Since the beginning of this year, the stock price of the German sportswear manufacturer Adidas has risen by about 18%, making it the best performer among major listed companies in the sportswear sector.

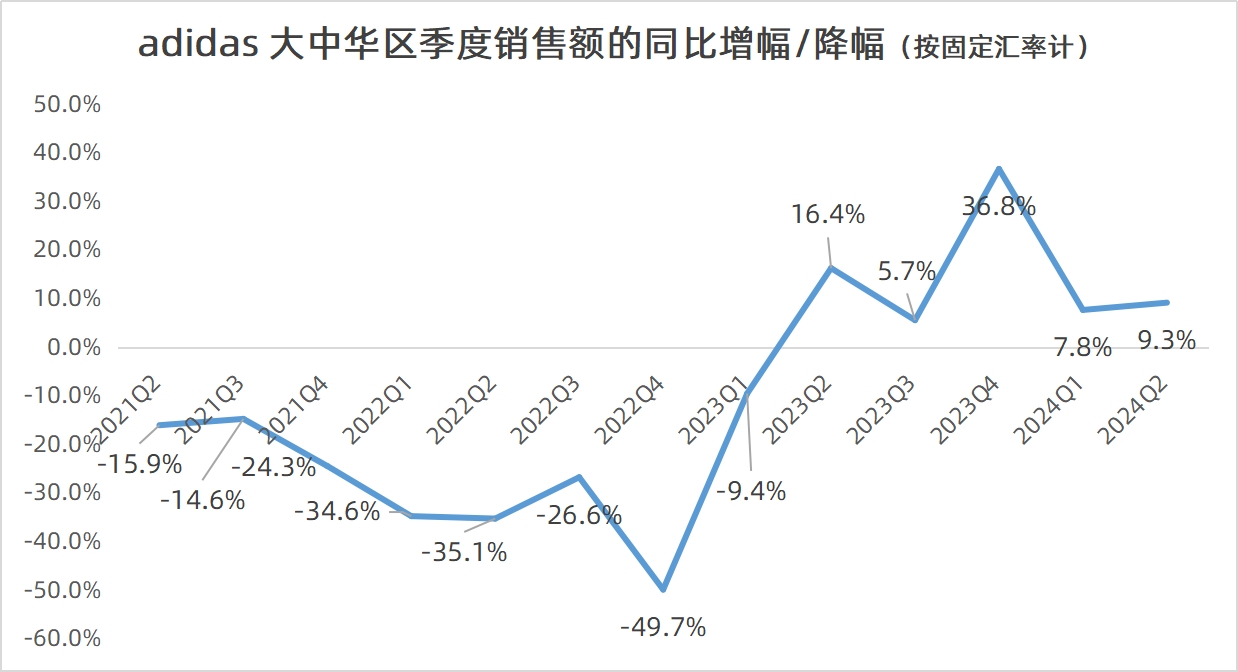

In the Chinese market, Adidas is also showing accelerated growth: in the first quarter of this year, net sales in the Greater China region increased by 1.5% year-on-year to 897 million euros (a 7.8% increase at constant exchange rates); in the second quarter, sales in the Greater China region increased by 7.4% year-on-year (a 9.3% increase at constant exchange rates).

Notably, Adidas has achieved year-on-year growth in quarterly sales in the Chinese market for five consecutive quarters, following eight quarters of decline.

The Group’s CEO, Bjørn Gulden, acknowledged that “the Chinese market has undergone tremendous changes over the past four years,” and that “China could be Adidas’ most profitable market.”

During two analyst meetings this year, Bjørn Gulden shared many facts and data about the Chinese market, helping us better understand Adidas’ recovery process in China and how the Group’s management views the Chinese sports market.

Bjørn Gulden stated, “My view on China is that the market always has uncertainties, but in our (sports) industry, that doesn’t matter much because we need growth regardless. After the ‘BCI’ incident, we lost market share in China, and during the pandemic, we also went through a difficult period.

“But I still like the Chinese market; it has a large, dynamic population. Again, I’m confident that we will regain market share. Every week, as we develop new products and learn where we should focus on pricing and categories, I believe we will make improvements. Therefore, despite these uncertainties, I remain optimistic that we will achieve double-digit growth in China this year.”

“The Chinese market has undergone tremendous changes over the past four years,” Bjørn Gulden added. “Previously, the market was mainly dominated by Western brands. Now, local brands have gained a significant share and established more vertical business models, with many being manufacturers who retail directly through their stores. As a result, the speed and price value they offer to consumers are different from before. We are working hard to adapt to this situation.”

Bjørn Gulden revealed that the EBIT margin in the Chinese market reached 29% in the first quarter, which is already a high level. But I believe our EBIT for the full year will reach 30%. China could be our most profitable market, with a medium-term target EBIT margin of between 25% and 30%.

Bjørn Gulden disclosed that we have a very strong management team in the Chinese market, who had previously worked at Adidas, then left and worked for local brands, and now have returned. After going through a very challenging period, they have shown tremendous energy and taken many measures to improve the business model.

“Now, we have a very dynamic team, and we have provided them with tools such as local design, local sourcing, and extensive marketing resources.”

Regarding how Adidas is recovering, Bjørn Gulden said that “localization” is key, covering all aspects from supply chain, product design, marketing, to sales channels.

On the localization of the supply chain, Bjørn Gulden stated, “The supply chain will become more localized. You can clearly see that China will be China’s China. …(considering factors like tariffs), we are now essentially no longer sourcing products from China to the U.S.”

“Therefore, our supply chain will eventually consist of more local suppliers, which can also bring us greater speed and agility. Along with the change in attitude, we quickly reversed the decline in brand popularity and business visibility, once again demonstrating the enduring strength of the Adidas three stripes. The next challenge is to maintain that.”

In terms of product performance, we have seen local brands gain significant market share by creating products at price points below 100 euros, an area where we don’t have strong global products. Therefore, what we are doing is developing products both for true performance and for lifestyle categories priced around 100 euros, and we are starting to see these products gain traction. But Rome wasn’t built in a day. So, the products we are developing now will have much greater visibility in 2025 than in 2024, because we have just started this process six months ago.

For marketing, Bjørn Gulden said, “The localization of the marketing process is very important, and we are conducting many large-scale campaigns in the Chinese market. I should say that our approach is closely related to consumers, highly relevant in the local market, but still within the global framework of the brand. We are investing not only in marketing but also in infrastructure.”

(*In September 2023, the opening ceremony of Adidas’ automated distribution center “X” in Suzhou, built with an investment of 1 billion yuan, was held in Suzhou Industrial Park. This is Adidas’ largest investment in China in the past five years.)

Regarding the localization of the sales channel model, Bjørn Gulden said that this model emphasizes responsiveness during peak sales seasons, whether in our own stores or with our retail partners. Of course, you must remember that our retail partners are all mono-brand stores, with Adidas signs outside.

Bjørn Gulden revealed, “In today’s Chinese retail market, our own stores are performing better than franchised stores because of the availability of fresh products. Therefore, we believe once again that our strong performance in self-operated stores indicates that our brand is on the right track. If we fill our stores with the right products, we will achieve the same results, but our wholesale partners or retail partners may experience delays in success due to limited supply and depth. Therefore, the situation in China is similar to what we have seen elsewhere.”

|Source: Adidas conference call

|Image Credit: Adidas official website

|Editor: LeZhi