brands will likely evolve in two directions: towards high-end positioning and aesthetics.

The proliferation of outdoor sports brands has led to mass production and product launches, contributing to increasing homogenization—a phenomenon the entire industry must address.

As a company that has witnessed the outdoor sports market’s rise, boom, and maturity, Goldwin’s active expansion in China is based on an in-depth analysis of the market size, development stage, and its unique advantages.

On China’s social media platforms, Goldwin has already established a certain level of user recognition. Terms such as “the hidden giant of the outdoor world,” “the perfect interpretation of quiet luxury in sports,” “fabric feel,” “fine craftsmanship,” and “versatile and timeless” are all real feedback from online consumers.

As the diverse and fast-changing Chinese market continues to develop, whether Goldwin can achieve its goals and successfully capture market share in the high-end outdoor sports sector remains to be seen.

|Image Credit: Provided by Goldwin

|Editor: Zhu Ruoyu