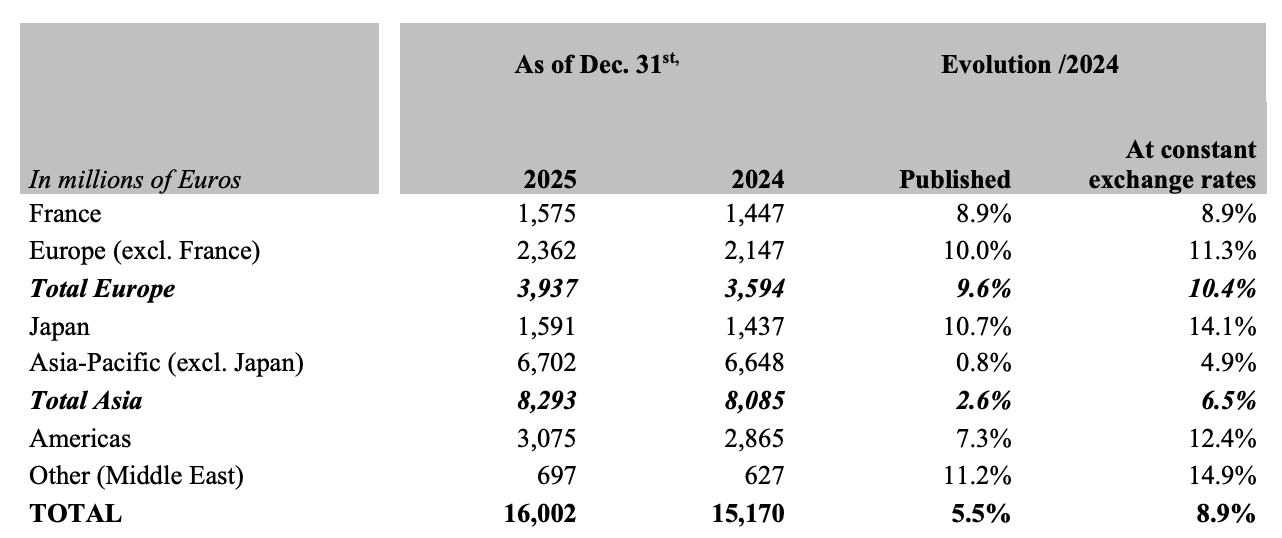

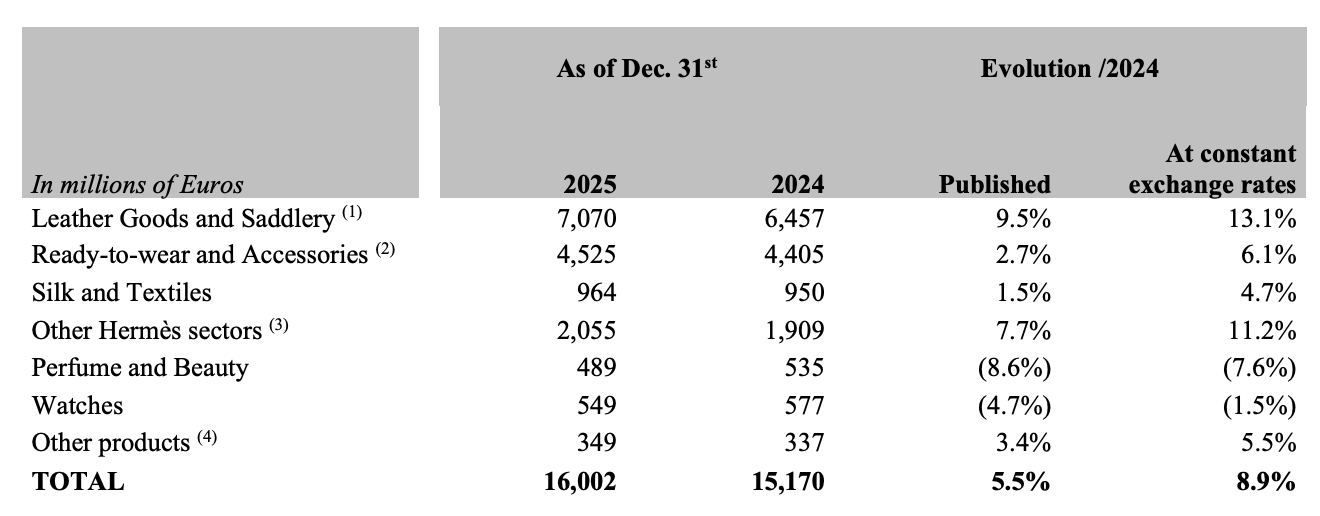

Before the market opened on February 12 local time, French luxury giant Hermès released its full-year and fourth-quarter results for 2025: full-year revenue reached EUR 16 billion, up 9% at constant exchange rates (up 5.5% at current exchange rates), with currency fluctuations having a significant negative impact of EUR 515 million. Fourth-quarter revenue totalled EUR 4.1 billion, up 10% year-on-year at constant exchange rates.

Among them, the Asia-Pacific region led by the Chinese Mainland (excluding Japan) recorded a 4.9% increase in sales at constant exchange rates (up 0.8% at current exchange rates), accounting for 41.9% of global sales.

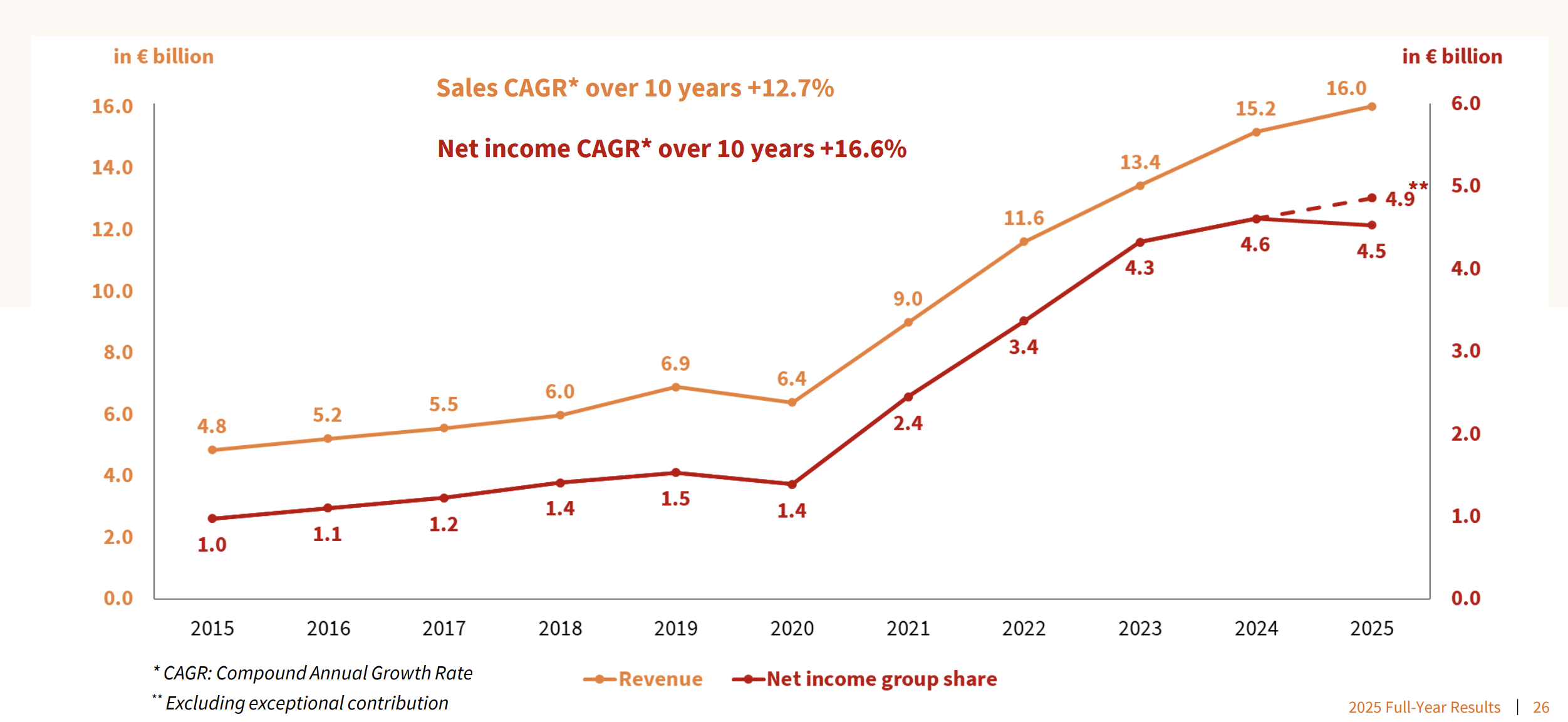

Over the past decade, Hermès has achieved a compound annual growth rate of 12.7% in sales, while net profit has grown at a higher compound annual rate of 16.6%.

In terms of profitability, Hermès’ recurring operating income reached EUR 6.6 billion in 2025. Despite the negative impact of currency effects, the recurring operating margin improved to 41%, compared with 40.5% in 2024. In addition, group net profit rose 5.5% year-on-year to EUR 4.86 billion (excluding the additional tax on the profits of large companies in France), in line with revenue growth.

Cash flow from operating activities increased 5% year-on-year to EUR 5.4 billion in 2025. Furthermore, after distributing EUR 2.8 billion in dividends, the Group’s net cash position stood at EUR 12.8 billion, compared with EUR 12 billion at the end of December 2024.

Axel Dumas, Executive Chairman of Hermès, stated, “The Hermès model based on an exclusive and qualitative network, as well as strong vertical integration, has once again proven successful. This distinctive strategy has enabled the house to achieve robust revenue growth and strong performance. I warmly thank the Hermès teams who share our commitment to uncompromising quality, as well as our customers for their loyalty. In an uncertain environment, Hermès is moving into 2026 with confidence, underpinned by its creativity and exceptional savoir-faire.”

As of 12:00 local time, the Group’s share price rose 1.56% from the previous day to EUR 2,153 per share, giving it a total market capitalisation of EUR 225.7 billion.

—— By geographic market ——

(Unless otherwise stated, all figures are at constant exchange rates.)

As of the end of December 2025, all regions recorded strong growth. The distribution network continued its high-quality expansion, including the opening of new stores and the expansion of existing locations.

- Asia-Pacific (excluding Japan) (+4.9%) delivered a solid performance across all countries in the region, with growth achieved in each market. In June, the Four Seasons Macau store reopened following renovation and expansion. In South Korea, two stores in Seoul reopened: the Galleria store in August and the Shinsegae store in October. In Thailand, the IconSiam store in Bangkok reopened at the end of November after renovation and expansion. In the Chinese Mainland, the expanded Changsha IFS store reopened in December.

- Japan (+14.1%) maintained strong momentum, driven by the loyalty of local customers and its exclusive distribution network. In November, an immersive experience event centred on Hermès objects, “Mystery at the Grooms’,” was held in Tokyo.

- The Americas (+12.4%) completed an excellent year. New stores opened in Scottsdale, Arizona, and Nashville, Tennessee, in September and October, respectively. In Mexico City, the Molière store reopened in early October following renovation. In Canada, the Vancouver store hosted an event in November showcasing the handcrafted creations of petit h.

- Europe (excluding France) (+11.3%) and France (+8.9%) achieved solid growth, supported by the loyalty of local customers and dynamic tourist flows. The Florence store in Italy reopened in February following renovation and expansion, followed by the reopening of the Knokke store in Belgium in November.

- Other regions (+14.9%), mainly including the Middle East, recorded strong growth, particularly in the United Arab Emirates.

—— By business segment ——

As of the end of December 2025, all business segments recorded growth except for Perfume & Beauty and Watches.

- Leather Goods and Saddlery (+13.1%) continued to post sustained growth in line with annual targets, supported by the strong appeal of collections and increased production capacity. The collections were enriched with new models, including So Médor, Seau Mousqueton, and Haut à Courroies à relier.

- Ready-to-Wear and Accessories (+6.1%) confirmed its strong momentum. The Spring/Summer 2026 men’s and women’s ready-to-wear collections, presented in June at the Palais d’Iéna and in early October at the Garde Républicaine headquarters, respectively, were warmly received. The latest Autumn/Winter 2026 men’s ready-to-wear collection, designed by Véronique Nichanian, Artistic Director of the Hermès men’s universe for 37 years, was unveiled at the end of January 2026 at the Palais Brongniart.

- Silk and Textiles (+4.7%) recorded growth, with a solid fourth quarter driven by exceptional materials and strong momentum in formats and colours.

- Perfume and Beauty (-7.6%) faced a high comparison base from 2024, when the new women’s fragrance Barénia was launched. The fragrance line was enriched with two new eaux de parfum intenses: Terre d’Hermès at the beginning of the year and Barénia in the second half. Hermès Beauty also introduced the new lipstick Rouge Brillant Silky.

- Watches (-1.5%) returned to growth in the second half after a challenging first half. The segment continued to develop, notably driven by new versions of the H08 line and a reinterpretation of its emblematic complication watch, Le temps suspendu.

- Hermès Other (+11.2%), including Jewellery and the Home universe, continued to achieve solid growth. The Adage jewellery line was enriched with exceptional new creations, while the eighth High Jewellery collection, Les formes de la couleur, was presented in April in Singapore and subsequently in July in Tokyo.

—— Supply chain footprint ——

Production capacity for Ready-to-Wear and Accessories continued to expand, and Hermès further strengthened its footprint in France:

- In September 2025, the Group inaugurated its 24th leather goods workshop in L’Isle-d’Espagnac (Charente).

- New workshops are planned to open in Loupes (Gironde) in 2026, in Charleville-Mézières (Ardennes) in 2027, and in Colombelles (Calvados) in 2028.

- At the end of January 2026, the Group announced plans to open a new site in Les Andelys (Eure) by 2030.

In July 2025, Hermès also announced the strengthening of production capacity for its watchmaking business, with the expansion of its manufacture in Noirmont, Switzerland, scheduled for completion by 2028.

In addition, at the end of May 2025, Hermès announced the laying of the foundation stone for a new workshop in Couzeix (Haute-Vienne), its second site dedicated to tableware.

—— Outlook ——

In the medium term, despite global economic, geopolitical, and currency uncertainties, the Group reaffirmed its ambitious objective of revenue growth at constant exchange rates.

Against a backdrop of continued economic and geopolitical uncertainty, the Group enters 2026 with confidence, supported by its highly integrated artisanal model, balanced distribution network, creativity of its collections, and customer loyalty. With its unique business model, Hermès is pursuing a long-term development strategy based on creativity, maintaining control over its know-how, and distinctive communication.

The annual theme for 2026 is “Venture beyond”.

| Source: Company financial report

| Image Credit: Company official website

| Editor: LeZhi