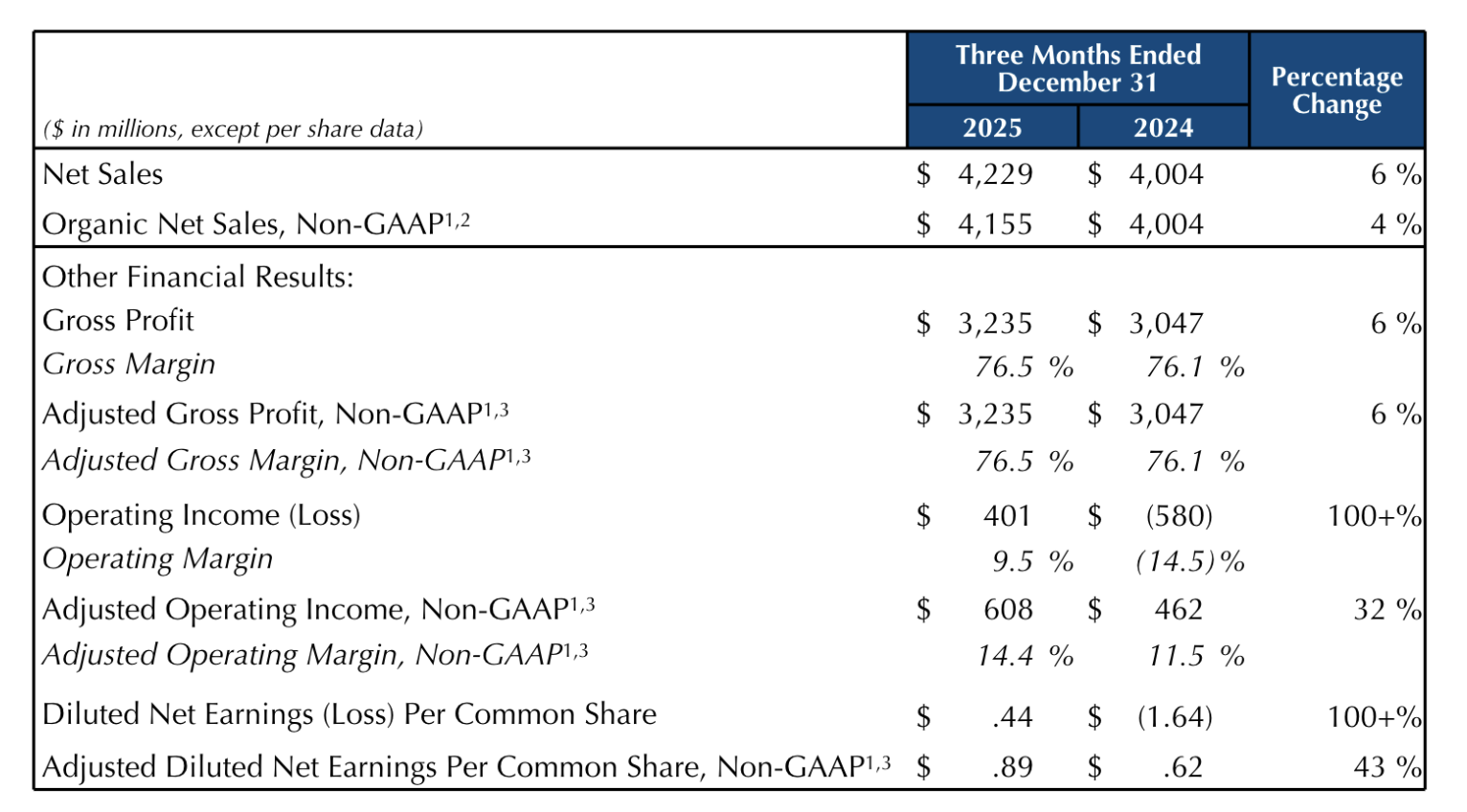

On February 5, US beauty giant Estée Lauder Companies Inc announced its financial results for the second quarter and first half of fiscal year 2025/26, ended December 31, 2025, with the group returning to profitability.

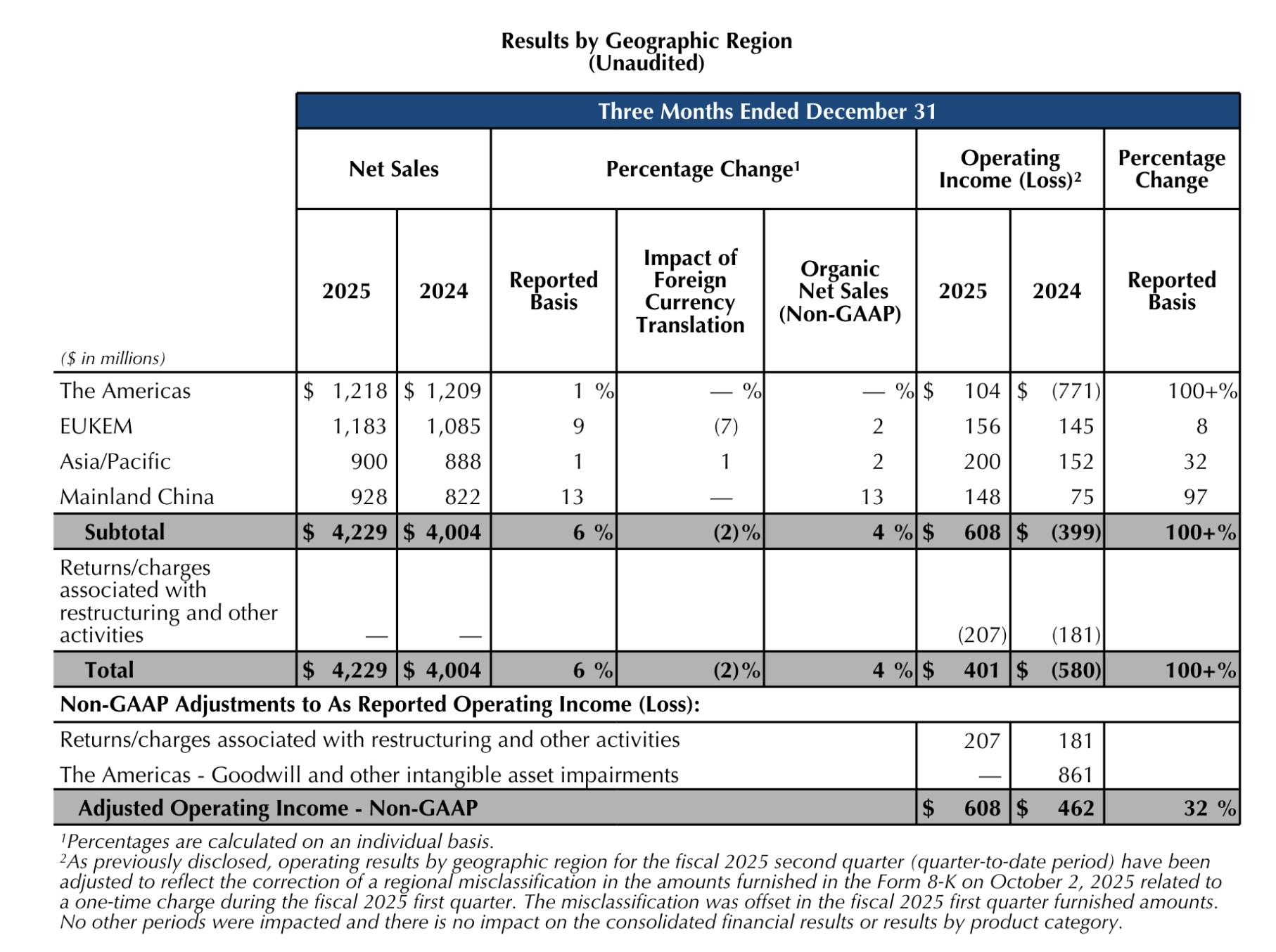

In the second quarter, net sales reached USD 4.229 billion, representing a year-on-year increase of 6%. Notably, the group fully reversed the USD 590 million loss recorded in the same period last year, achieving a profit of USD 162 million in the quarter. For the first half of the fiscal year, group revenue totalled USD 7.71 billion, up 5% year on year, also reversing the prior-year loss to deliver a profit of USD 209 million.

Focusing on the Chinese Mainland market, second-quarter sales rose 13% year on year to USD 928 million, marking the second consecutive quarter of double-digit growth. The group outperformed the overall industry in the Chinese premium beauty market.

Stéphane de La Faverie, President and Chief Executive Officer of Estée Lauder Companies, emphasised during the earnings call, “We have achieved market share gains across all four major categories in the Chinese Mainland market for four consecutive quarters.” Chief Financial Officer Akhil Shrivastava added, “As sales in the Chinese Mainland market continue to rise, discount rates are tightening at the same time, naturally leading to improved profitability.“

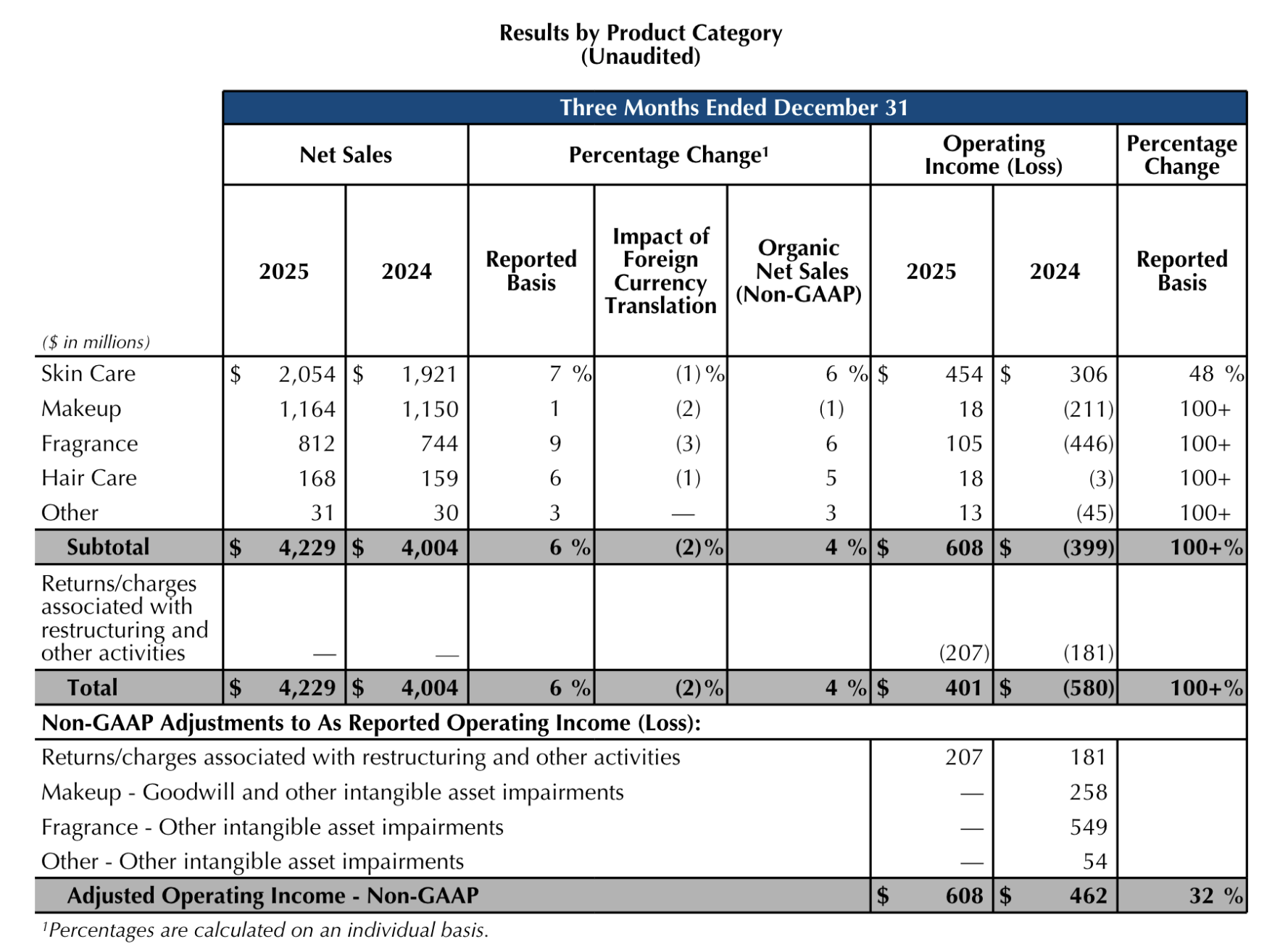

As of December 31, 2025, Estée Lauder Companies’ financial performance for the second quarter of fiscal year 2026 is as follows:

In the announcement, Stéphane de La Faverie, President and Chief Executive Officer of Estée Lauder Companies, commented, “We delivered outstanding performance in the second quarter, further strengthening the strong momentum of the first half of fiscal year 2026. At this critical juncture, our ‘Reimagining Beauty‘ strategy has injected new vitality into the business, driving the largest operational, leadership and cultural transformation in the company’s history. As we mark the first anniversary of this strategy, and based on our confidence in the progress of the transformation, we have raised our full-year outlook for fiscal year 2026. While we still face previously anticipated challenges in the second half and are increasing consumer-facing investments, we continue to expect a return to organic sales growth and our first expansion in operating margin in four years.”

The group is advancing its Profit Recovery and Growth Plan (PRGP) to reshape its global operating model. The benefits of the plan stem from improved operational efficiency, including more competitive sourcing strategies, cost optimisation, and reductions in excess and obsolete inventory.

The plan is expected to be largely completed in fiscal year 2026/27, when most of the benefits will be realised, supporting a return to sales growth in fiscal year 2025/26 and enhancing margin resilience.

The restructuring plan is expected to generate total annual benefits of USD 800 million to USD 1 billion, with total costs of USD 1.2 billion to USD 1.6 billion, and a net reduction of 5,800 to 7,000 positions. As of January 30, 2026, Estée Lauder Companies had approved a total of USD 1.2 billion in costs and plans to eliminate more than 6,000 positions, achieving over 80% of the targeted benefits, cost savings and workforce reductions.

By market

Key market performance was as follows:

— Chinese Mainland: The group delivered double-digit growth for the second consecutive quarter, outperforming the overall industry in the Chinese premium beauty market. Growth in the Chinese Mainland was driven by product innovation, strong execution during the Double 11 Shopping Festival and holiday marketing campaigns, as well as increased consumer-facing investments. During the quarter and across the 2025 calendar year, the company achieved market share gains across all categories, both online and offline, in the premium beauty market. La Mer, TOM FORD and Le Labo were particularly strong performers.

Stéphane de La Faverie highlighted during the earnings call that the group’s innovation initiatives in the Chinese market have delivered significant results.

He stated, “In China, innovation is resonating strongly. Three breakthrough innovations from Estée Lauder in the field of skin longevity science drove double-digit organic net sales growth in our skincare category in the Chinese Mainland. TOM FORD delivered strong double-digit organic net sales growth in the Chinese Mainland, fueled by highly sought-after, on-trend launches across lip, face and fragrance. In China, we are encouraged by the strength of our brand desirability and innovation results, while remaining clear-eyed that consumer sentiment is still subdued.”

Looking ahead to the 2026 Chinese New Year and the travel retail selling season, Stéphane de La Faverie expressed confidence, saying: “We are particularly energised as we approach the Chinese New Year selling season. This clearly shows that we have regained our ability to convert traffic into sales. It is important to note that Hainan is only one part of the East Asia travel retail market. East Asia travel retail includes Hainan, Beijing and Shanghai airports, online platforms, as well as other parts of Asia-Pacific. Frankly, Korea remains under pressure, and while other parts of Asia-Pacific are showing signs of recovery, the ecosystem is still weaker compared with China.“

Regarding performance in China and Asia in the second half of the year, Chief Financial Officer Akhil Shrivastava said, “In the second half, Asia, particularly China domestic and travel retail, will face challenges from tough comparables. Our ambition is to outperform the market, although we expect the market itself to moderate from its previous double-digit growth rates.”

— Japan: Overall market share gains were primarily driven by the makeup category, led by M·A·C and Bobbi Brown, as well as the fragrance category, led by Le Labo, KILIAN PARIS and Editions de Parfums Frédéric Malle.

— United States: The group gained share in overall premium beauty sales, while value share increased in both skincare and haircare. Clinique and The Ordinary drove skincare value share growth as the number one and number two brands in the category, respectively. Estée Lauder and Le Labo delivered value share gains in makeup and fragrance, respectively.

— Western Europe: Fragrance market share increased in France, Spain and the UK.

By category

— Skincare growth was primarily driven by La Mer, Estée Lauder and The Ordinary.

— Makeup was mainly impacted by a decline in Estée Lauder brand sales, partially offset by growth from M·A·C.

— Fragrance benefited from high-single-digit growth in luxury brands, with Tom Ford, Le Labo and KILIAN PARIS driving growth across all regions.

— Haircare growth was driven by channel expansion, the success of The Ordinary Multi-Peptide Serum for Hair Density, and initial shipments following the February 2026 launch of the SalonCentric range under Bumble and bumble.

Fiscal year 2025/26 outlook

Estée Lauder Companies raised its full-year outlook, with organic net sales growth for fiscal year 2025/26 expected to be between 1% and 3%, and adjusted operating margin projected to range from 9.8% to 10.2%. Based on this outlook, the group expects low-single-digit growth in the second half, with a recovery anticipated in the fourth quarter.

Tariff policies are expected to create approximately USD 100 million of volatility in profitability, primarily in the second half of the fiscal year. The company continues to mitigate tariff-related impacts through trade programmes, more flexible supply chain management, and further optimisation of its regional manufacturing footprint by moving production closer to consumers.

丨Source: Official press release; analyst earnings call transcripts

丨Image Credit: Estée Lauder Companies official website

丨Editor: LeZhi