Amid the backdrop of a tumultuous global consumer market, luxury jewelry and watch brands have encountered both new opportunities and challenges when compared to other luxury product categories. Particularly in areas such as branding, talent development, customer relationships, and distribution channel strategies. Greater courage and wisdom are required for the management to drive change and innovation.

On one hand, luxury jewelry and watches are increasingly seen as investment objects whose value may be preserved or even appreciated over time. As the most important clientele for fine jewelry and ultra expensive watches, local high-net-worth individuals have received more and more attention from the brands.

On the other hand, with the growing interest of more local consumers in jewelry and watches, better, richer and updated brand contents and activities are urgently needed in order to reach a much larger audience and grasp the growth opportunity.

In the latest version of “Luxury Jewelry and Watch Brands China Power Ranking” by Luxe.CO, we can see that over the past year, many brands have expanded their influences and solidified customer relationships through means such as exhibitions, pop-up events, and boutique tours.

Especially in the are of watches, where consumers have higher awareness thresholds and longer buying cycles, brands need to rethink their strategies for longer term regarding brand heritage, storytelling, craftsmanship, unique value proposition, store design/ambiance, and customer services.

Today, Luxe.CO Intelligence issue the “Luxury Jewelry and Watch Brands China Power Ranking” to provide a comprehensive “dashboard” for industry review and forecast.

The rankings covers 292 major activities from 38 global luxury jewelry and watch brands in the China market over the past year, providing a clear snapshot of these brands’ marketing investments and business development in China.

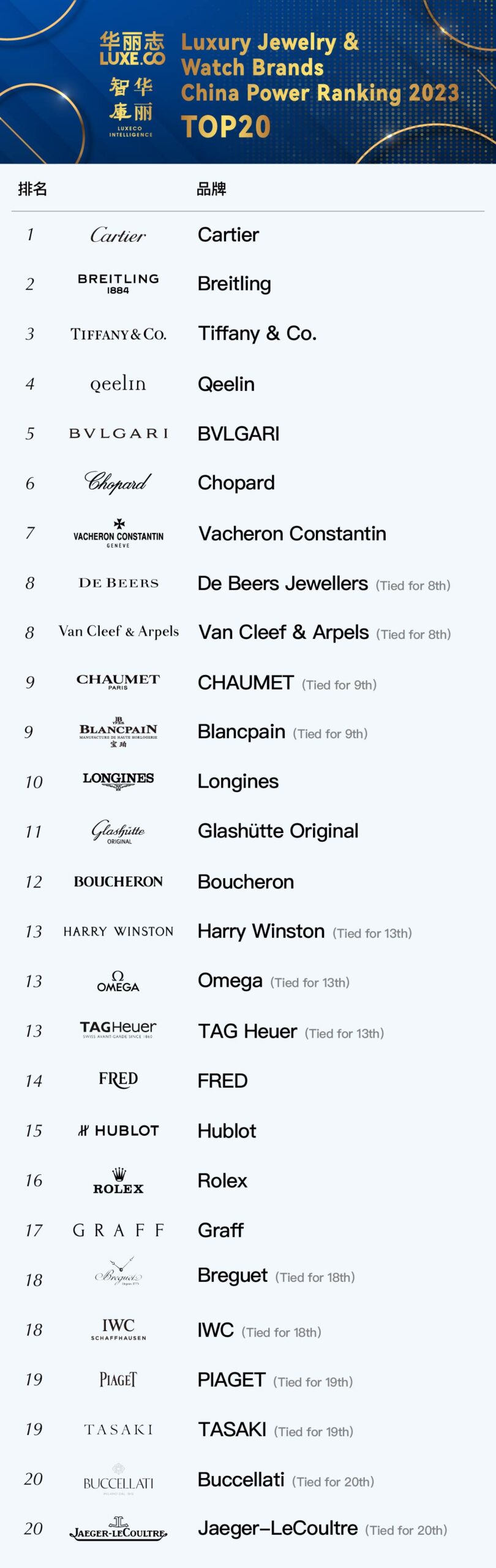

Today, we issue“Luxury Jewelry and Watches Brands China Power Ranking 2023” TOP 20

Congratulations to all the brands on the list!!!

In the report, you will read the following contents:

- Which Chinese cities welcomed the most “first stores” of luxury jewelry and watch brands in the past year?

- Which luxury jewelry and watch brands opened the most new stores?

- How did the brands strategize their marketing activities across different types?

- What are the top 8 cases in 2023?

- …

Key insights from the data include:

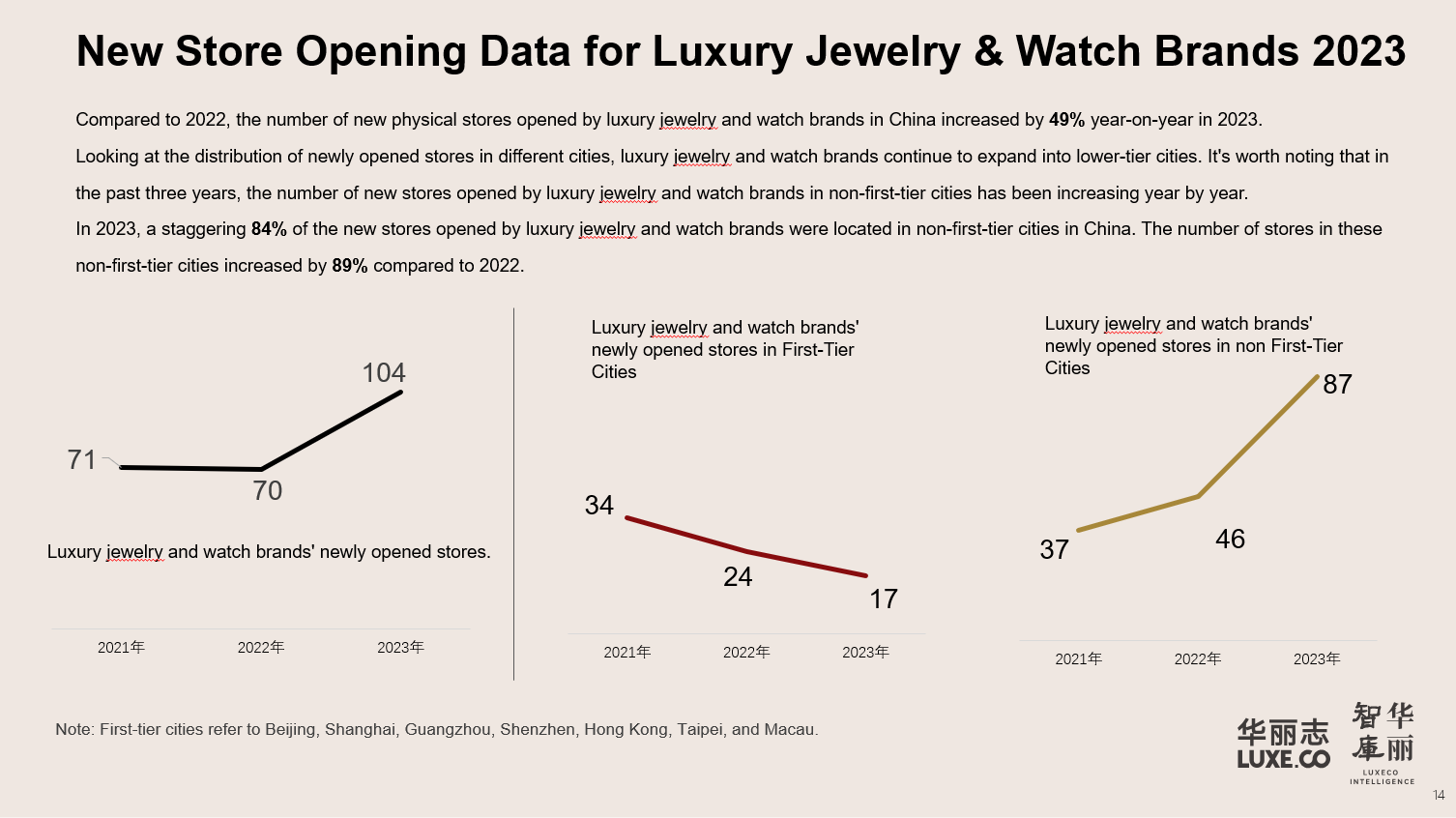

- Luxury jewelry and watch brands have intensified their efforts in opening new stores: Compared to 2022, there was a 49% year-on-year increase in the number of new physical stores opened by luxury jewelry and watch brands in China.

- Active brands in store openings include Qeelin, Breitling, TAG Heuer, Longines, Chopard, Cartier, Glashütte Original, Omega, and Rolex.

- Luxury jewelry brands are expanding their geographical coverage, focusing on non-first-tier cities: In 2023, 84% of new stores opened by luxury jewelry and watch brands were in China’s non-first-tier cities, representing an 89% increase compared to 2022.

- In 2023, luxury jewelry and watch brands opened a total of 104 new stores, including 50 first stores in China/cities by 28 brands.

- Cities with the most luxury brand “first stores” opened include Lanzhou (10), Zhengzhou (8), Shenzhen (4), Fuzhou (3), and Jinan (3).

— TOP 8 Brand Cases & Luxe.CO Insights

While compiling the annual Power Ranking, Luxe.CO Intelligence hand-picked 8 Top cases from a pool of 292 activities within the luxury jewelry and watch brand sector. These cases represent the best practices of luxury jewelry and watch brands’ marketing efforts in China over the past year. For each case, we have highlighted the most important learning points and key trends reflected.

These cases are significant marks left by luxury brands as they deepen their presence in the China market,which are expected to have lasting effects on connecting with local consumers and enhancing brand power. Through the many interesting details, we could see the level of marketing investment of the brands in China and the capability of the brand’s team in terms of planning, execution, and innovation.

We hope the following top cases will provide new clues, inspirations and stimulations to our readers in their own effort to build and upgrade their brands in jewelry, watches and many other different sectors.

About Luxe.CO “Luxury Brands in China Power Ranking”

Luxury brands and the luxury industry have been the main focus of research and media coverage for Luxe.CO since its inception in 2013.

In May 2020, Luxe.CO issued the first “Luxury Brand Bi-weekly Reports”; one and half year later, we produced the first “Luxury Brands in China Power Ranking” for the year of 2021.

The “Luxury Brands in China Power Ranking” report is the industry’s first comprehensive and systematic summary and analysis on the activities carried out by major luxury brands in the China market regarding channel expansion and brand marketing.

The list includes ten categories of brand dynamics: store expansion, fashion shows in China, brand exhibitions, visual communication, collaborations, sponsorship, creative partnerships, brand spokespersons/ambassadors/friends, digital marketing and e-commerce, and other brand activities. (Note: This report does not include luxury brand beauty, skincare, and fragrance updates)

The scoring for the Power Ranking is calculated based on data collected by Luxe.CO on the marketing activities and channel expansion efforts of major luxury brands in the China market in 2023. Different weighting factors are assigned to different subtypes of brand activities based on their importance and magnitude. For example, the weight for a grand exhibition is higher than a regular exhibition, and the weight for a nationwide first store opening is higher than that of a city’s first store opening, with first stores in first-tier cities carrying higher weight than those in second-tier cities, and so on.

Click here to download the full report (in English)for free

Or scan the QR code to download the report

About Luxe.CO Intelligence

Luxe.CO Intelligence has been deeply involved in the fashion and luxury sectors for a long time. Leveraging our continuously expanding industry network, data intelligence, and knowledge system, we are committed to providing professional, innovative, and forward-looking consulting services to brands and companies in China and overseas. Our areas of focus include brand revitalization and upgrade strategies, brand content and communication strategies, niche industry positioning and opportunity analysis, and strategies for entering the Chinese market.

Contact for collaboration: lci@luxe.co

About Tong.Luxe.CO

Launched on Luxe.CO website and app in early summer 2022, Tong.Luxe.CO is an innovative digital service that tracks daily activities of fashion brands with all-encompassing coverage for China market and selective coverage for overseas market.

The activities covered include product launch, store opening, marketing events, as well as personnel change, financial reporting and other major corporate initiatives.

Through Tong.Luxe.CO, you could find over 2000 entries on average each month about more than 1000 brands in luxury, fashion, beauty, sports and outdoor …, all tagged carefully to facilitate multi-dimensional analysis for further research.