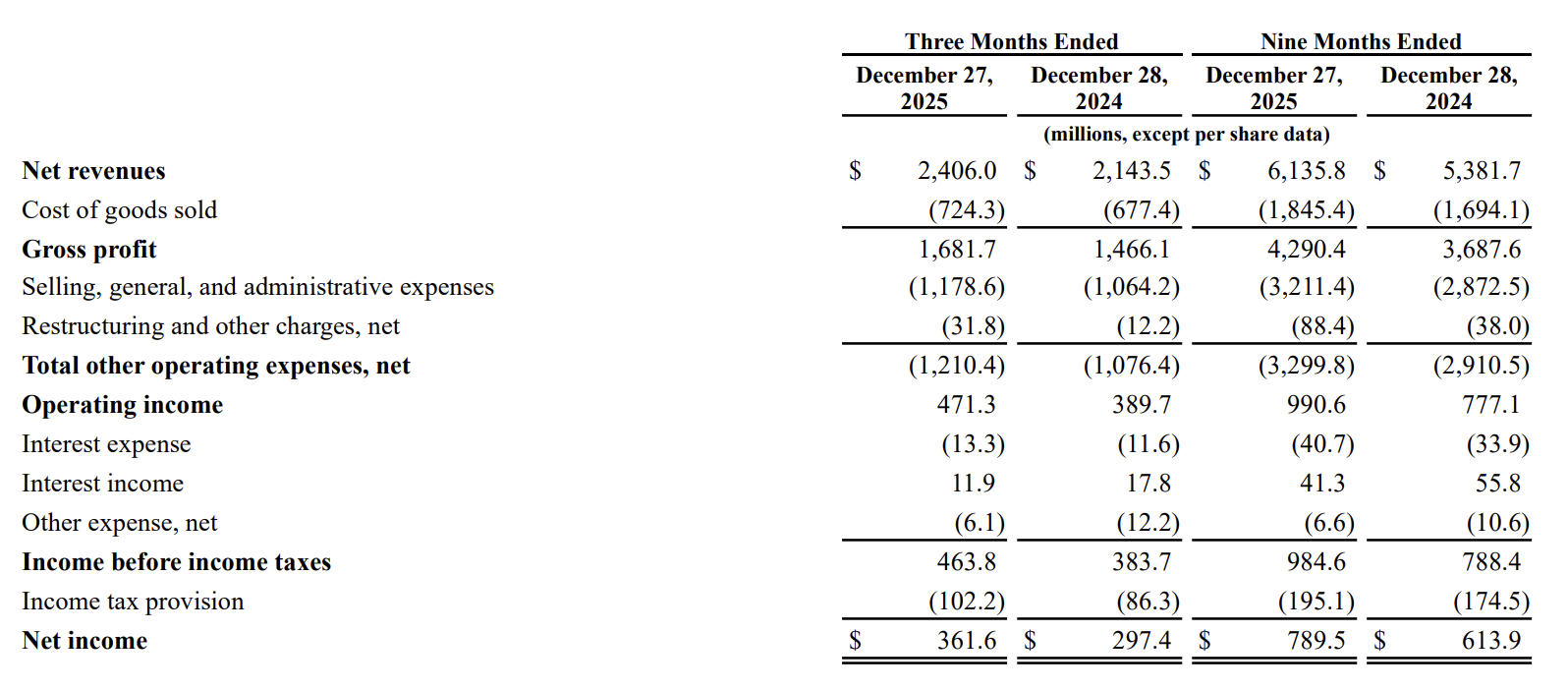

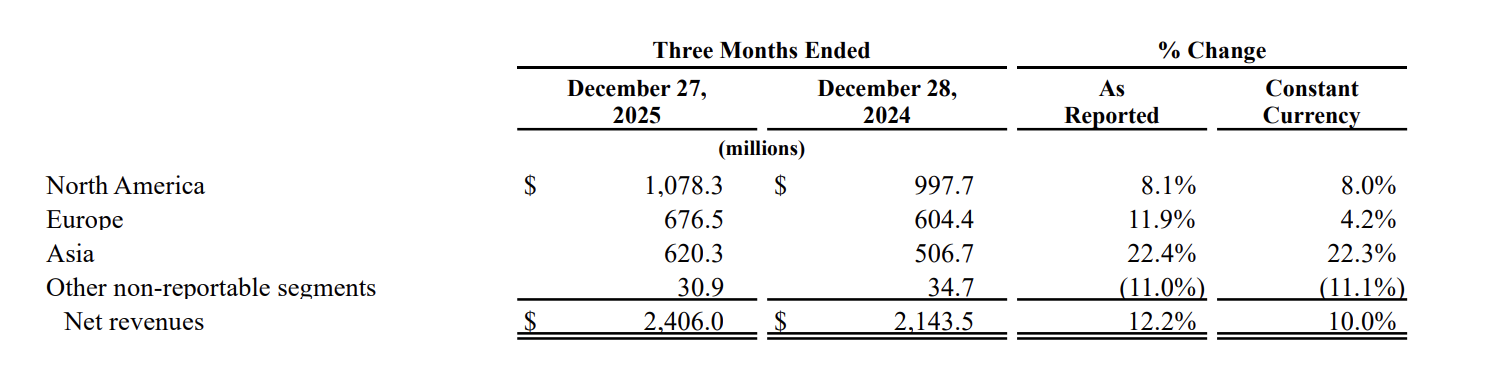

Before the market opened on February 5 Eastern Time, US fashion luxury group Ralph Lauren Corp (Ralph Lauren; NYSE: RL) released its financial results for the third quarter of fiscal year 2026, ended December 27, 2025: net revenue rose 12% year on year to USD 2.4 billion (+10% at constant currency), exceeding expectations. Asia was the primary growth driver, with growth of 22% both at reported and constant currency. Among these, net revenue in the Chinese market increased by more than 30%.

Patrice Louvet, President and Chief Executive Officer of Ralph Lauren, said: “This holiday season, our teams delivered strong, high-quality growth across geographies and consumer segments, enabling accelerated investment in our long-term strategic priorities and brand elevation,” said Patrice Louvet, President and Chief Executive Officer. “In a dynamic operating environment, our Next Great Chapter: Drive strategy — supported by multiple growth drivers, the enduring and emotional power of our brand, and strong operational discipline — positions us well to continue to deliver sustainable growth and long-term value creation.”

Following the earnings release, the company’s share price fell 9.36% in pre-market trading. As of the close on February 5, Ralph Lauren shares declined 4.52% from the previous trading day to USD 338.66 per share, with a current market capitalisation of approximately USD 20.537 billion. Over the past 12 months, the company’s share price has risen by a cumulative 36.01%.

During the third quarter of fiscal year 2026, key highlights across Ralph Lauren’s strategic priorities were as follows:

—— Elevating and energising the lifestyle brand

Through its direct-to-consumer business, the group enhanced new customer acquisition and loyalty. In the third quarter, it added 2.1 million new customers, further strengthening brand awareness, net promoter score and luxury perception. Social media followers exceeded 68 million, representing close to double-digit growth year on year.

The brand drove authentic engagement and connection with consumers at key cultural moments, including the Fall/Winter 2025 holiday “Mountain Living” campaign and the “Timeless Gifting” programme; immersive family experiences held in London, Tokyo, Los Angeles, Munich and Seoul; the Double 11 promotional event; and screenings of the “Very Ralph” documentary in Hong Kong and Singapore.

—— Strengthening core categories and expanding growth areas

Driven by sweaters and knitwear, the company’s core categories continued to maintain growth momentum, delivering close to double-digit growth. High-potential categories (womenswear, outerwear and handbags) continued to outpace the company’s overall growth, rising by nearly 10% year on year, primarily driven by strong performance in women’s sweaters, mid-weight down jackets and tailored coats, as well as core handbag collections.

The group reduced discounting on a striped linen shirt priced at USD 148 (approximately RMB 1,020, about USD 142) and a handbag priced at USD 498 (approximately RMB 3,450, about USD 480), increasing full-price sales and refreshing core styles, thereby enhancing their appeal to affluent younger consumers, including Gen Z, in line with the brand’s ongoing premiumisation.

Star products during the quarter included:

- The Polo Ralph Lauren x TÓPA capsule collection, the fourth collaboration under the Artist in Residence programme, designed to empower and celebrate community artisans who have historically inspired the company’s designs;

- The Team USA uniforms designed for the Milano Cortina 2026 Winter Olympics;

- The annual Pink Pony collection, supporting Ralph Lauren’s long-standing commitment to cancer care and research.

In the DTC channel, average unit retail (AUR) increased by 18%, exceeding expectations, reflecting continued premiumisation, strong full-price selling trends and lower-than-expected promotional activity.

—— Consumer ecosystem success in key cities

The group opened 32 new owned and partner-operated stores in key cities, expanding the scale of its brand ecosystem. These included locations in Chengdu, China; Sydney, Australia; and Bangkok, Thailand, as well as two new stores in London, the UK, and New Delhi, India.

As of December 27, 2025, key financial data for Ralph Lauren’s third quarter of fiscal year 2026 were as follows:

Gross profit was USD 1.7 billion, with a gross margin of 69.9%, up 150 basis points year on year. The improvement in gross margin was primarily driven by high double-digit growth in average unit retail (AUR), product mix optimisation and lower cotton costs, which more than offset US tariff increases and other product cost pressures.

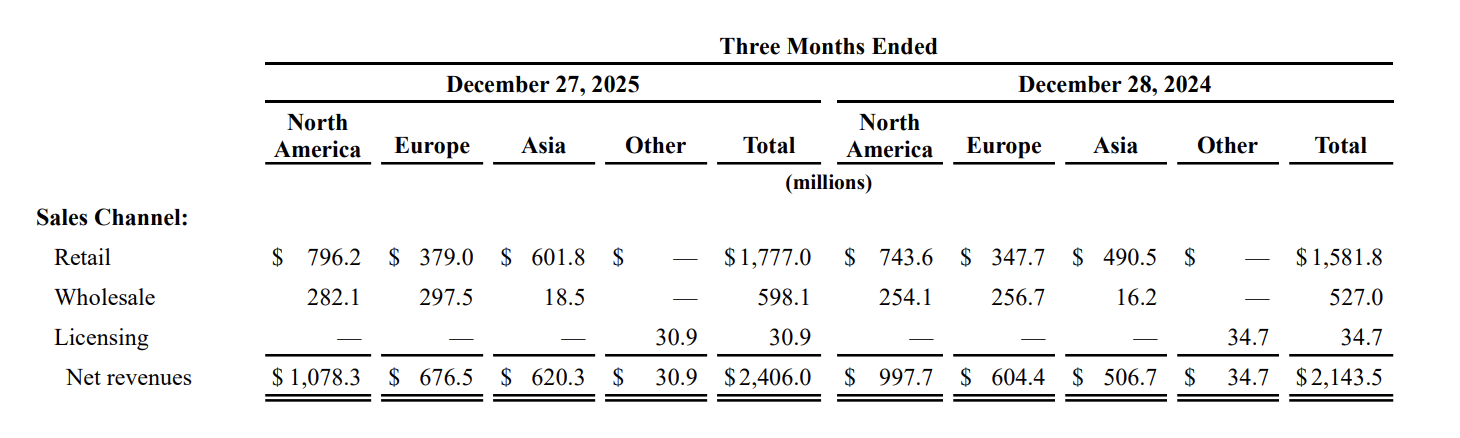

By channel:

By region:

North America:

- Retail: Comparable store sales increased by 7%, with physical stores up 6% and e-commerce up 7%.

- Wholesale: Revenue rose 11% year on year.

Justin Picicci, Chief Financial Officer of the group, said during the analyst call: “While consumer resilience this year has exceeded our expectations, we remain cautious about the operating environment in North America.”

Europe:

- Retail: Comparable store sales posted slight growth, with online sales up 5%, partially offset by a 1% decline in physical stores.

- Wholesale: Revenue increased by 16% year on year on a reported basis and by 8% at constant currency.

Asia:

- Operating profit was USD 197 million, with an operating margin of 31.8%, up 490 basis points year on year. Foreign exchange factors increased operating margin by 10 basis points in the third quarter.

Based on these results, Ralph Lauren raised its full-year outlook for fiscal year 2026:

- Net revenue is expected to grow at a high single-digit to low double-digit rate at constant currency, higher than the previous guidance of 5% to 7%;

- Operating margin (at constant currency) is expected to increase by approximately 100 to 140 basis points, above the previous forecast of 60 to 80 basis points;

- Foreign exchange is expected to increase gross margin and operating margin by approximately 20 and 50 basis points, respectively.

| Source: Official financial report, Reuters

| Image Credit: Brand official website

| Editor: LeZhi