On June 13, Chow Tai Fook Jewellery Group Ltd., a jewelry giant based in Hong Kong, China, released its FY2024 annual performance report for the year ending March 31, 2024. Despite the negative impact of the global macroeconomic environment, Chow Tai Fook achieved record highs in both revenue and operating profit. Revenue increased by 14.8% year-on-year to HKD 108.713 billion, surpassing the HKD 100 billion milestone for the first time. Operating profit rose by 28.9% year-on-year to HKD 12.163 billion.

Net profit attributable to shareholders increased by 20.7% year-on-year to HKD 6.499 billion.

2024 also marks the 95th anniversary of Chow Tai Fook Jewellery. To drive higher value growth and long-term sustainable growth, the Group announced five strategic guidelines: brand transformation, product optimization, accelerated digital transformation, improved operational efficiency, and enhanced talent cultivation. The Group embarked on its brand transformation journey in April, achieving the following key milestones:

- Launch of a new consumer-facing brand logo;

- Introduction of the “Rouge Collection” inspired by the passionate red hue and the auspicious symbol of 「福」 (fortune);

- Appointment of Nicholas Lieou as the Creative Director for high jewelry, responsible for enhancing brand image and designing new product lines, including the Rouge Collection. Lieou has designed jewelry for several luxury brands and was appointed Design Director at Tiffany & Co. in 2015.

In FY2025, the Group is also committed to reshaping the omnichannel experience, including the launch of new corporate and brand websites in April and the unveiling of two new concept stores within the fiscal year. One store will open in Central, Hong Kong in the third quarter, and the other, a five-story flagship store, will open in Shanghai in 2025. In anticipation of the 100th anniversary in 2029, the Group plans to renovate all its stores over the next five years.

In FY2024, improved foot traffic and retail activities in Mainland China, Hong Kong, and Macau boosted the Group’s retail value by 20.4% year-on-year.

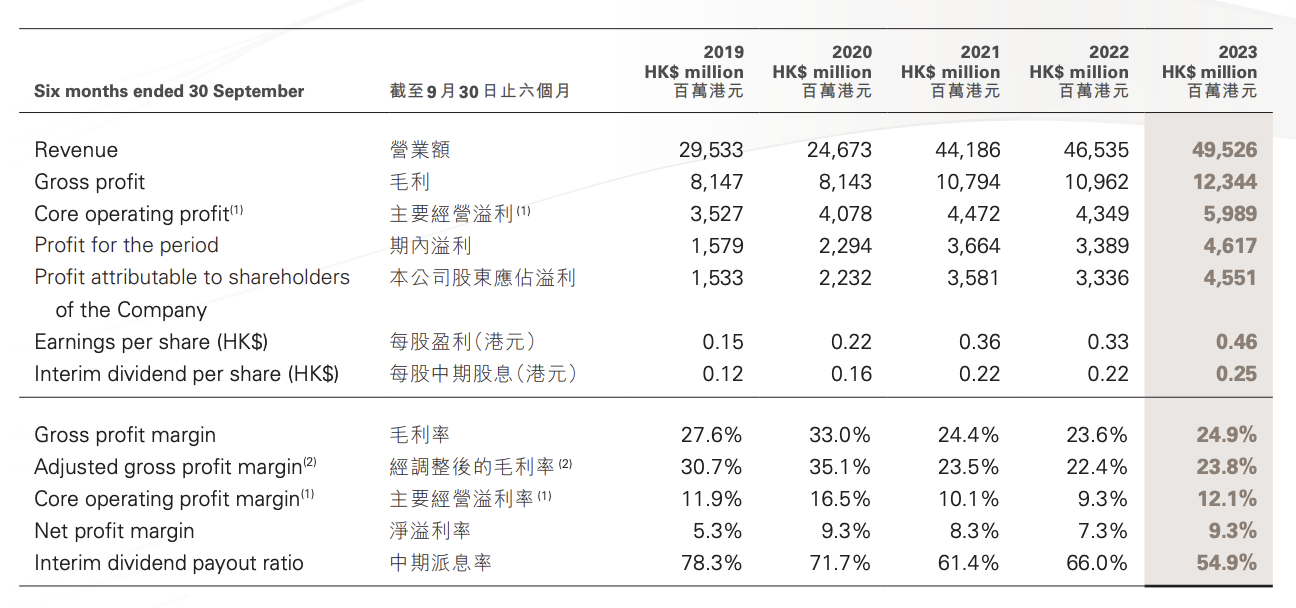

As of March 31, 2024, key financial data for Chow Tai Fook Group in FY2024 includes:

Focused efforts on enhancing store productivity and optimizing product mix, along with stringent cost management, led to a 120 basis point increase in operating profit margin to 11.2%.

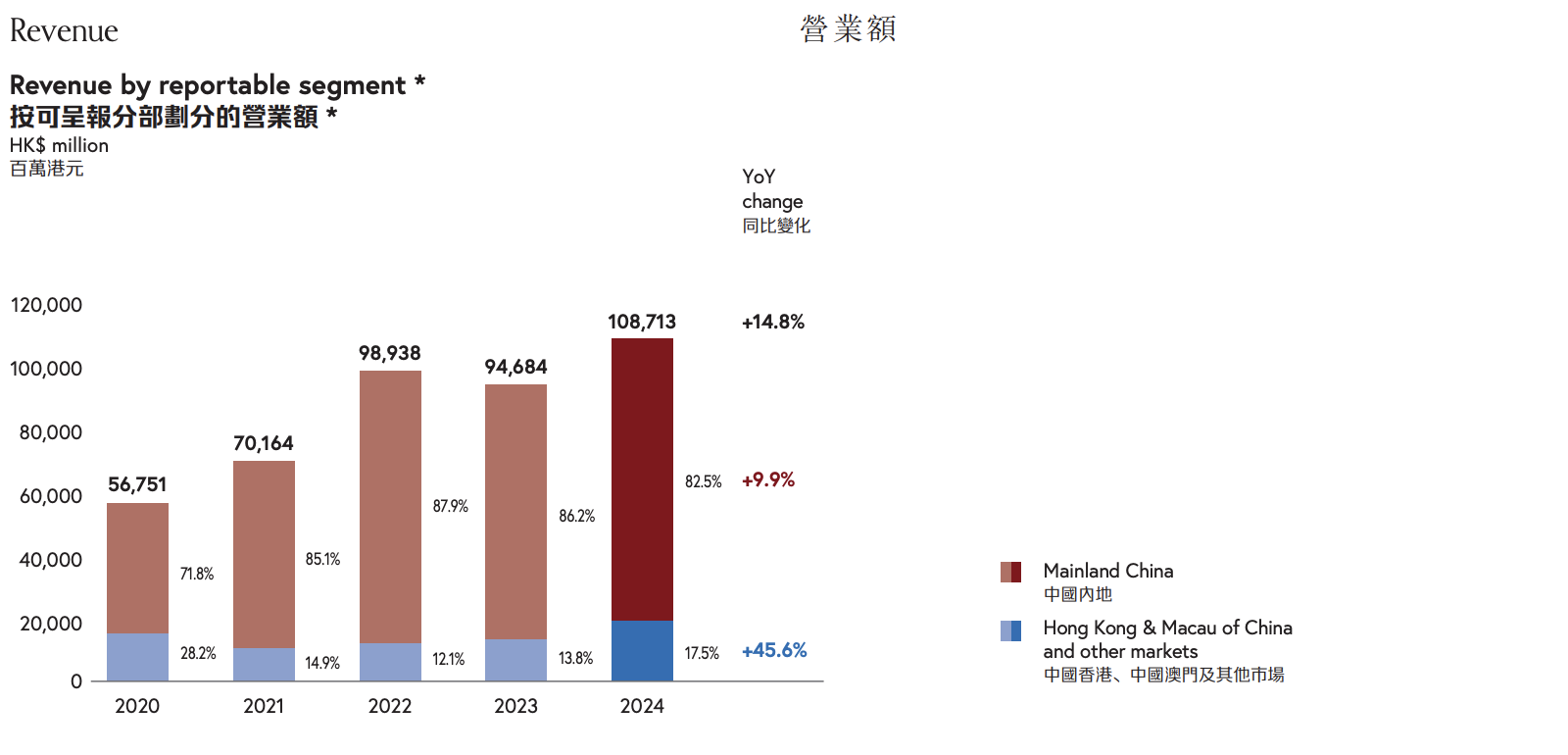

By region:

Mainland China:

- Revenue grew by 9.9% year-on-year, accounting for 82.5% of the Group’s total revenue.

- The iconic gold jewelry heritage series continued to be popular, with retail value increasing by approximately 20% year-on-year. Despite macroeconomic challenges affecting jewelry inlay consumption, sales trends for various inlay series remained stable.

- E-commerce retail sales grew strongly by 18.8%, contributing over 10% of mainland sales.

- Retail value increased by 17.3%, mainly due to the steady improvement in store performance of new stores opened in the past two to four years, the strong momentum of gold products, and robust holiday demand.

- The Group opened a net total of 143 new stores in Mainland China in FY2024. As of March 31, the Group had 7,403 retail points in Mainland China, 50% of which were opened in the past two to four years.

Hong Kong, Macau, and other markets:

- Revenue grew by 45.6% year-on-year, accounting for 17.5% of the Group’s total revenue, driven mainly by the recovery in inbound tourism.

- Inbound tourism from Mainland China and the Lunar New Year holiday contributed to continuous growth in Hong Kong and Macau. Daily average foot traffic in Hong Kong and Macau stores significantly increased year-on-year, driven by Mainland tourist visits.

- Benefiting from improved inbound tourism, retail value in Hong Kong and Macau grew by 32.0% and53.2%, respectively. As of March 31, the Group had 87 retail points in Hong Kong and Macau.

- Other markets saw the strongest retail value growth in FY2024, with an increase of 118.9%, primarily driven by strong domestic demand and the rise of the middle class, which spurred economic recovery in Southeast Asia. Mainland tourists’ return further boosted retail recovery in this region, with notable performance in Singapore, Malaysia, Canada, and Hainan duty-free stores. Hainan duty-free stores’ strong performance was driven by local government consumption vouchers and holiday demand. The Group opened eight stores in other markets during the year, including four duty-free stores in Mainland China, one retail point in Canada, and three retail points in major Southeast Asian markets.

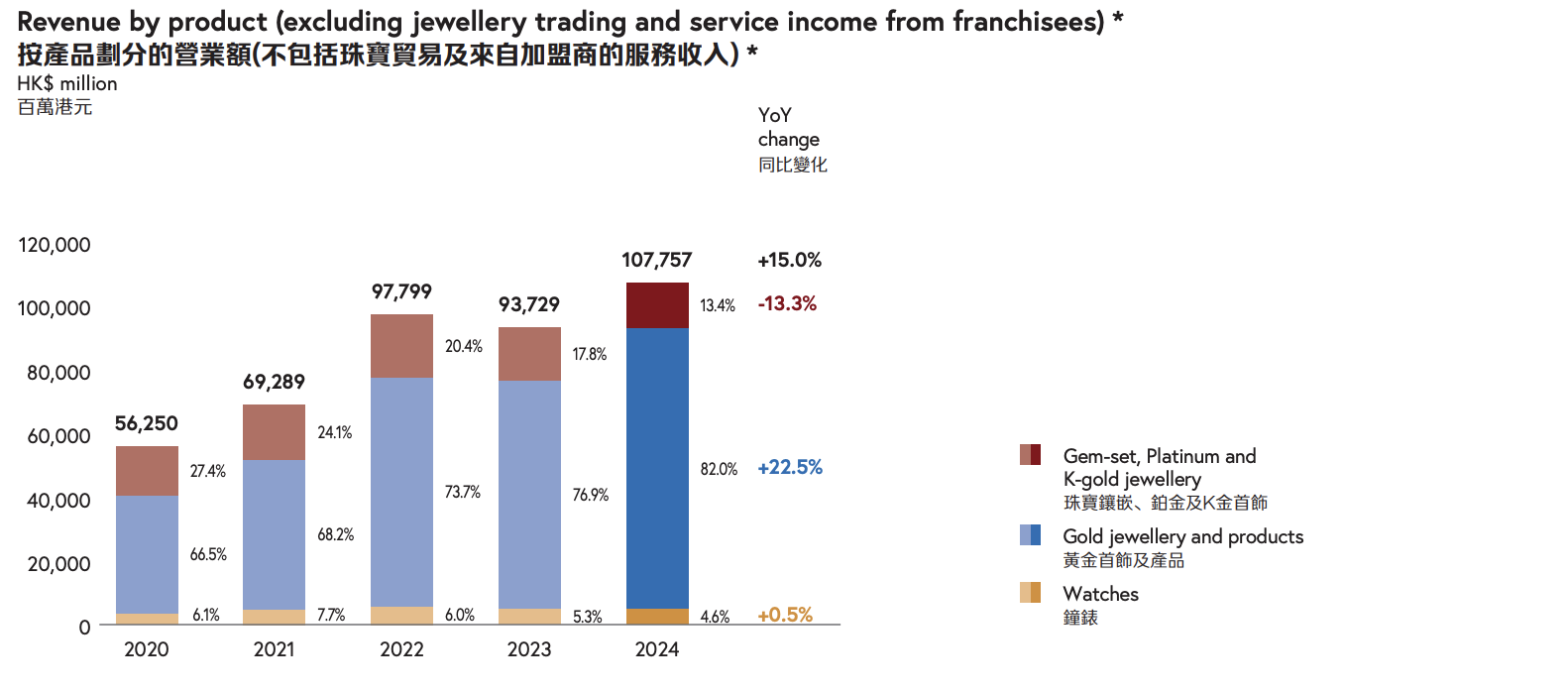

By product:

- Gold jewelry and products, known for their value retention and defensive characteristics, continued their strong momentum in FY2024, contributing 82% of the Group’s revenue.

- Demand for jewelry inlays, platinum, and K-gold jewelry was relatively affected by macroeconomic challenges, with revenue declining by 13.3% year-on-year. However, the “Four Beauties of Life” and “Chow Tai Fook Lily of the Valley” series performed well, exceeding management expectations.

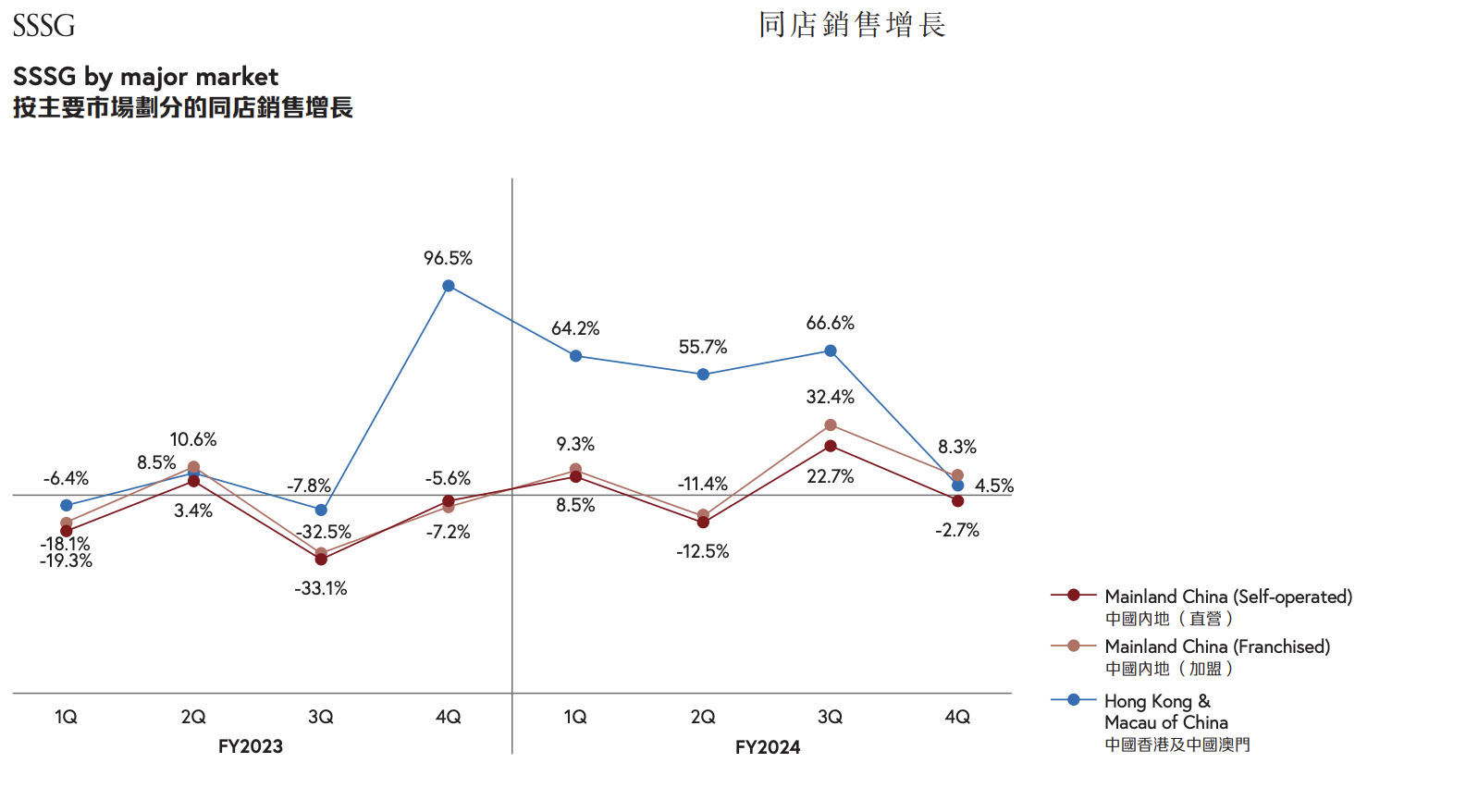

Same-store sales growth in FY2024:

- Mainland China increased by 1.8%, Hong Kong by 40%, and Macau by 50.9%.

In the final section of the FY2024 annual results announcement, the Group disclosed unaudited key operating data from April 1 to May 31, 2024:

- Retail value declined by 20.2% year-on-year, with Mainland China down by 18.8%, and Hong Kong, Macau, and other markets down by 29%.

- Same-store sales in Mainland China decreased by 27.6%, and in Hong Kong and Macau by 32%.

- Mainland China sales of gold jewelry and products fell by 29.8%, and sales of jewelry inlays, platinum, and K-gold jewelry fell by 32.9%.

On the second day after the financial report release, as of the close on June 14, Chow Tai Fook’s stock price dropped by 8.9% to HKD 8.62 per share compared to the previous trading day. The stock has fallen by 25.8% year-to-date, with a current market capitalization of approximately HKD 90.5 billion.

| Source: Financial report

| Image Credit: Group website & financial report

| Editor: LeZhi