After the market closed on April 18, Chinese cosmetics group Proya (SH:603605) released its 2023 annual report and the main operational data for the first quarter of 2024: In 2023, revenue grew by 39.45% to 8.905 billion yuan, and net profit attributable to the parent company increased by 46.06% to 1.194 billion yuan. These key financial metrics represent an acceleration from the growth rates of 37.82% and 41.88% in 2022, respectively, marking an accelerated growth for Proya.

Additionally, in the first quarter of 2024, revenue increased by 34.56% to 2.182 billion yuan, and net profit attributable to the parent grew by 45.58% to 303 million yuan.

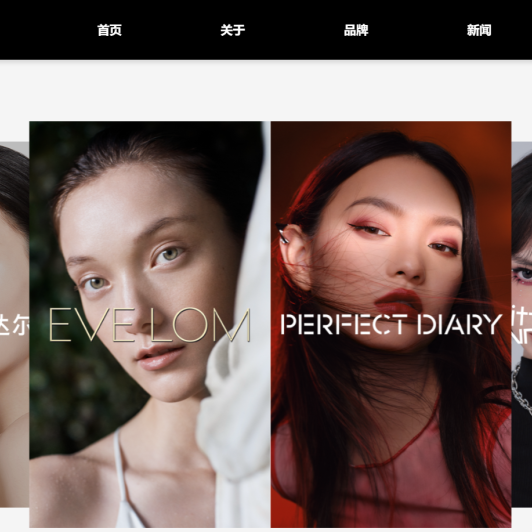

As a new national platform for cosmetics, the group primarily owns the mass skincare brand Proya and Hapsode, the makeup brand Timage, the hair care brand Off&Relax (OR), and the high-efficacy skincare brand CORRECTORS, among others.

As of the close on April 19, Proya’s stock price slightly increased by 0.14% to 103.6 yuan per share, with a total market capitalization of 44.8 billion yuan.

In terms of specific brands:

- Proya: Revenue grew by 36.36% to 7.177 billion yuan, surpassing 7 billion yuan for the first time and contributing 80.73% of the group’s revenue. Proya focuses on technology-driven skincare targeted at young professional women, with a main price range of 200-500 yuan.

- Timage: Revenue soared by 75.06% to 1.001 billion yuan, crossing 1 billion yuan for the first time, increasing its share from 8.99% in 2022 to 11.26%. Timage, launched in 2019, is tailored for the Chinese face and is a professional makeup artist brand, with a main price range of 150-300 yuan.

- Off&Relax: Revenue surged by 71.17% to 215 million yuan. Launched in 2021 and developed in Japan, OR focuses on scalp health, with a main price range of 150-200 yuan.

- Hapsode: Revenue increased by 61.82% to 303 million yuan. Yuefumei was introduced in 2016 and rebranded in 2021, customized for young skin and targeted at college students and young women, with a main price range of 50-200 yuan.

By category, skincare (including cleansing) revenue grew by 37.85% to 7.559 billion yuan, contributing 85.03% of the group’s revenue; beauty and makeup revenue increased by 48.28% to 1.116 billion yuan, raising its share from 11.82% in 2022 to 12.55%; hair care revenue jumped by 71.17% to 215 million yuan, increasing its share from 1.98% in 2022 to 2.42%.

In terms of channels, the online share continues to rise. In 2023, online revenue increased by 42.96% to 8.274 billion yuan, raising its share of total revenue from 90.98% to 93.07%; offline revenue grew by 7.35% to 616 million yuan, making up 6.93%.

Looking ahead, the group stated in the report that it will adapt flexibly to market developments, rapidly invest in and layout emerging channels, explore opportunities for international expansion, and seize the opportunity for Chinese brands to go global, driving corporate growth with a larger market scale and faster response times.

| Source: Company Website

| Photo Credit: Company Website

| Editor: LeZhi