Recently, Bain & Company, in collaboration with the Italian luxury goods industry association Fondazione Altagamma, released the 24th edition of its global luxury market study, titled “Finding a New Longevity for Luxury.”

According to the report, after the post-pandemic surge, the luxury industry entered a “normalization” phase in 2025. While the overall market remained stable, it also showed increasing polarization within.

Focusing on the Chinese Mainland market, although it remained under pressure in 2025, the rate of decline narrowed compared to 2024, despite the challenging macroeconomic environment. A rebound was observed in the third quarter, supported by recovering consumer confidence and renewed interest in core categories and brands. Bain pointed out that competition in the domestic market continues to intensify, with Chinese high-end brands now competing head-to-head with international brands.

Key takeaways and data from the report are as follows:

Overall Market Performance and Structural Shifts

Stable Market Size:

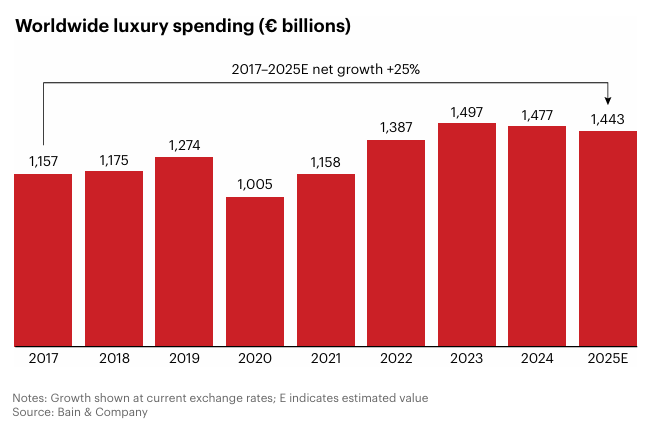

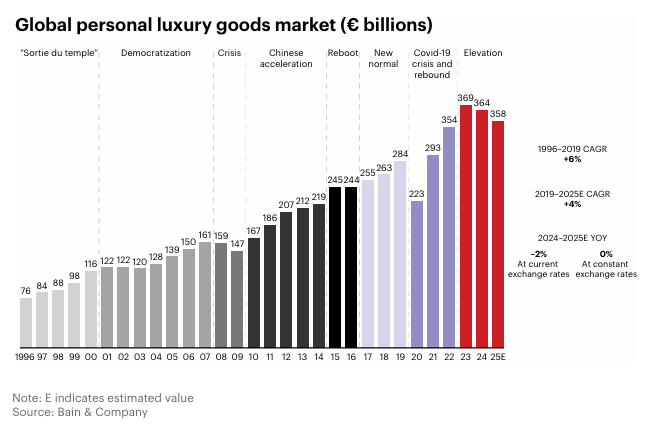

Global luxury spending is expected to reach €1.44 trillion in 2025, representing a slight decline of 1%-3% at current exchange rates relative to 2024, or a range of -1%-+1% at constant exchange rates.

Market Composition:

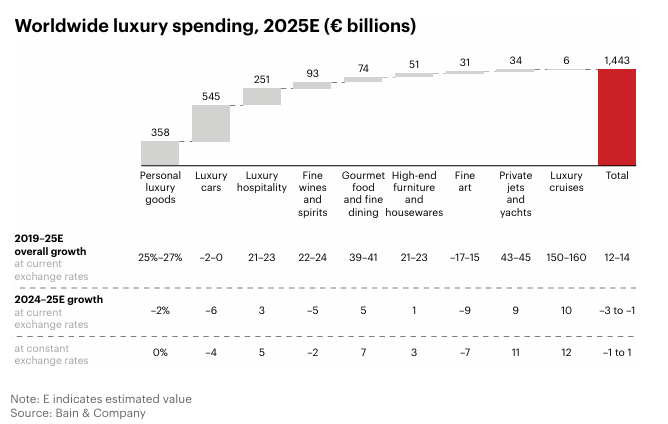

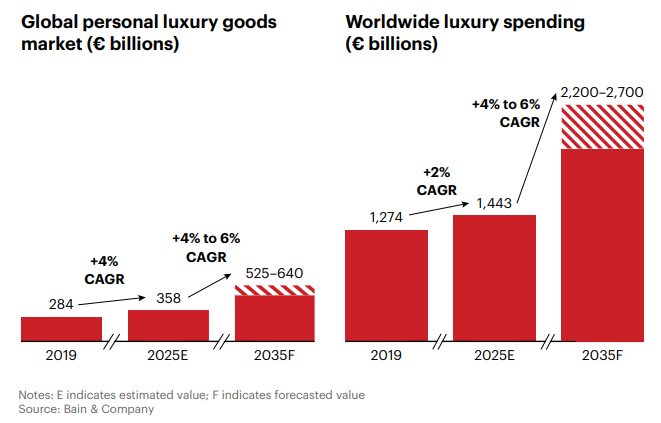

The global luxury market comprises nine major segments. The core pillars are luxury cars (€545 billion), personal luxury goods (€358 billion), and luxury hospitality (€251 billion), together accounting for 80% of the total market.

Other luxury categories covered in the report include fine wines and spirits, gourmet food and fine dining, high-end furniture and housewares, fine art, private jets and yachts, and luxury cruises.

Experiences Outperform Products:

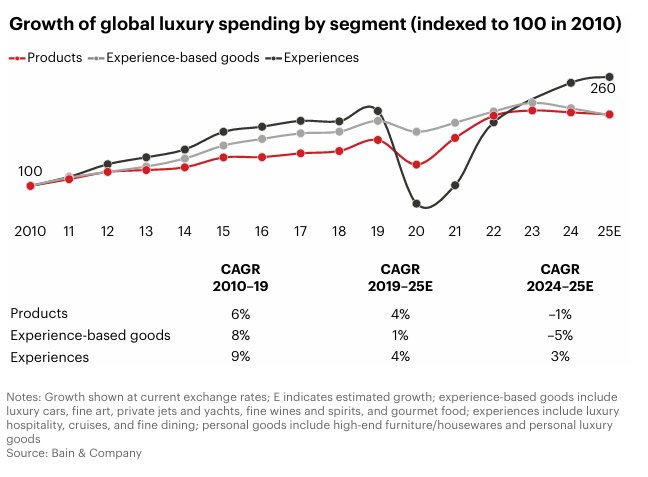

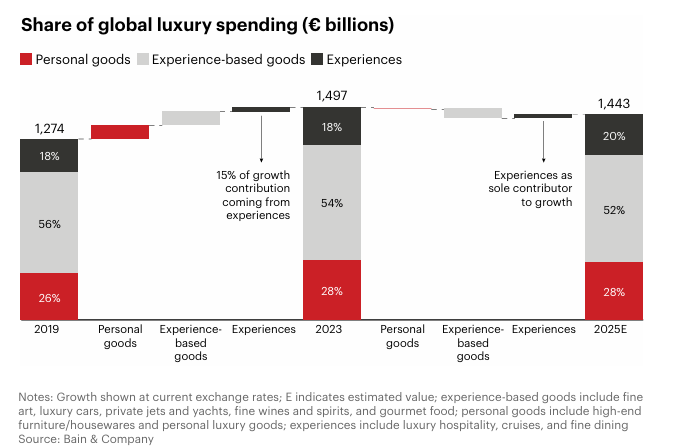

Consumer spending continues to shift from tangible goods to experiences such as luxury hospitality, cruises, and fine dining. Since 2023, experiential categories have become the primary contributors to luxury market growth.

-

Experiential luxury grew by approximately 3% in 2025, accounting for 20% of global luxury spending;

-

Personal luxury goods accounted for 28%, down by 1%;

-

Experience-based personal luxury (including luxury cars, fine art, private jets and yachts, and fine wines and spirits) made up 52%, marking a 5% decline.

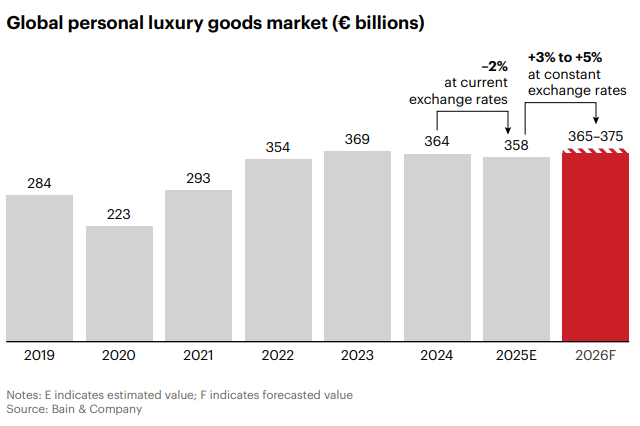

Changes in Consumer Base and Price Sensitivity in the Personal Luxury Market

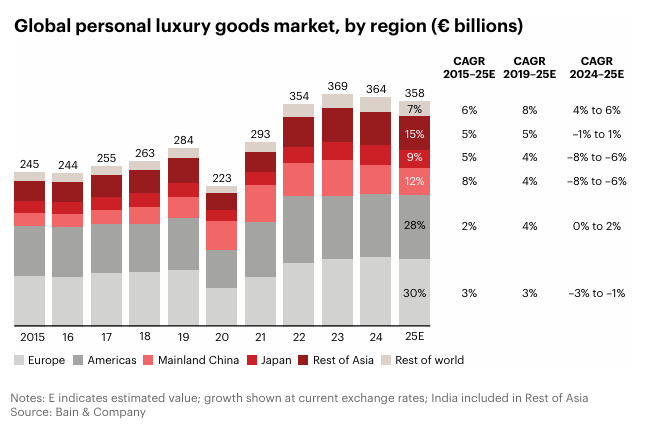

Despite macroeconomic uncertainty and high prices, the personal luxury goods segment, at the heart of the luxury industry, remained relatively stable, with total sales expected to reach €358 billion in 2025. This reflects a slight decline of 2% at current exchange rates and flat performance at constant exchange rates.

Three key trends in the global personal luxury market in 2025:

— Significant Customer Attrition:

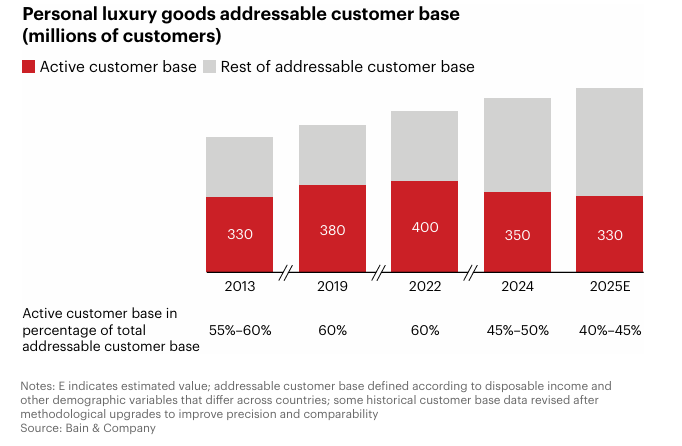

Around 20 million consumers exited the market in 2025, reducing the global active customer base to approximately 330 million. This was largely due to “aspirational” consumers withdrawing or shifting to the secondhand market amid rising prices, economic uncertainty, and waning sentiment.

— Increased Importance of Top-Tier Clients:

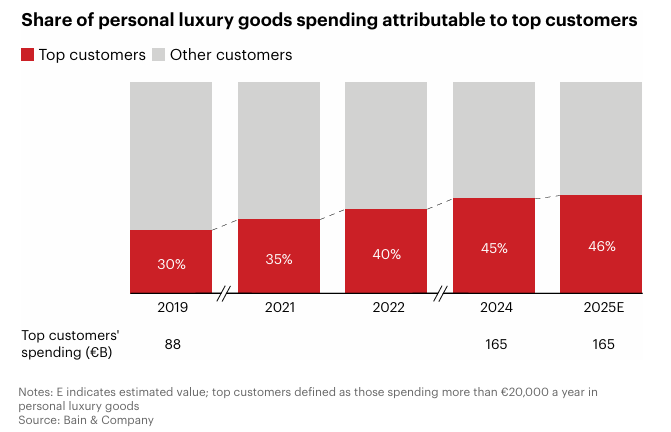

Clients spending more than €20,000 annually remained stable in absolute terms, but their contribution to total spending rose to 46%, compared to only 30% in 2019.

— Entry-Level Luxury Gains Momentum:

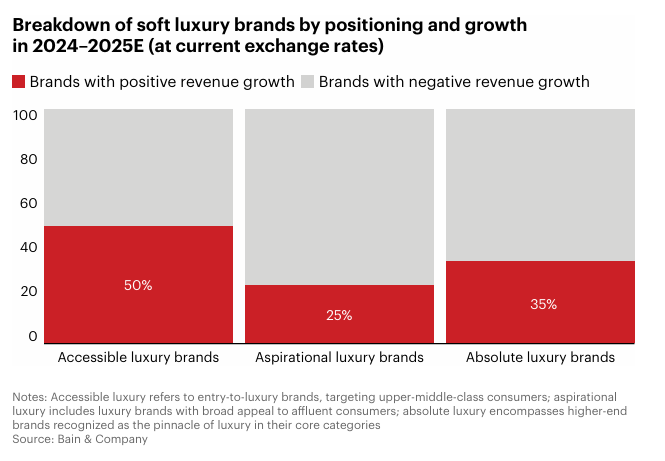

Entry-level luxury items were the most dynamic, with approximately 50% of brands reporting growth, reflecting consumers’ increased selectivity under price pressure. By contrast, only 25% of “aspirational luxury” brands and 35% of “top-tier luxury” brands saw growth.

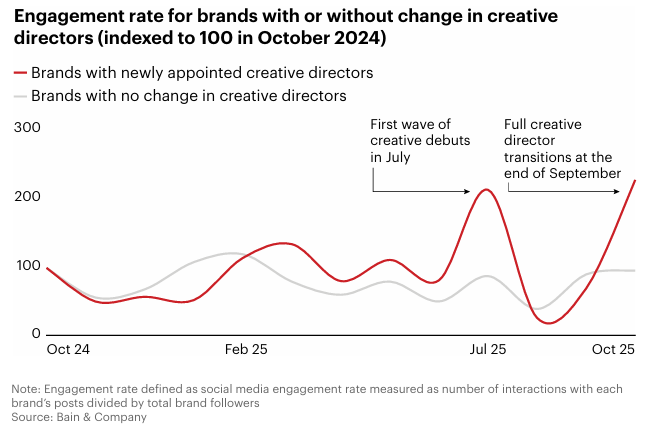

The report also highlighted an interesting trend: creative director changes have brought new energy to some brands.

Tracking data from October 2024 onward, Bain found a strong correlation between creative director turnover and brand engagement rates. As shown by the red line in the chart, waves of creative director appointments in July and late September 2025 triggered engagement spikes for the associated brands (with October 2024 as the baseline at 100).

Regional Market Performance

— Americas Show Strong Resilience:

The Americas achieved stable performance in 2025 with growth between 0% and +2%. Despite macroeconomic fluctuations, local spending was supported by a weakening US dollar (encouraging domestic consumption) and stock market recovery.

— The Chinese Mainland and Japan Remain Under Pressure:

The Chinese Mainland market remained sluggish. While the decline narrowed compared to last year, it is still expected to shrink by 6% to 8%, due to weak consumer confidence and intensifying competition from domestic brands. After explosive growth in 2024, Japan saw a correction, also forecasted to decline by 6% to 8%, as both tourist numbers and spending dropped.

— Slight Decline in Europe:

Expected to decline by 1% to 3%, with tourism-driven consumption losing momentum and signs of fatigue among local consumers. Southern Europe performed better than Northern Europe.

— High Growth Potential in Emerging Markets:

Southeast Asia, Latin America, the Middle East, India, and Africa all show significant potential. Combined, these markets are expected to generate €40 billion to €45 billion in retail sales—equivalent to the size of the Chinese Mainland luxury market in 2025.

Polarization in Brand and Category Performance

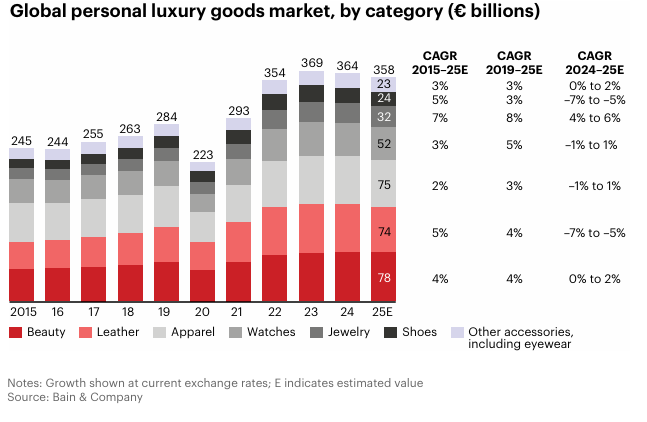

— Divergent Category Performance:

Jewelry was the top-performing category in 2025, with growth of 4%-6%. Beauty and eyewear also saw steady growth. In contrast, leather goods and footwear contracted by 5%-7%, with leather goods particularly affected by steep price increases (classic models up 50%–70% since 2019) and a lack of innovation, leading to a significant decline in demand.

— Specialist Brands Outperform Large Conglomerates:

Only 40% to 45% of brands reported revenue growth, highlighting high polarization. Specialist brands significantly outperformed diversified large groups.

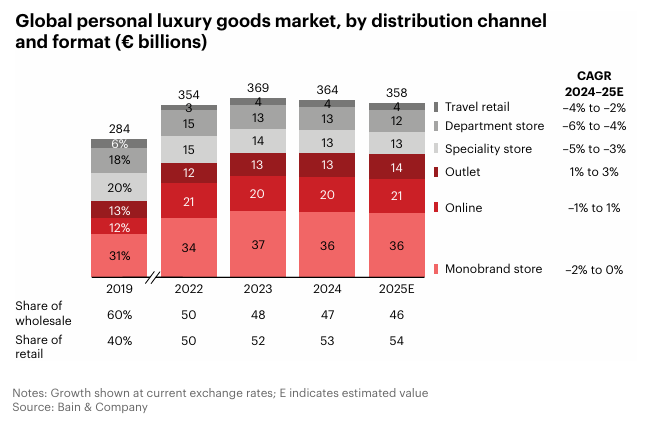

Channel Trends and Profitability Challenges

— Outlet Stores:

Outlets were the only physical retail format to maintain growth (1%–3%), reflecting consumers’ pursuit of value. Other offline channels—including travel retail, department stores, and brand boutiques—saw declining trends.

— Monobrand Stores:

With slowing foot traffic, sales declined by around 2%. Brands are responding by offering “hyper-personalized services” through larger flagship stores.

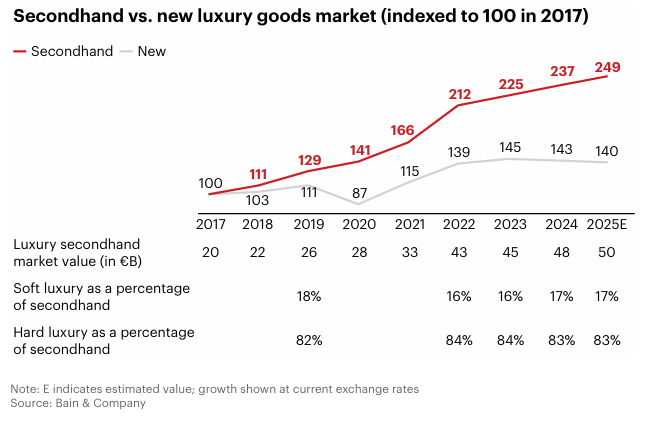

— Secondhand Market Growth:

Secondhand luxury sales grew to around €50 billion, up 4% to 6%, surpassing the growth of new product sales. Hard luxury (watches and jewelry) accounted for 83% of this market.

The profitability of the luxury industry was eroded in 2025. Due to inflation, tariffs, increased discounting, and rising operating costs, the average EBIT margin dropped from 21% in 2022 to 15%–16%—reverting to levels last seen in 2009.

Outlook

Bain forecasts the luxury market will resume moderate growth of 3% to 5% in 2026.

In the longer term, by 2035, the market is expected to grow at a compound annual growth rate of 4%-6%, driven by an expanding customer base (especially younger generations) and enduring demand for luxury. Total market size is projected to reach €2.2 trillion to €2.7 trillion, with personal luxury goods accounting for €525 billion to €640 billion.

|Source: Original report

|Image Credit: Original report

|Editor: LeZhi