Following Beijing and Guangzhou, Hangzhou is the third Chinese city to host the highest-level international comprehensive sports event in Asia.

Over the past decade, with the flourishing development of e-commerce and the digital economy, Hangzhou’s importance in the Chinese economic landscape has significantly increased. As aesthetic tastes and personal wealth have rapidly grown, this city has also played a crucial role in the development of the luxury goods market in China.

According to data compiled by Luxe.CO Tong the world’s first real-time fashion business dynamic platform under Luxe.CO, in the past year (September 2022 to August 2023), 106 luxury brands in mainland China have collectively recorded 895 dynamics (including new store openings, pop-up shops, exhibitions, art installations, offline events, etc.). Among these, there were 38 offline dynamics related to luxury brands in Hangzhou, ranking sixth among all mainland cities and third among non-first-tier cities (cities other than Beijing, Shanghai, Guangzhou, and Shenzhen).

Looking at the opening of new stores by luxury brands, Hangzhou ranks fifth among the cities with the most store openings in the past year. In terms of offline marketing dynamics (including pop-up shops, exhibitions, art installations, and offline events), Hangzhou’s luxury brand activity density ranks seventh among all mainland cities.

Based on data collected by Luxe.CO Tong, Luxe.CO Intelligence has exclusively created four charts to shed light on the significant trends of luxury brands in Hangzhou over the past year:

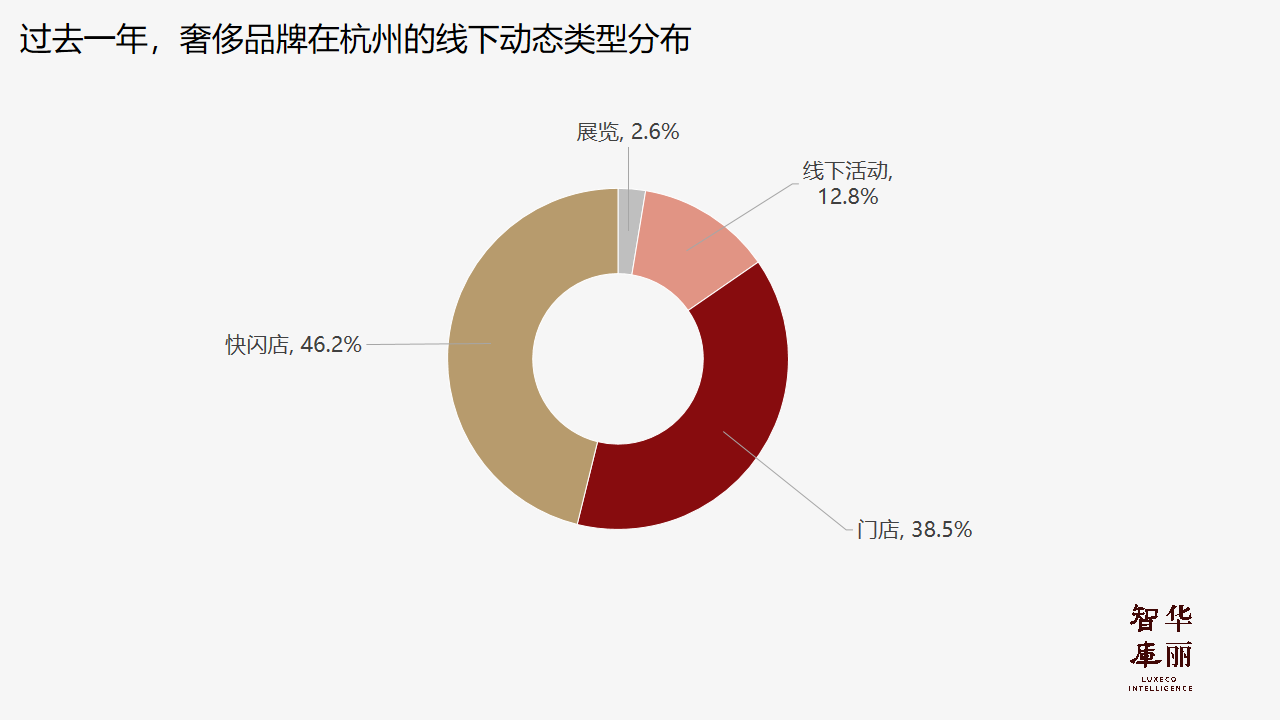

- Chart 1: Distribution of Types of Offline Dynamics of Luxury Brands in Hangzhou

- Chart 2: Overview of New Store Openings by Luxury Brands in Hangzhou

- Chart 3: Top 3 Commercial Centers with the Most Offline Marketing Dynamics by Luxury Brands in Hangzhou

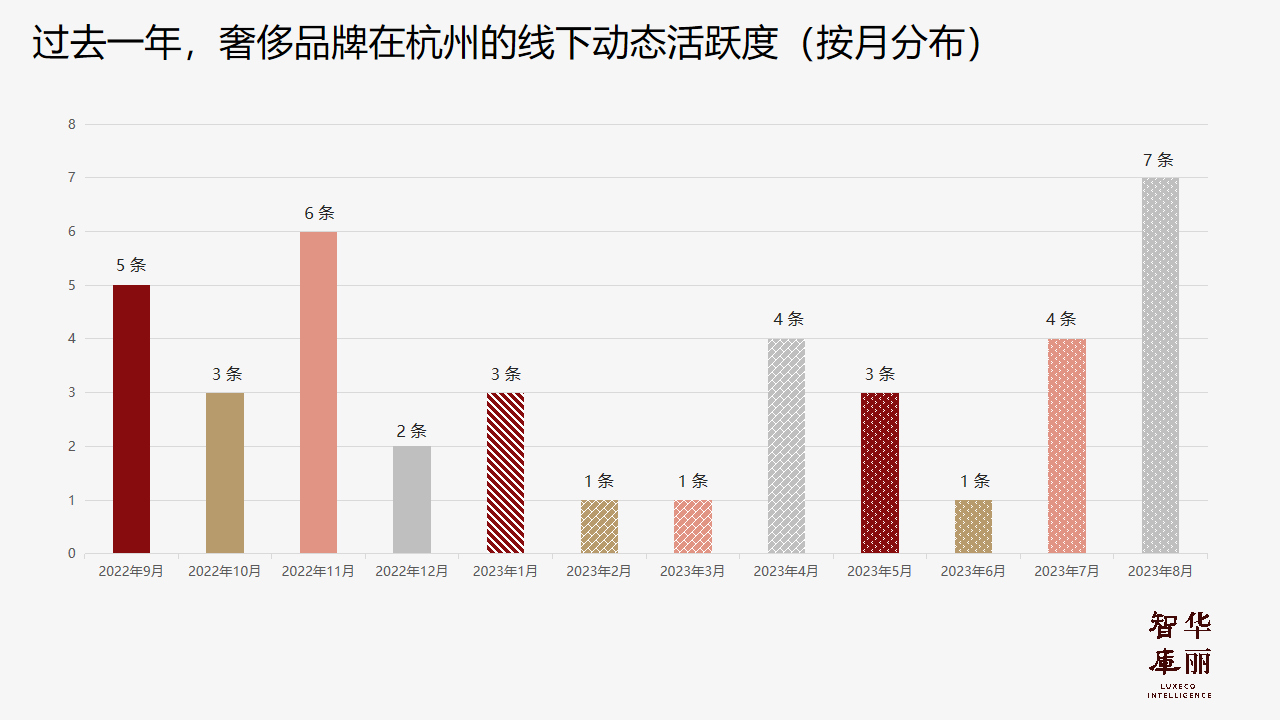

- Chart 4: Activity Level of Luxury Brands’ Offline Dynamics in Hangzhou (Monthly Distribution)

Chart 1: Distribution of Types of Offline Dynamics of Luxury Brands in Hangzhou

From the perspective of dynamic types, luxury brands in Hangzhou have been most frequently opening pop-up shops. In the past year, 16 brands have launched a total of 18 pop-up shops, accounting for 46.2% of all offline dynamics. Following closely are new store openings, constituting 38.5% of all offline dynamics.

Hangzhou’s unique geographical and cultural ambiance has also inspired luxury brands to organize various events.

In August of this year, Louis Vuitton hosted a high-end jewelry exhibition at the Lian Mei Shu Guan in the West Lake Wetland in Hangzhou. This exhibition was exclusively open to the brand’s VIP clientele.

Chart 2: Overview of New Store Openings by Luxury Brands in Hangzhou

In the past year, 13 brands have opened 14 stores in Hangzhou, with “flagship stores” and “renovation and expansion” emerging as the two major trends.

Among them, three high-end jewelry brands, Buccellati, De Beers, and Boucheron, opened their first stores in Zhejiang in Hangzhou Tower. In April of this year, the Italian luxury shoe brand René Caovilla opened its first store in Hangzhou in Hangzhou Tower.

In August of this year, Louis Vuitton upgraded and expanded its store in Hangzhou MixC Mall into a two-story store, with the first floor dedicated to women’s fashion and the second-floor hosting Hangzhou’s second men’s fashion boutique. In January, Versace opened a two-story boutique in Hangzhou Hubin Intime, offering a full range of products, including men’s and women’s clothing, bags, shoes, accessories, and home goods.

Louis Vuitton men’s boutique in Hangzhou MixC Mall

Additionally, the renovation of the facades of luxury brand stores has become a major highlight. For example, in June of this year, Louis Vuitton redesigned the facade of its two-story store in Hubin Intime, presenting two completely different visual styles during the day and at night.

Looking at the timing of store openings, November was the busiest month for brands opening stores in Hangzhou, with a total of 3 luxury brands establishing their presence in the city during that month.

Chart 3: Top 3 Commercial Centers with the Most Offline Marketing Dynamics by Luxury Brands in Hangzhou

Looking at the commercial centers, in the past year, Hangzhou Tower (6 stores), Hangzhou MixC Mall (4 stores), and Hangzhou Hubin Intime (4 stores) were the top three commercial centers where luxury brands opened new stores the most.

In the past year, when it comes to the frequency of offline marketing dynamics by luxury brands (including pop-up shops, exhibitions, art installations, and offline events), the top three commercial centers were as follows: Hangzhou MixC Mall (14 events), Hangzhou Tower (3 events), and Hangzhou OōEli (3 events).

In 2023, Hangzhou Tower is celebrating its 30th anniversary since its opening, and at this milestone, it continues to attract high-end luxury brands. In addition to the three high-end jewelry brands mentioned earlier, Harry Winston and Graff are also set to open their first stores in Zhejiang here. Both brands’ boutiques are already under construction in Hangzhou Tower. Tiffany & Co.’s latest flagship store in the country is also set to debut at Hangzhou Tower.

Hangzhou MixC Mall has been maintaining a pace of 60 to 80 brand adjustments per year in recent years. This includes optimizing the luxury brand lineup on the first floor, adding high-end brand exhibitions, pop-up shops, and other forms of activities.

Hangzhou Hubin Intime in77 is Hangzhou’s first block-style shopping center, continuously enriching its own formats. Besides expanding its collection of high-end luxury brands, it also focuses on introducing fashion and trend-setting brands, becoming a unique and distinctive shopping center near West Lake.

Chart 4: Activity Level of Luxury Brands’ Offline Dynamics in Hangzhou (Monthly Distribution)

Looking at the months, the most active month for luxury brands to hold offline events in Hangzhou was August (7 events), followed by November (6 events) and September (5 events).

| Image Credit: Produced by Luxe.CO, On-site Photography by Luxe.CO, Official Weibo Accounts of Various Commercial Centers and Brands.

| Editor: Zhu Ruoyu