Ski season now kicks off in China.

For ski enthusiasts, selecting and purchasing ski attire and equipment, as well as choosing ski resorts, have become essential pre-season preparations. As more and more ski enthusiasts emerge, what are their views on ski fashion? Beyond skiing, what other experiences do they seek at ski resorts?

Recently, Luxeplace.com conducted a survey through its WeChat public account, inviting readers to answer ten questions about ski fashion. Among the Luxeplace.com readers who completed the survey, 74% have experienced skiing, and 58% have a budget of over 3000 yuan for ski wear, suggesting that the survey accurately reflects the profile of fashion-conscious, financially capable ski enthusiasts.

Based on 113 valid responses, Luxe.CO Intelligence has created 6 charts to present the real views of China’s mid-to-high-end consumers on ski fashion:

- Do you value the fashion aspect of ski wear?

- What are the pain points of current ski wear on the market?

- How do you choose where to buy ski wear and which brands to choose?

- What type of ski resort attracts you?

Over 80% of High-End Consumers Value the Fashion Aspect of Ski Wear

Of the 113 high-end consumers participating in the study, 74% have experienced skiing and show varying degrees of affection for the sport; 21% said they “haven’t been to a ski resort but are very eager to”; only 5% expressed no interest in skiing.

When discussing skiing, 25% view it as an “extreme and dynamic” sport or a “must-do winter ritual”; 17% associate skiing with being a “high-end sport”; and 12% appreciate its fashion aspect.

In terms of ski wear, 82% consider its fashion aspect important, while 18% are indifferent to it.

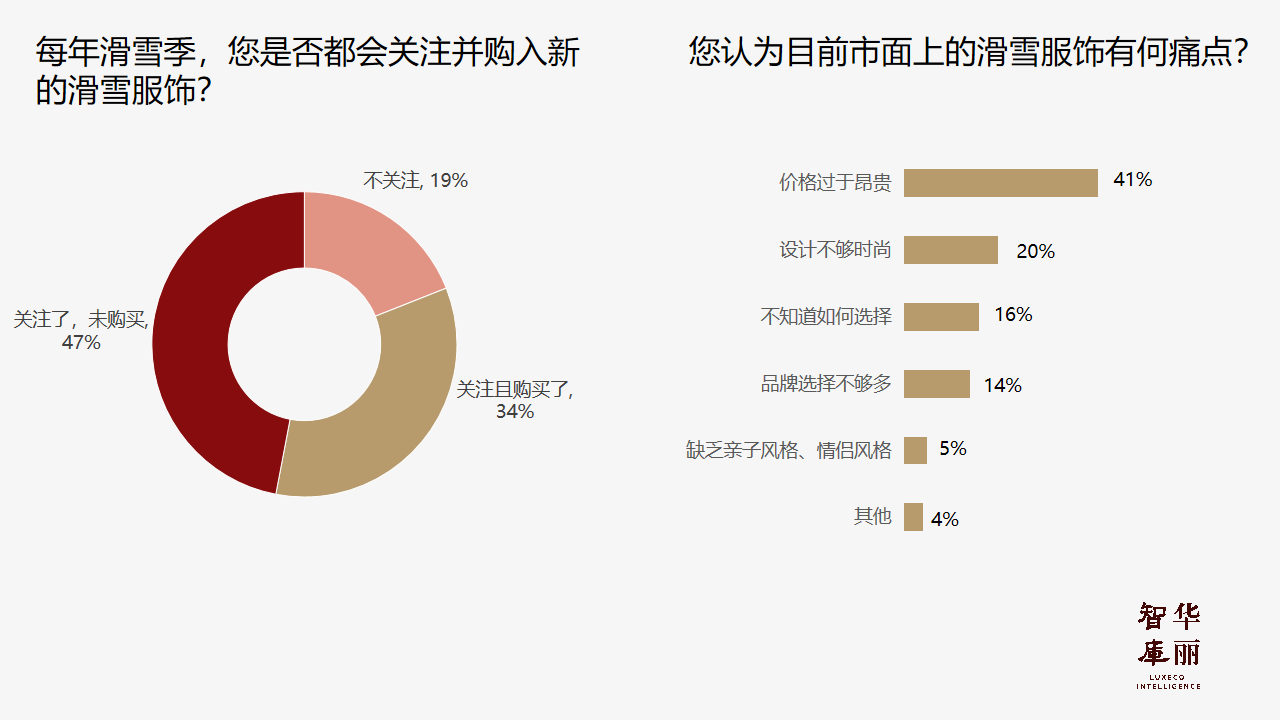

80% of High-End Consumers Pay Attention to New Ski Wear Annually, With Price Being a Significant Factor in Their Purchasing Decisions

81% of respondents say they pay attention to new ski wear each season, but only 34% opt to purchase, leaving 47% who choose not to buy.

“Price” is a key factor influencing the purchase of ski wear, followed by “fashion”. 41% find the prices of ski wear on the market too high; 20% think the designs are not fashionable enough.

16% expressed uncertainty about how to choose ski wear, indicating brands need to invest more in product details, helping consumers understand functionality, applicable scenarios, and styling.

Offline Channels Are the Mainstay for Ski Wear Shopping, With Professional Ski Brands Preferred by High-End Consumers

Regarding purchasing channels, high-end consumers slightly favor offline over online. Offline channels include “brand stores in malls (27%)”, “multi-brand stores specializing in ski/outdoor products (23%)”, and “brand stores at ski resorts (4%)”. 42% of respondents choose to buy ski wear online.

In brand selection, “professional ski-only brands” are more favored, with 47% opting for them; followed by “well-known outdoor brands (27%)”, “niche brands with a strong sense of fashion design (17%)”, and “luxury brands’ ski lines (8%)”.

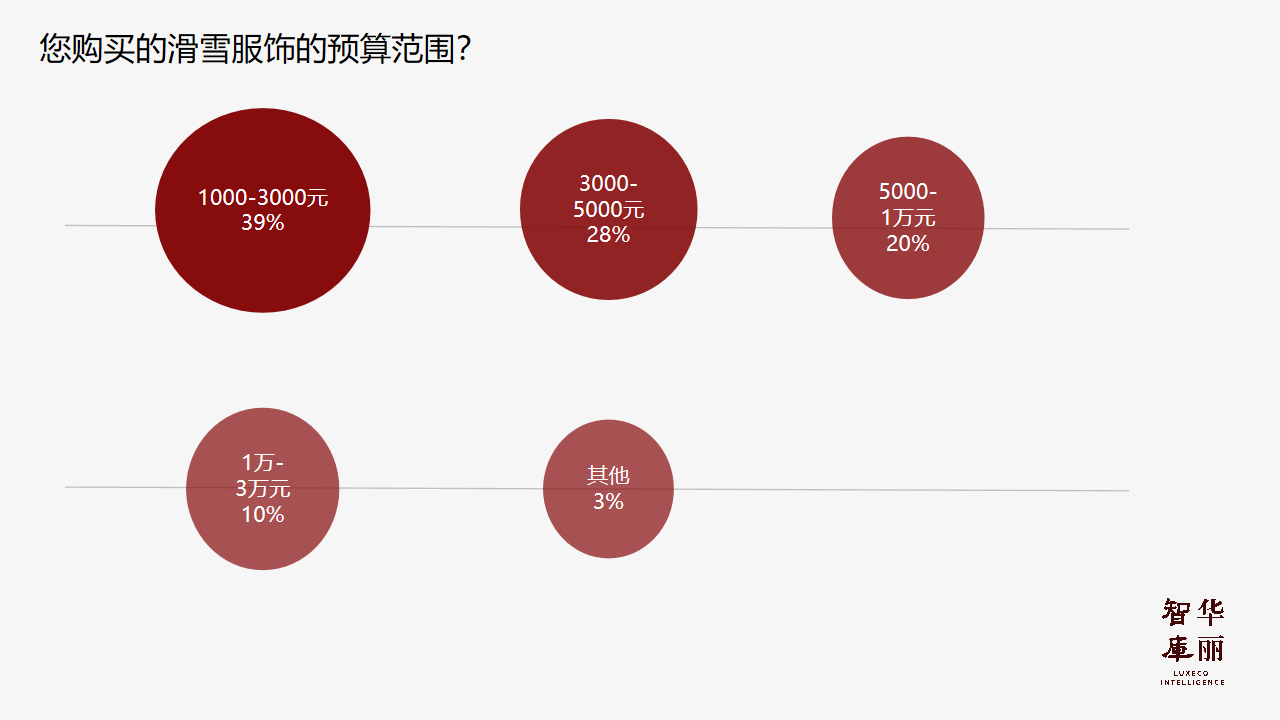

Budget-wise, consumers prioritize “value for money” in ski wear. 39% have a budget of “1000-3000 yuan”; 28% budget “3000-5000 yuan”; 20% budget “5000-10,000 yuan”; and 10% have a budget exceeding 10,000 yuan.

Accommodation and Transport Experiences Are Key Attractions for High-End Consumers at Ski Resorts

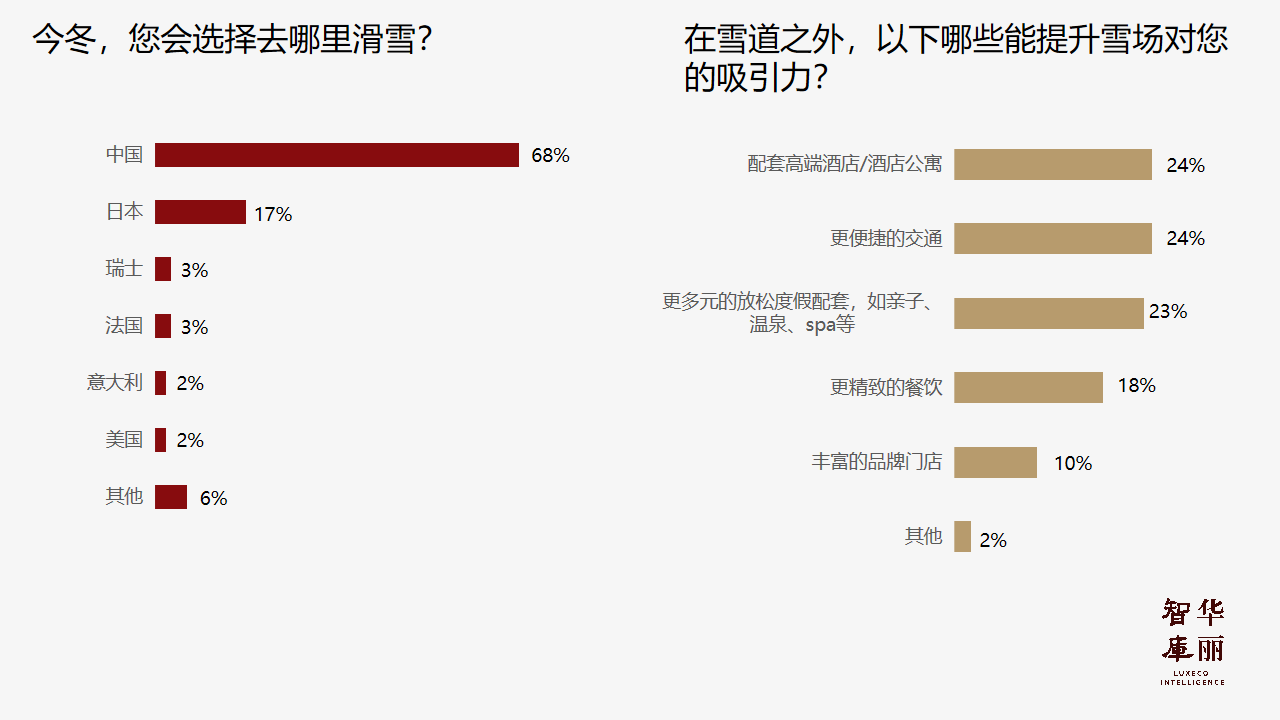

Despite the reopening of international travel, 68% of respondents still choose to ski at various Chinese resorts this winter, with 17% opting for nearby Japan and at least 8% wishing to experience skiing in European countries.

In choosing a ski resort, high-end consumers highly value accommodation and transport experiences, with 24% attracted to resorts offering “high-end hotels/apartments” or “more convenient transport”.

23% hope for “more diverse relaxation and holiday options, like family-friendly, hot springs, spa, etc.” at ski resorts; 18% and 10% respectively seek “more exquisite dining” and “a wider range of brand stores”.

| Image Credit: Produced and photographed by Luxeplace.com

丨Reporter:Zuo Xiaoli

| Editor: Zhu Ruoyu