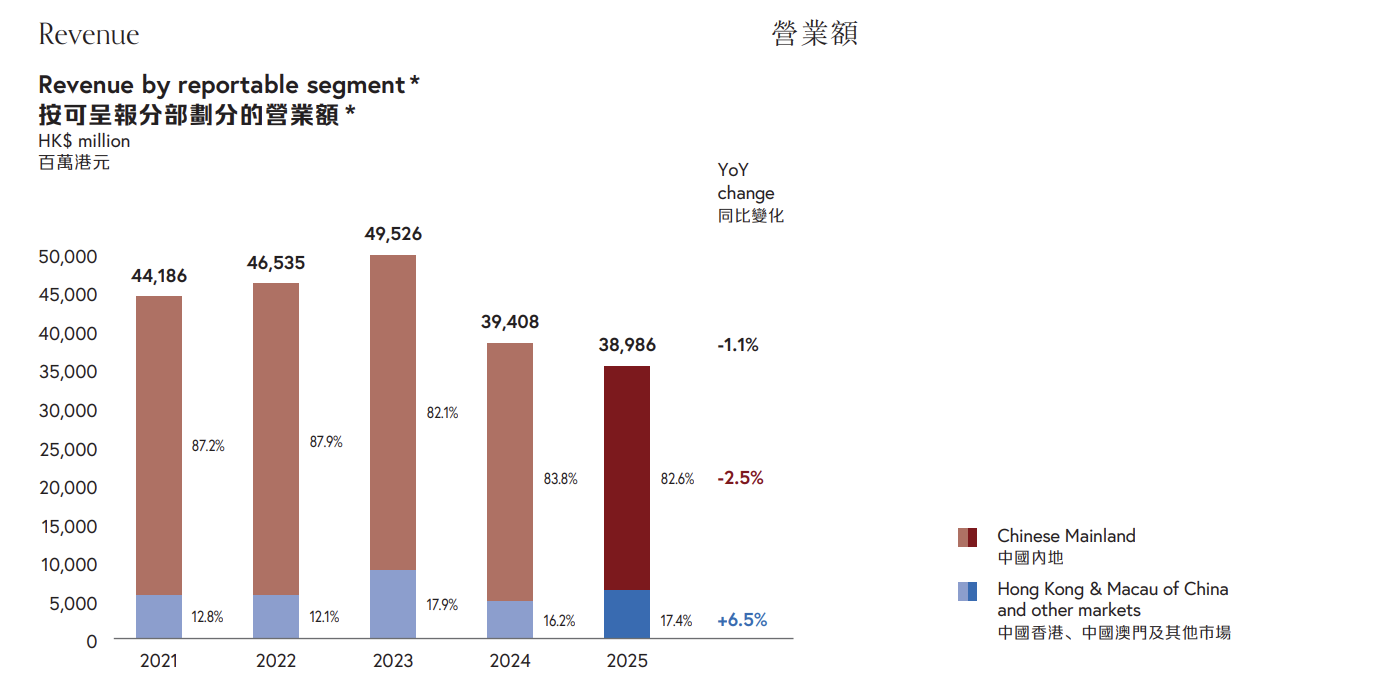

After the market closed on November 25, Chow Tai Fook Jewellery Group Ltd., a major player in the jewelry industry based in the Hong Kong SAR, released its interim results for the first half of fiscal year 2026, ending September 30, 2025. Amid macroeconomic volatility and elevated gold prices, the Group demonstrated remarkable resilience, with revenue edging down 1.1% year-on-year to HKD 38.986 billion [USD 5.00 billion] (from HKD 39.408 billion [USD 5.06 billion] in the same period of FY2025). On a constant currency basis, revenue was broadly flat, declining just 0.5%.

Of particular note, thanks to effective store optimization and rigorous cost control, operating profit rose 0.7% year-on-year to HKD 6.823 billion [USD 875 million], with the operating profit margin expanding by 30 basis points to 17.5%—a five-year high. Additionally, the Group maintained a historically high gross margin of 30.5%, benefiting from a greater contribution from priced jewellery and retail business.

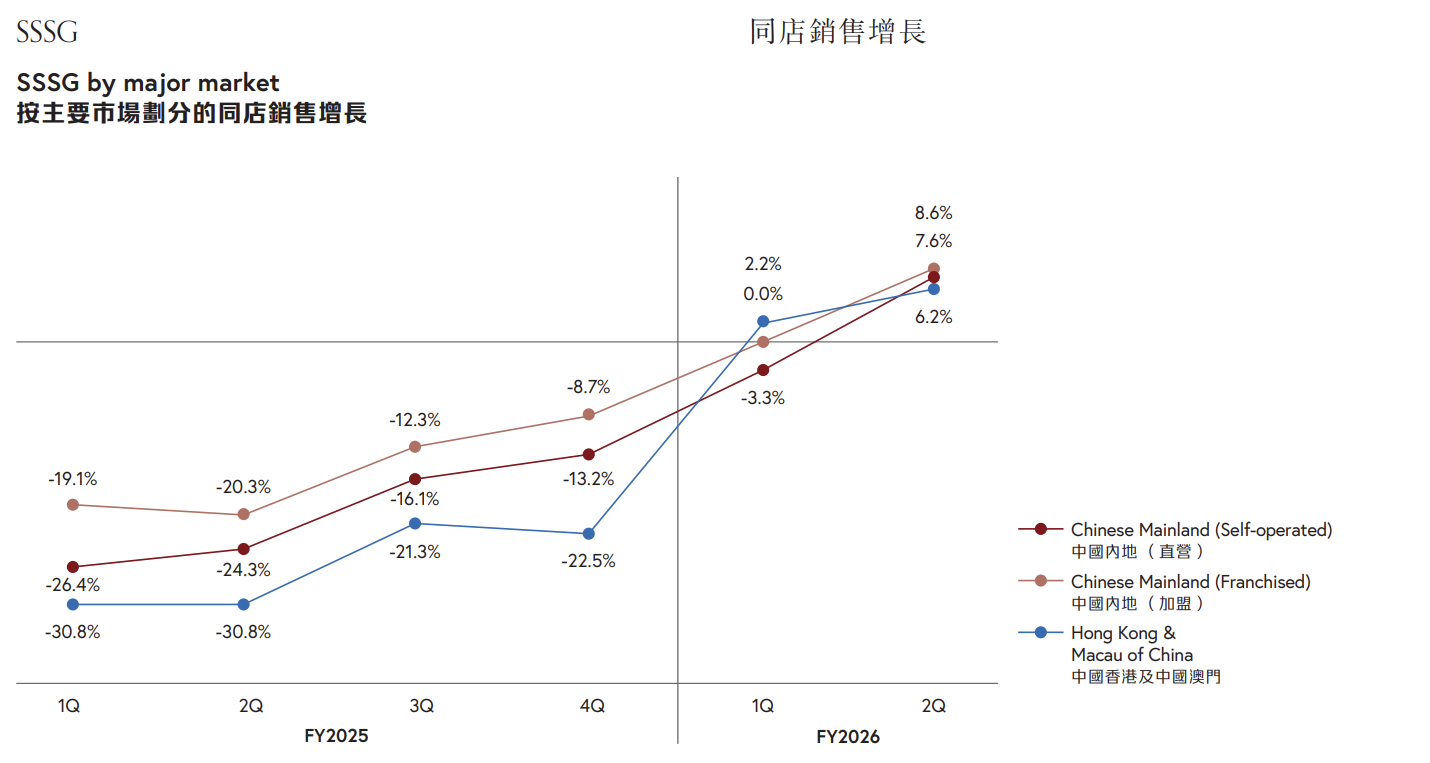

Dr. Cheng Kar-Shun, Henry, Chairman of Chow Tai Fook Jewellery Group, stated, “In the first half of FY2026 (“1HFY2026”), the Group demonstrated remarkable resilience and delivered solid results, supported by an improvement in consumer sentiment and a revival in jewellery spending across the Group’s key markets. We made steady progress in our brand transformation and product optimisation during the period. These strategic initiatives strengthened our operational efficiency and financial resilience, reaffirming our commitment to quality growth. Our Same Store Sales growth turned positive in the Chinese Mainland, Hong Kong, and Macau during the period, validating our store optimisation strategy with a focus on store productivity.”

Looking ahead, the Group noted that, despite short-term industry challenges, same-store sales remained solid in the first two months of the third quarter. The Group will remain agile and continue refining its strategies, expressing strong confidence in a sustained recovery in the second half of the fiscal year.

By Market Region: Same-Store Sales Fully Return to Positive Growth, Strong Overseas Expansion

During the reporting period, all of the Group’s major markets recorded positive same-store sales growth, signaling a business recovery:

Chinese Mainland:

Revenue declined 2.5% year-on-year to HKD 32.194 billion [USD 4.13 billion], accounting for 82.6% of the Group’s total revenue. Same-store sales grew by 2.6% (excluding the watch segment, same-store sales rose by 4.7%), driven primarily by the strong performance of priced jewellery and improved demand for weighted gold jewellery.

Hong Kong, Macau, and Other Markets:

Revenue increased 6.5% year-on-year to HKD 6.792 billion [USD 872 million], supported by recovering retail sentiment and higher foot traffic. Same-store sales grew by 4.4%, with Hong Kong up 1.8% and Macau up 13.7%.

International Expansion:

The Group actively explored high-potential new markets. Retail value in other international markets (excluding Mainland duty-free stores) surged 16.9% year-on-year. In particular, store upgrades and strategic repositioning in Singapore and Malaysia led to nearly 30% growth in same-store sales.

By Product Category: Increased Contribution from Priced Jewellery, Fine Jewellery and IP Collaborations Highlighted

Throughout the reporting period, the Group continued to optimize its product mix, focusing on high-margin products:

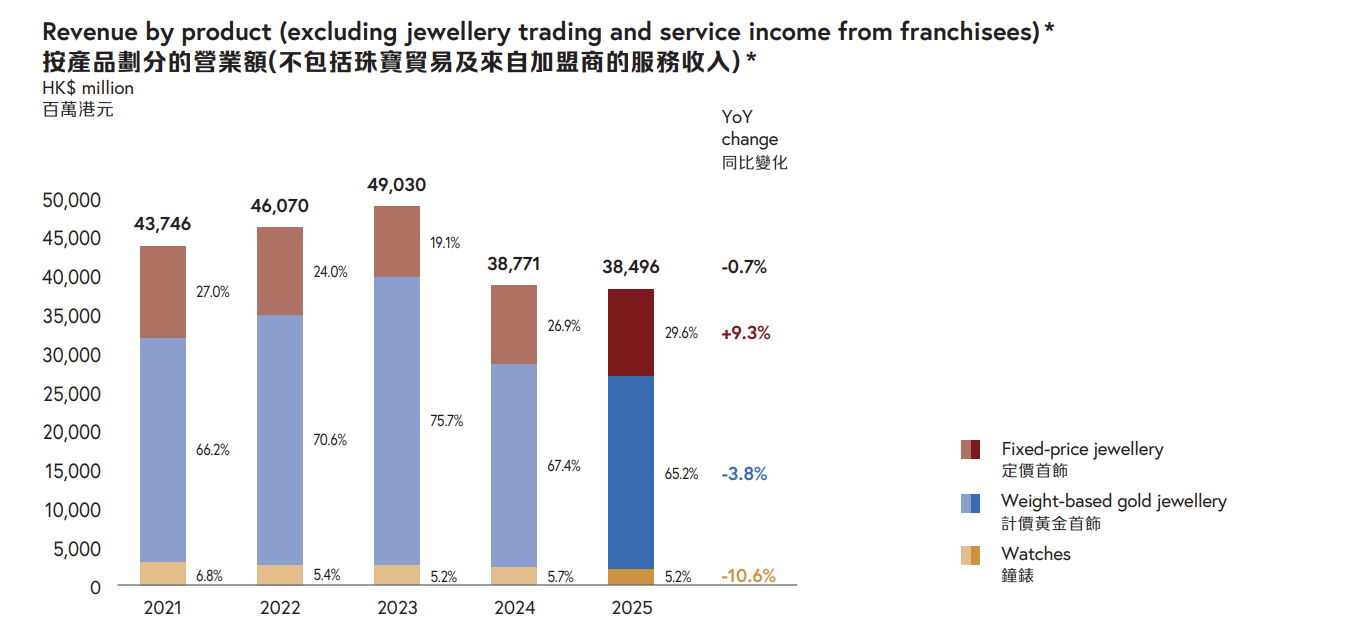

Priced Jewellery:

Revenue rose 9.3% year-on-year. Iconic product lines such as the CTF Blessings, CTF Bliss, and CTF Palace Museum collections saw strong sales momentum, with total revenue reaching HKD 3.4 billion [USD 436 million] (up from HKD 2.3 billion [USD 295 million] in the prior year). In the Chinese Mainland, the contribution of priced jewellery to retail value significantly increased from 27.4% to 31.8%.

Weighted Gold Jewellery:

Revenue declined 3.8% year-on-year, impacted by store consolidation. However, consumer confidence in purchasing gold at higher prices improved, with same-store sales for weighted gold jewellery in the Mainland up 3.1%.

High Jewellery:

In June 2025, the Group launched its first high jewellery collection, “Timeless Harmony,” marking a key milestone in the brand transformation. The collection aims to strengthen the Group’s position as a leading global jewellery brand through exquisite craftsmanship and rare gemstones.

Jadeite Products:

The Group launched the “Heaven and Earth” collection and incorporated jadeite into joint collections with the Palace Museum in Beijing and streetwear label CLOT. Sales of jadeite jewellery more than doubled year-on-year.

Same-Store Sales: Growth Resumes Across Major Markets

All major markets recorded a rebound in same-store sales during the reporting period, validating the Group’s focus on optimizing store productivity.

Chinese Mainland:

Same-store sales at self-operated stores rose 2.6% year-on-year (excluding watches, the growth was 4.7%). However, same-store volume declined 9.7%.

By product:

-

Priced jewellery same-store sales: +8.3%

-

Weighted gold jewellery same-store sales: +3.1%

Additionally, given the high proportion of newly opened franchised stores in recent years, same-store sales at franchised locations grew 4.8%.

Hong Kong and Macau:

Same-store sales in Hong Kong and Macau rose 4.4% year-on-year, with Hong Kong up 1.8% and Macau up 13.7%. Same-store volume declined 9.4%.

By product:

-

Priced jewellery same-store sales: +6.1%

-

Weighted gold jewellery same-store sales: +8.5%

Channels and Network: Focus on Store Productivity, E-Commerce Surges

The Group continued implementing its strategy to optimize its retail network, prioritizing store productivity and profitability:

Store Adjustments:

As of September 30, 2025, the Group operated 5,663 Chow Tai Fook retail points in the Chinese Mainland, with a net closure of 611 stores during the period. The Group emphasized that this was aimed at improving overall financial health, with new openings concentrated in premium shopping malls and prime locations.

New Concept Stores:

New flagship stores were launched in Beijing, Shijiazhuang, and Macau. These immersive stores target high-end consumers, and since opening, their average monthly sales have consistently exceeded the district average.

E-commerce:

Retail value of e-commerce businesses in the Chinese Mainland surged 6% year-on-year, accounting for 16.2% of total sales volume. Retail value through Chow Tai Fook’s official online store (CTF Mall) and Douyin both grew over 40%. Livestream sales performed strongly, contributing 17.6% of online retail value.

Strategic Developments and Collaborations: Deepening IP Partnerships and Supporting Major Sporting Events

As part of its brand transformation journey, Chow Tai Fook attracted younger consumers through a series of high-profile cross-industry collaborations:

Gaming and Anime IPs:

The Group partnered with “Black Myth: Wukong,” China’s first AAA video game, as well as streetwear brand CLOT and popular manga “Chiikawa,” creating buzz among younger audiences and enhancing brand appeal.

Sports Marketing:

In October 2025, the Group signed a three-year partnership with the National Basketball Association (NBA), launching the Chow Tai Fook x NBA collection that blends basketball culture with fine jewellery craftsmanship. As the exclusive jewellery sponsor of the 15th National Games, the Group co-designed the event’s medals with Guangzhou Academy of Fine Arts and launched the “Chow Tai Fook x National Games” series to further promote Chinese culture and sportsmanship.

Customization Services:

On its “CTF for You” platform, the Group introduced customized T MARK diamond engraving services, allowing customers to inscribe personal messages on diamonds, enhancing the personalized shopping experience.

On the trading day following the earnings release, Chow Tai Fook’s share price fell 6.1% to HKD 14.31, with a total market capitalization of HKD 141.2 billion [USD 18.1 billion]. Year to date, the company’s stock has risen 122%.

|Source: Official Financial Report

|Image Credit: Brand Website, Official Financial Report

|Editor: LeZhi