On September 10, L Catterton, the global leading consumer-focused investment firm under the LVMH Group, announced the completion of its acquisition of a majority stake in STENDERS, a high-end Latvian bathing and body care brand. STENDERS stated that this acquisition would accelerate its global expansion in Asia, Europe, the Middle East, and the United States.

In 2007, Chinese entrepreneur Yang Gang and his partner Zhao Yang introduced STENDERS to the Chinese market through an agency partnership. In October 2017, with the support of China International Capital Corporation (CICC), Yang and his Chinese team successfully completed a reverse acquisition of STENDERS’ global business. Following the recent transaction with L Catterton, Yang Gang and Zhao Yang retain significant shares in the brand.

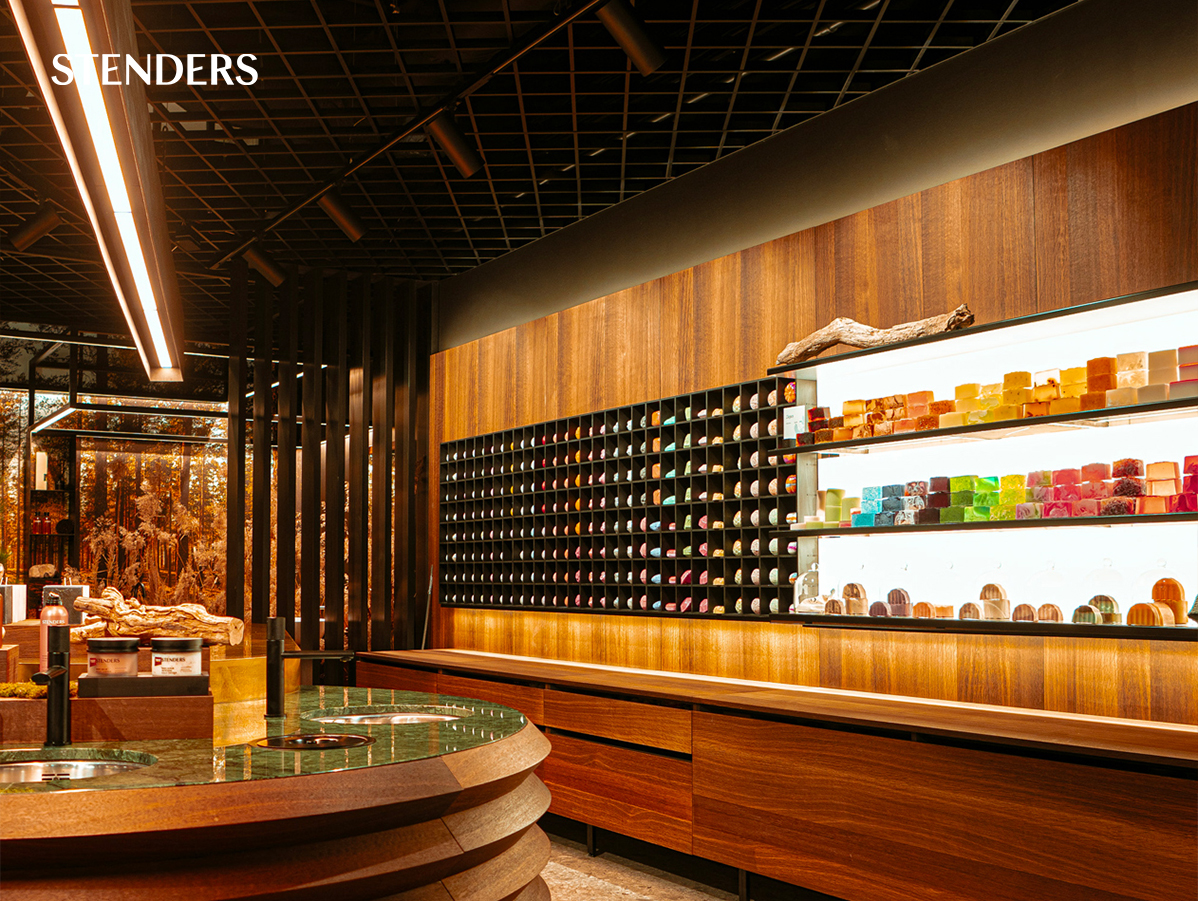

Founded in 2001 in Riga, Latvia, STENDERS was inspired by the unique Latvian bathing tradition “Pirts,” which dates back to the 19th century and views bathing as a means to relax and purify both the body and soul. The brand is known for its philosophy of “handcrafted, fresh, and natural” products, covering categories such as cleansers, bath products, body care, home fragrances, and facial, lip, hair, and hand care. For example, bath products are priced between 65 and 115 RMB per item. The brand boasts over 400 SKUs, all produced in Latvia using natural ingredients and fully recyclable packaging. As a household name in Latvia and a leader in the high-end bathing and body care market, STENDERS has even been gifted by the Latvian government as a diplomatic gift.

STENDERS products are sold in over 300 stores across more than 20 countries, as well as through online platforms including its official website, Tmall, JD.com, and Douyin. Over the past four years, the brand has seen annual global revenue and Chinese market sales growth of around 20%. Notably, due to its high consumer conversion and repurchase rates, STENDERS has achieved strong same-store sales growth and maintained healthy single-store economics during its expansion.

In early 2023, during a deep discussion with Luxeplace.com, Yang Gang revealed that between the 2017 reverse acquisition and 2022’s rapid international expansion, his team grew STENDERS’ sales from under 300 million RMB at the time of acquisition to nearly 1 billion RMB by 2022—a growth of more than twofold in five years.

Following the acquisition, Yang Gang remarked, “L Catterton has extensive experience in empowering and creating value for its portfolio companies. I look forward to close collaboration in the coming years as we work together to bring STENDERS into every bathroom around the world.”

STENDERS’ store at Nanjing Deji Plaza, which opened on September 9.

Chen Yue, Managing Partner of L Catterton Asia Fund, stated, “With the growing consumer demand for personal care, body care has become an integral part of daily life. More consumers are placing importance on the experience and quality of these products. L Catterton’s insights into the beauty and personal care sectors show us that just like the premiumization trend in facial skincare and hand care, consumers will increasingly opt for high-end bathing and body care products. As Latvia’s most well-known national brand, STENDERS has been with Chinese consumers for 17 years, and its brand value and iconic products resonate strongly with its target audience. We look forward to collaborating with the STENDERS management team to achieve our shared goals.”

L Catterton was founded in 2016 as a joint venture between U.S. private equity firm Catterton and L Capital, the private equity and real estate investment arm of French luxury conglomerate LVMH. Headquartered in Greenwich, Connecticut, L Catterton manages over $35 billion across private equity, credit, and real estate asset classes. Its previous investments in the beauty and personal care sector include Japanese personal care company Ci FLAVORS, British luxury skincare brand ELEMIS, Japanese mineral makeup brand ETVOS, U.S. personalized hair care brand Function of Beauty, mother-and-baby care brand The Honest Company, Swedish sustainable hair care brand Maria Nila, U.S. minimalist makeup brand MERIT, professional oral nutrition hair care brand Nutrafol, beauty brand operator Oddity (parent company of Il Makiage), Indian beauty brand SUGAR Cosmetics, U.S. probiotic skincare brand TULA, as well as Chinese skincare brand Marubi, children’s personal care brand Daddy Turtle, and recombinant collagen developer GeneHealth Medical.

In October 2022, L Catterton closed its first RMB-denominated fund, officially announcing its Chinese name “Lu Wei Kai Teng” and launching the first phase of the RMB fund in the Chengdu High-Tech Zone in Sichuan Province. This marked the beginning of L Catterton’s strategy to cover the consumer investment sector in China with both RMB and USD funds.

Since the start of 2024, L Catterton has completed several global investments and exits, including a strategic investment in U.S. veterinary chain Sploot Veterinary Care, leading the Series A round for WTHN, a modern wellness brand based on traditional Chinese medicine, the business combination of L Catterton Asia Acquisition Corp and Lotus Technology, which went public on Nasdaq, a significant equity investment in luxury river cruise company AmaWaterways, a strategic investment in U.S. RV and adventure vehicle supplier Storyteller Overland, a majority stake acquisition in Italian beauty brand KIKO Milano, leading a $40 million Series A round for enterprise management platform Homebase, a $40 million Series A round for innovative consumer incubator Squared Circles, a collaboration with British actress Naomi Watts to acquire beauty brand Stripes Beauty, and a strategic investment in plant-based protein drink brand Vitasoy.

丨Source: Official Press Release; Luxe.CO historical reports

丨Image Credit: STENDERS official social media & website

丨Editor: Maier