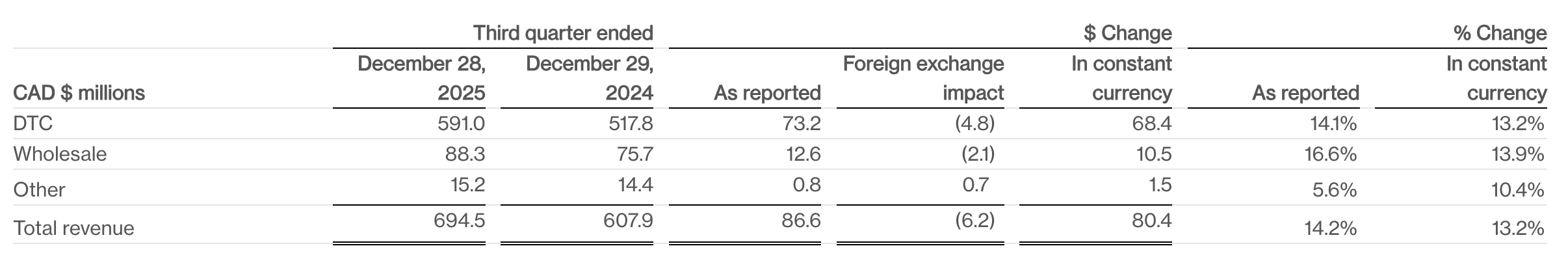

At local time before market opening on February 5, Canada Goose announced its third-quarter results for fiscal year 2026, covering the period ended December 28, 2025. Global revenue rose strongly by 14.2% year on year to CAD 694.5 million (approximately USD 514.9 million), or up 13.2% on a constant-currency basis. In terms of profitability, gross profit increased by 13.7% year on year to CAD 513.8 million (approximately USD 380.2 million), with a gross margin of 74.0%, remaining at a high level.

Driven by robust growth across all revenue streams, direct-to-consumer (DTC) channel revenue increased by 14.1% year on year to CAD 591.0 million (approximately USD 437.3 million). Within this, DTC comparable sales grew by 6.3% year on year, marking the fourth consecutive quarter of positive comparable growth for the channel.

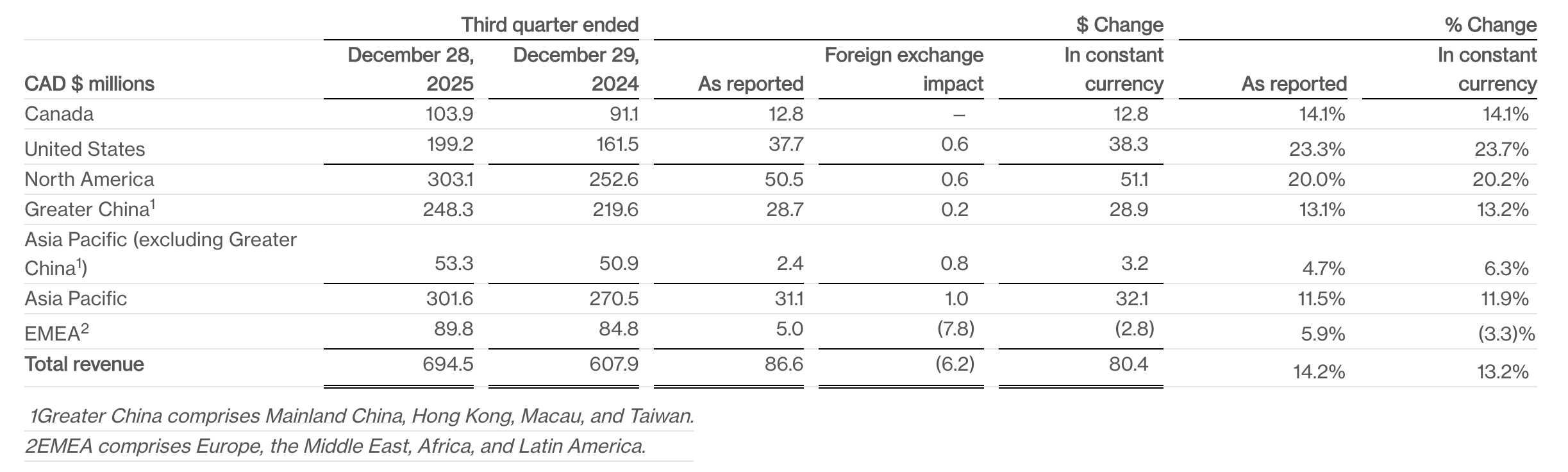

From a regional perspective, Greater China revenue rose by 13.1% year on year to CAD 248.3 million (approximately USD 183.7 million), or up 13.2% on a constant-currency basis, driving Asia-Pacific revenue up sharply by 11.5% year on year to CAD 301.6 million (approximately USD 223.2 million). North America also delivered a strong performance, with revenue increasing by 20% year on year.

Canada Goose Chairman and Chief Executive Officer Dani Reiss said, “Our third-quarter results underscore the strength of our global brand and top-line engine, with broad-based revenue growth and continued momentum across key regions and channels. Our peak selling period reflected sharper execution — higher quality traffic driven by integrated global campaigns, strong consumer response to our expanded year-round assortment, and robust performance across both retail and e-commerce.”

He further added, “Margins this quarter reflected deliberate choices we made to expand product relevance and fuel brand momentum. Our focus now is converting this demand into stronger profitability.”

Greater China and North America Drive Global Growth

During the quarter, Canada Goose delivered particularly strong results in its core markets, with North America and the Chinese Mainland emerging as the key engines of global growth.

Greater China revenue increased by 13.1% year on year to CAD 248.3 million (approximately USD 183.7 million). This performance was primarily driven by the DTC channel and high single-digit comparable sales growth.

Chief Financial Officer Neil Bowden emphasised during the earnings call, “The Chinese Mainland market, supported by strong consumer demand, was the largest contributor to growth this quarter.”

“The robust demand in the Chinese Mainland was underpinned by solid growth across Douyin and Tmall e-commerce operations, alongside a notable improvement in conversion rates at key offline stores.”

Dani Reiss stated directly during the call, “Our brand desire in core markets, especially in the Chinese Mainland, has surpassed our industry competitive benchmarks.”

North America revenue rose by 20.0% year on year to CAD 303.1 million (approximately USD 224.3 million). The United States market performed particularly strongly, with revenue up 23.3% year on year, mainly driven by strong brand momentum and retail execution in the region.

In addition, EMEA (Europe, the Middle East, Africa, and Latin America) revenue increased by 5.9% year on year to CAD 89.8 million (approximately USD 66.5 million).

Four Core Strategic Pillars Advancing in Tandem

The comprehensive revenue growth achieved by Canada Goose in the third quarter of fiscal 2026 stemmed from disciplined execution across four core operational strategy pillars: expanding the product assortment, elevating brand heat, strengthening retail operations, and optimizing efficient operations.

—— Expanding the product assortment to enhance year-round relevance

The brand continues to deepen product innovation, with its expanding assortment attracting a broader consumer base. During the quarter, Canada Goose launched the Fall/Winter 2025 collection and the Snow Goose by Canada Goose Fall/Winter 2025 capsule collection, sparking strong consumer engagement and effectively accelerating sales growth. The expanded year-round assortment drove growth across both down and non-down categories.

—— Deepening brand storytelling to strengthen brand heat

The brand focused on improving the efficiency of marketing investments, achieving simultaneous growth in brand awareness and reputation through integrated, high-value marketing initiatives. In the Chinese Mainland market, key indicators, including paid and organic reach, consumer sentiment, and organic discussion volume, all delivered strong performances, providing powerful brand momentum to support business growth.

—— Strengthening retail operations and optimising the channel experience

The brand continued to reinforce its presence in key markets, opening three new brand stores during the quarter, including two newly opened stores in the Chinese Mainland, bringing the global store count to 81. In international markets, the relocation and upgrade of the Milan store showcased a new store design concept, strategically positioned within a luxury brand cluster, further advancing the brand’s premiumisation.

—— Efficient operations and inventory management

Inventory levels for the quarter stood at CAD 408.7 million (approximately USD 302.4 million), remaining broadly flat year on year. This outcome reflected strong market demand and precise inventory management strategies, ensuring stable supply of core products while demonstrating the company’s accurate demand forecasting and rapid response capabilities. At the same time, net debt decreased from CAD 546.4 million (approximately USD 404.3 million) a year earlier to CAD 413.0 million (approximately USD 305.6 million), further strengthening the company’s financial position.

Organisational and Management Updates

To further drive business development in the North American market, Canada Goose announced a significant management appointment: Patrick Bourke has been named President, North America, effective February 5, 2026.

Patrick Bourke will assume full responsibility for the brand’s North American business, focusing on driving brand momentum, strengthening execution across retail and wholesale operations, and deepening engagement with consumers in the region. Having spent nearly a decade at Canada Goose, he has previously led investor relations, strategy, and business development, and brings deep strategic expertise and commercial acumen.

In February, Ana Mihaljevic, who had served as President, North America and spent more than a decade at Canada Goose, departed the company to pursue new opportunities.

Appendix:

|Source: Official financial report

|Image Credit: Brand-provided

|Editor: Lezhi