During the four years spanning from 2020 to 2023, which crossed the pandemic, people around the world have been actively pursuing a sense of “happiness” (quality of life) from physical, psychological, and social aspects. The sports and outdoor sector has been a whirlwind of innovation in products and services, providing significant energy, events, and communities for this “happiness”.

Luxe.CO Intelligence has been continuously tracking and analyzing global investment and acquisition transactions in the sports and outdoor sector, drawing a clear roadmap that showcases the development trajectories and hotspots in various sub-sectors for entrepreneurs and investors.

On November 23rd, at the “2023 Xiamen International Fashion Week Fashion” industry investment forum the founder of Luxe.CO/Orange Bay Education, Alicia Yu, shared the latest research findings of Luxe.CO Intelligence: “Global Sports and Outdoor Investment Trend Analysis 2020-2023“. This included a series of exclusive data:

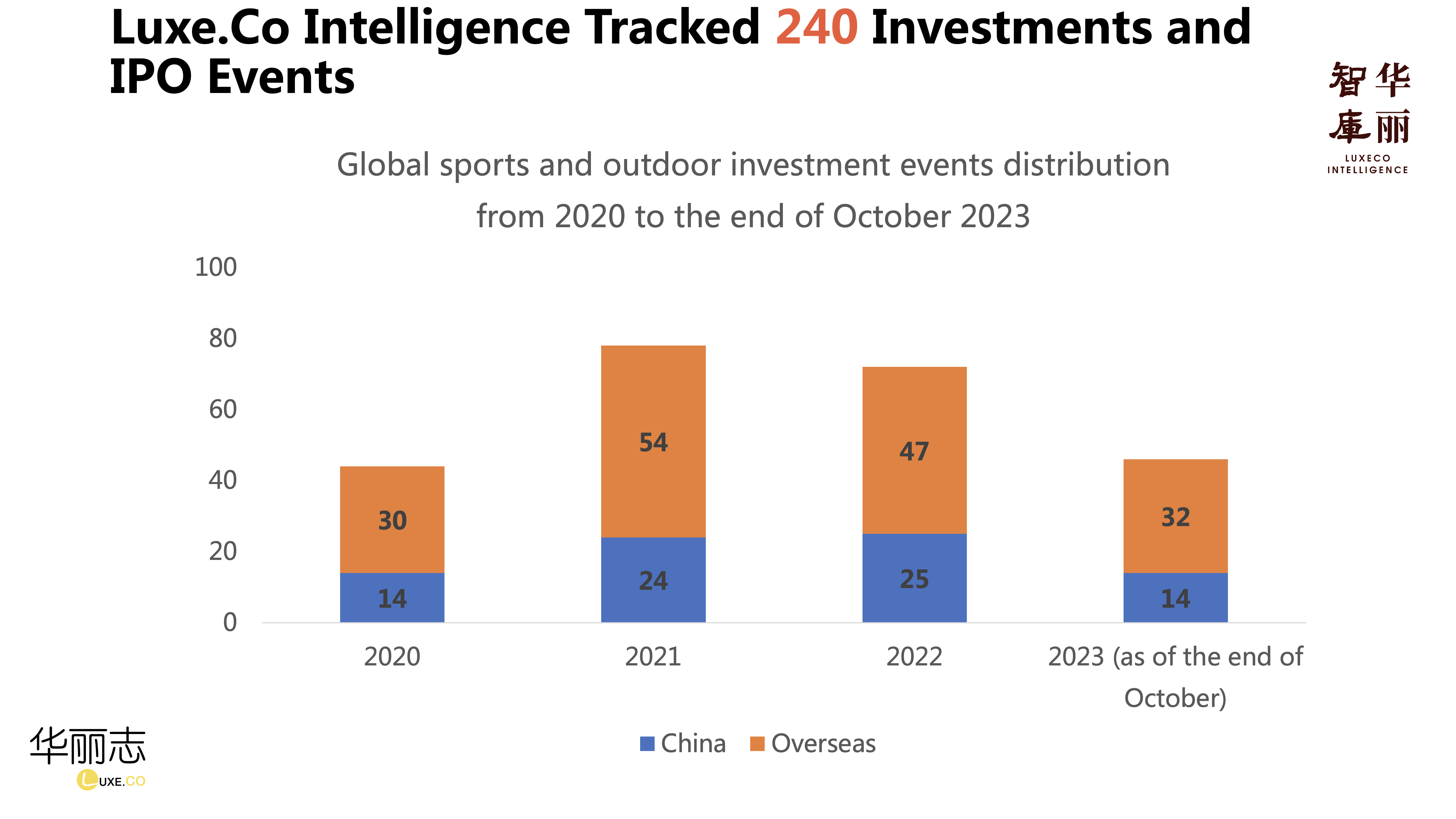

From 2020 to October 2023, Luxe.CO Intelligence tracked a total of 240 investment, acquisition, and IPO events globally in the sports and outdoor field.

In the year 2020, when the pandemic broke out, there were 44 related financial transactions globally, with China having a higher proportion (14).

As more people focused on physical health and outdoor activities, 2021 became the peak year of investment in the sports and outdoor sector over the past four years, with 78 financial transactions worldwide (24 in China).

Entering 2023, due to various macro and micro factors, the global capital market has become cautious, but there were still 46 investment and acquisition transactions in the sports and outdoor sector by the end of October (14 in China).

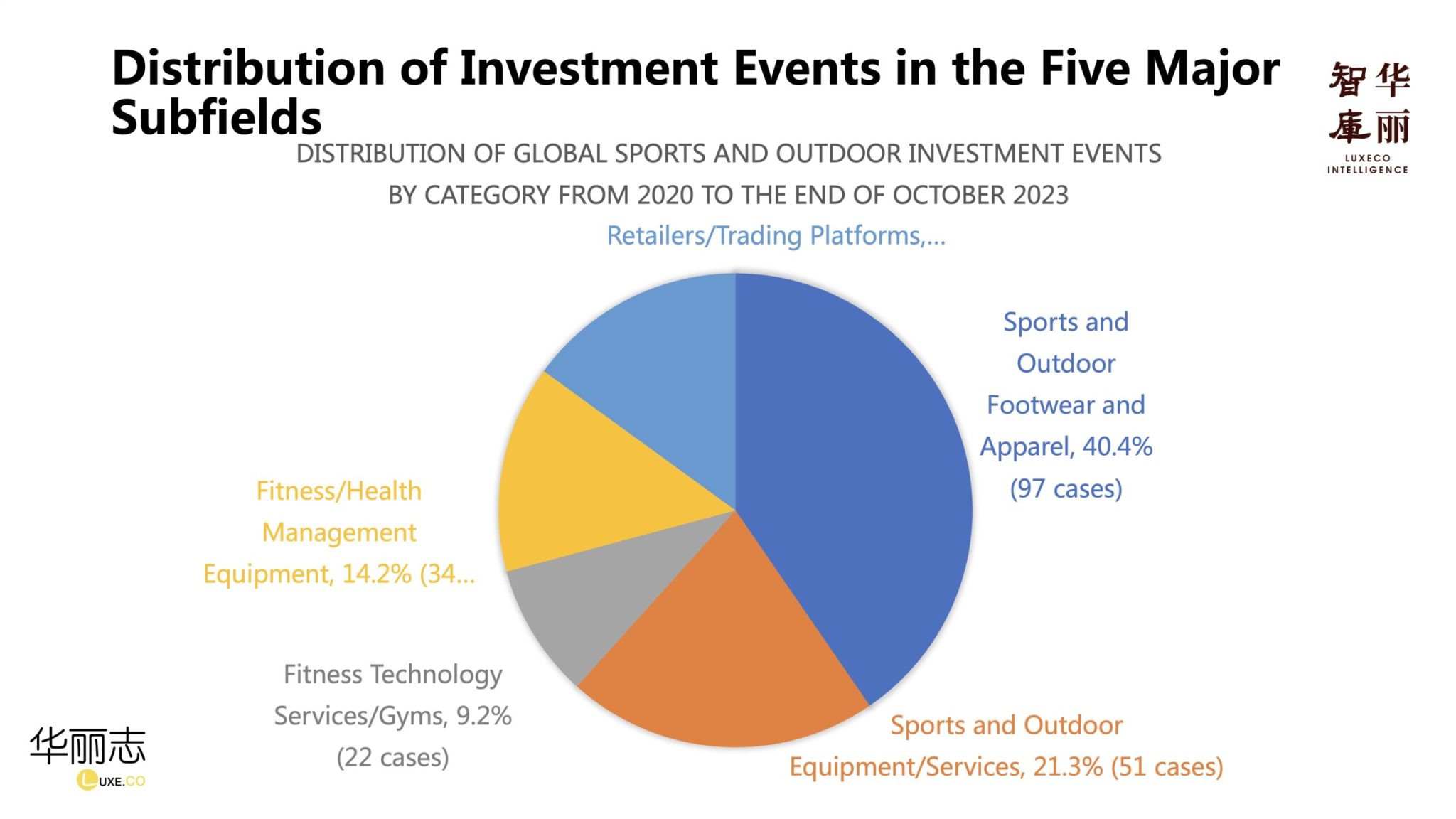

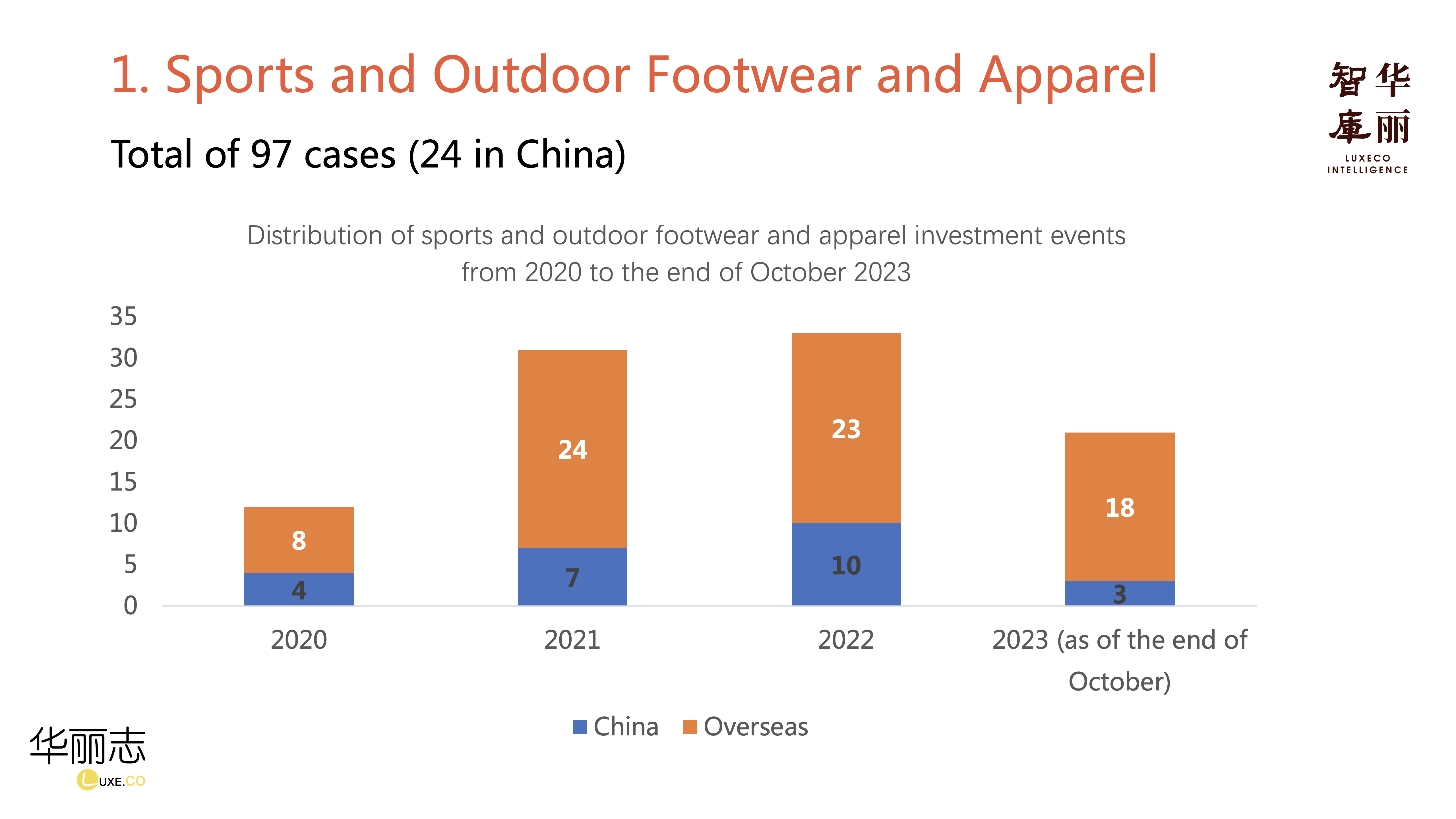

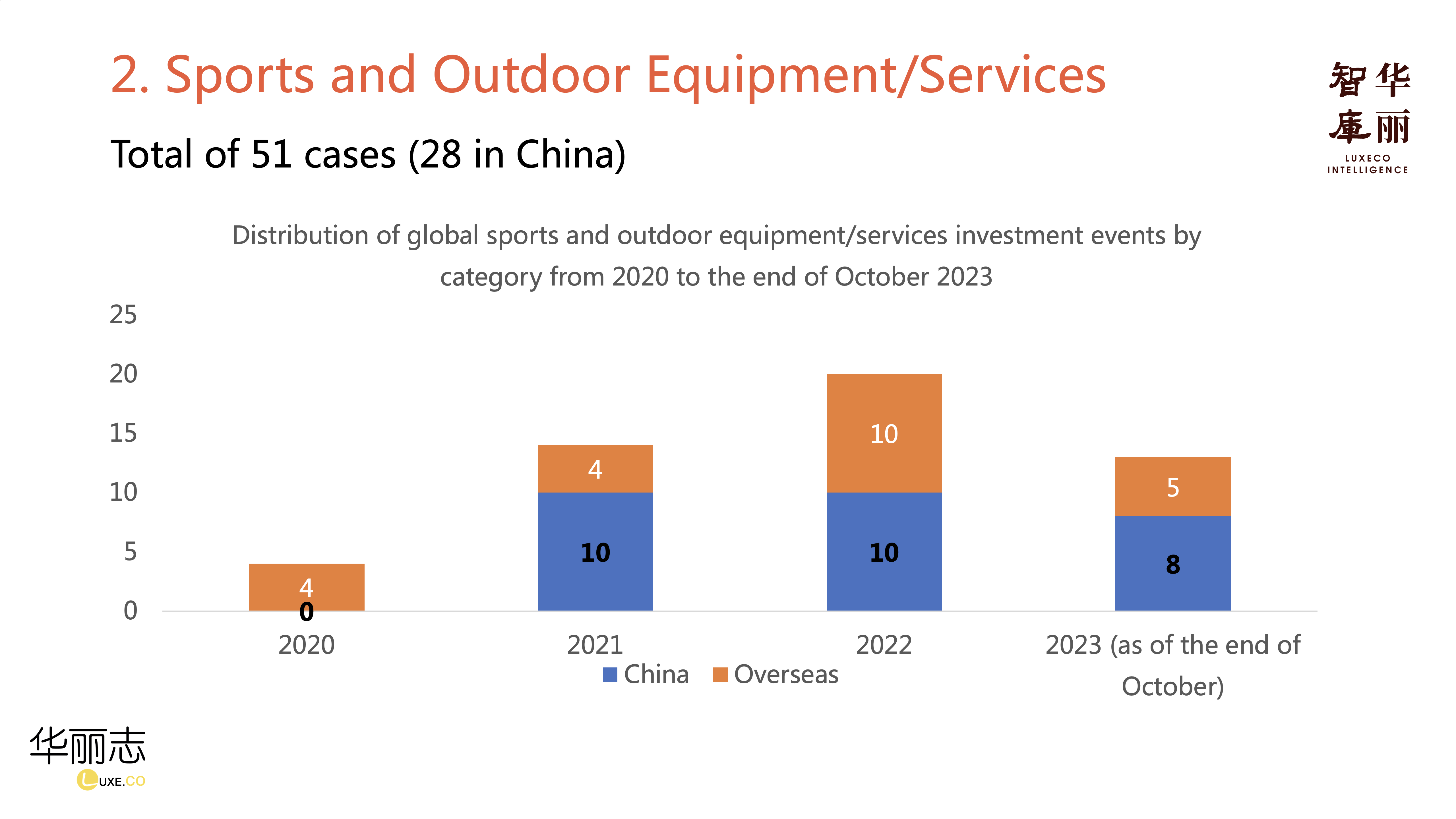

Over the past four years, the investment weights in different sub-sectors of sports and outdoors have varied. As shown in the following graph, the highest proportion was in sports and outdoor footwear and apparel brands, holding a commanding 40.4% share, followed by sports and outdoor equipment/services (21.3%), retailers/trading platforms (15%), fitness/health management equipment (14.2%), and fitness tech services/gyms (9.2%).

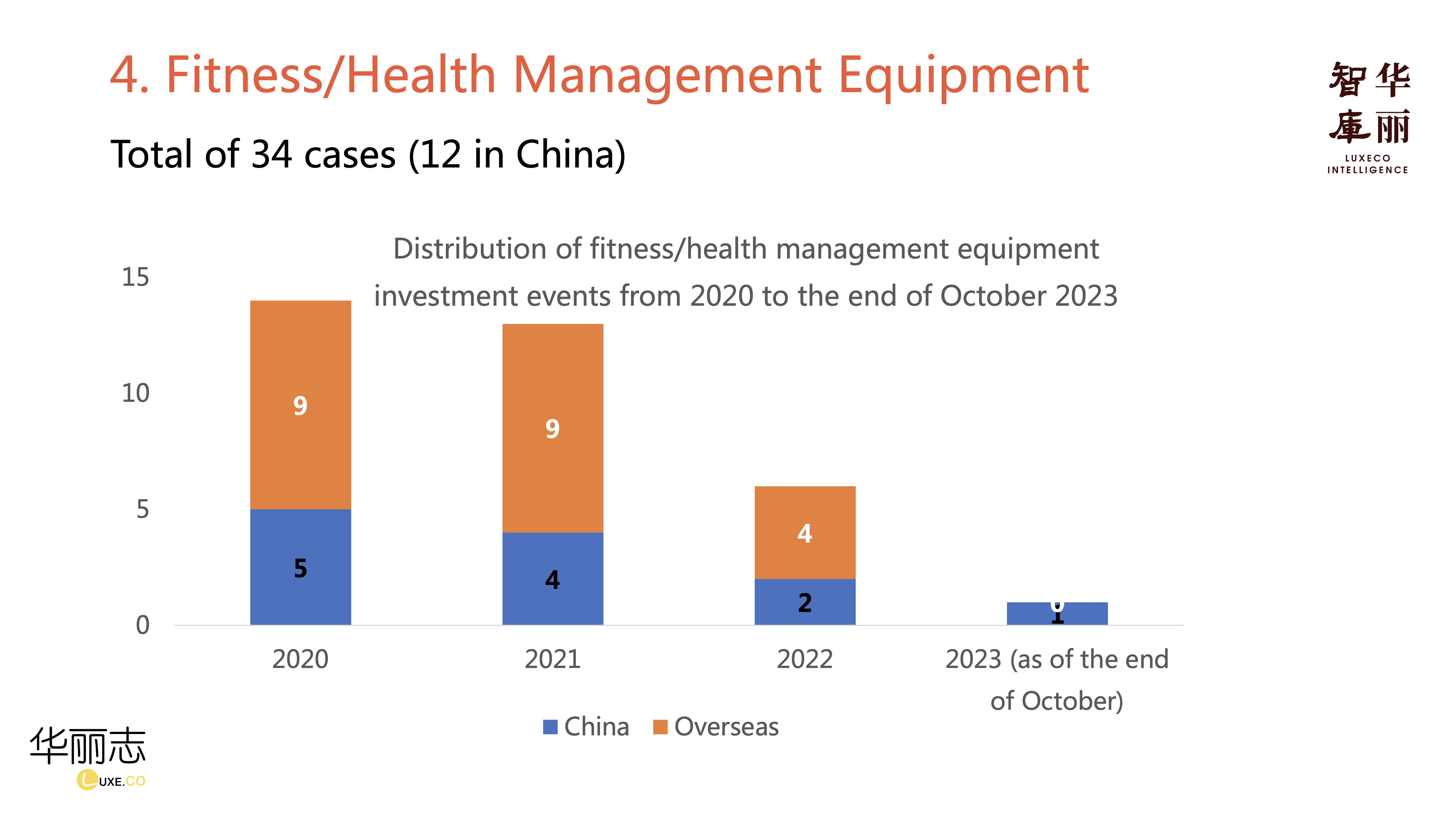

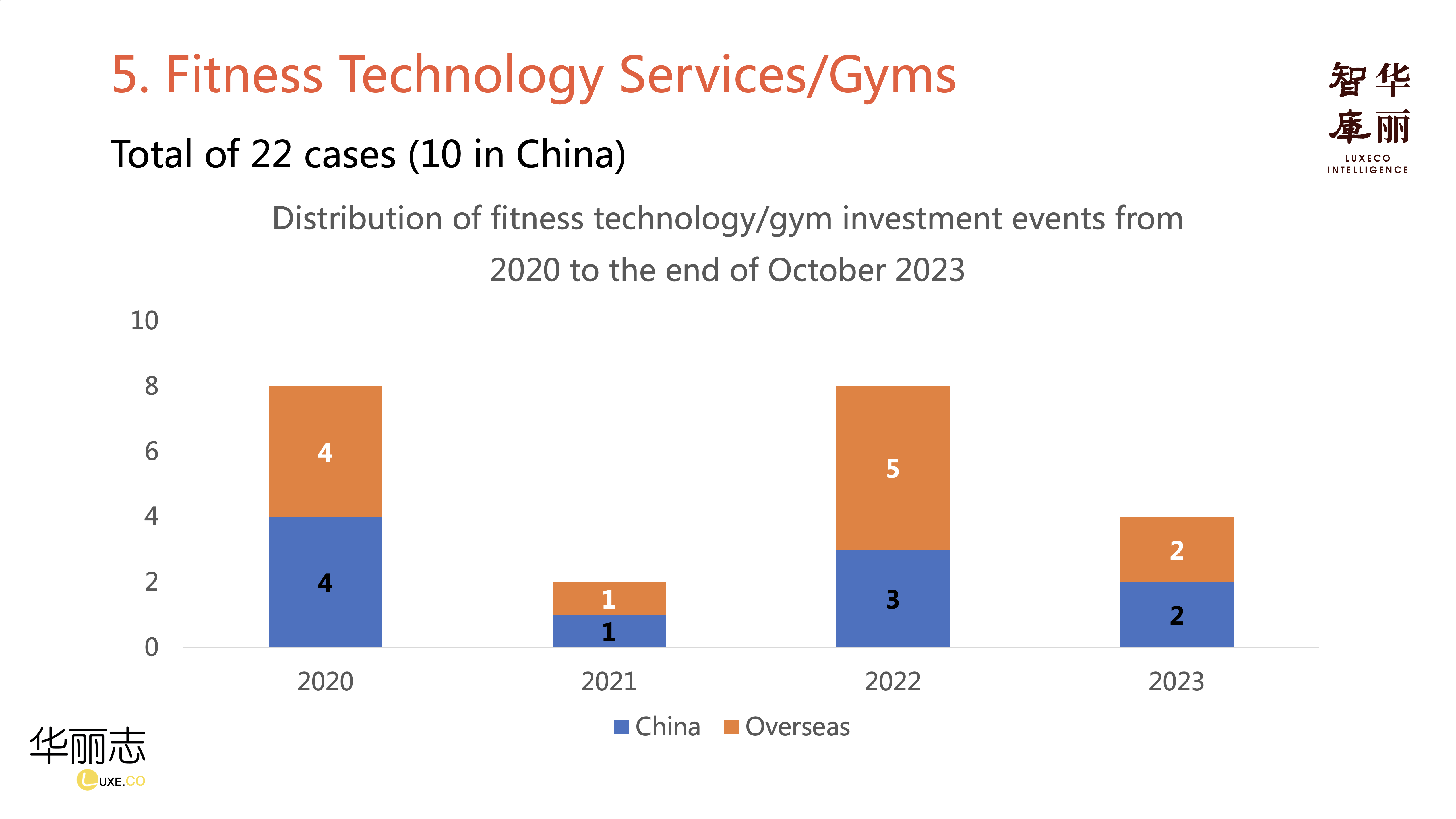

During the peak of the pandemic in 2020 and 2021, online trading platforms for trendy sneakers and fitness/health management equipment (especially home fitness equipment) became significant investment hotspots. However, as the pandemic subsided, activities and purchases in the sports and outdoors returned more to offline modes, leading to a quieting of capital movements in the aforementioned areas. Still, investments and acquisitions in sports and outdoor footwear and apparel brands, equipment, and offline services remained quite active.

The five sub-sectors each have different “keywords” that correspond to the latest trends and hotspots in the development of sports and outdoor products and services. At the forum, Yu succinctly interpreted representative investment and acquisition cases under each keyword:

- Sports and Outdoor Footwear and Apparel: Eco-friendly and sustainable, internet-native brands, functional design and materials, women’s empowerment, specialized niche scenarios, internationalization of Chinese companies, transformation and rebirth of old brands.

- Sports and Outdoor Equipment/Services: Camping, cycling, extreme sports, equipment.

- Retailers/Trading Platforms: Trendy sneakers, IP licensing.

- Fitness/Health Management Equipment: Home fitness, smart wearables.

- Fitness Tech Services/Gyms: Social motivation, immersive experiences.

Yu noted that the enduring success of the sports and outdoor sector is backed by a global “paradigm shift”—different sub-categories, from basketball, running, to cycling, camping, are experiencing a transition from niche to mainstream, from functional to fashionable, from professional to luxurious.

Sports and outdoor brands often start from super-specialized professional areas and then develop into multi-category brands. Compared to other apparel brands, they possess a more distinctive “brand power”. Taking global sports and outdoor leading brands like NIKE, lululemon, Arc’teryx, Moncler as examples, their “brand power” stems from four main sources: a strong and authentic founder’s DNA, captivating brand stories, pursuit of ultimate product spirit, and positive and aspirational “universal values”.

Luxe.CO Intelligence recently released the “Outdoor Brands China Power Ranking 2023“, based on the comprehensive coverage and real-time updates of brand public activities by Tong.Luxe.CO, including 616 China-related activities of 102 outdoor brands from November 1, 2022, to October 31, 2023.

These activities involve store expansion, pop-up stores, collaborations highly relevant to the Chinese market, festival marketing, spokespersons, and e-commerce/department store presence, etc. Each activities was weighted and scored based on Luxe.CO Intelligence’s exclusive research findings, leading to a comprehensive ranking of all recorded brands.

Click the image or this link to read the full report.

The vitality list clearly shows that outdoor brands are seizing opportunities in the Chinese market: mature brands continue to evolve and deepen their roots, new Chinese outdoor brands are emerging, and niche overseas outdoor brands are accelerating their entry. From store design, content dissemination, to marketing activities, outdoor brands are showcasing themselves in more fashionable, diverse, and three-dimensional ways.

About Xiamen International Fashion Week:

Sports and outdoors is a core theme of Xiamen International Fashion Week. Xiamen, nestled by mountains and sea, is not only a natural haven for sports and outdoor activities but also boasts unique industrial resource advantages. A series of benchmark companies at the forefront of the sports industry have emerged here, providing fresh examples for innovative development in the industry.

Xiamen International Fashion Week includes exhibitions, shows, FED Shows, investment and financing matchmaking events, competitions, and other activities. It aids brands in connecting with capital and business resources and serves as a testing ground for the youthful transformation and innovation of traditional brands and small and medium-sized brands.

| Image Credit: Xiamen International Fashion Week, Luxe.CO Intelligence

| Editor: Maier