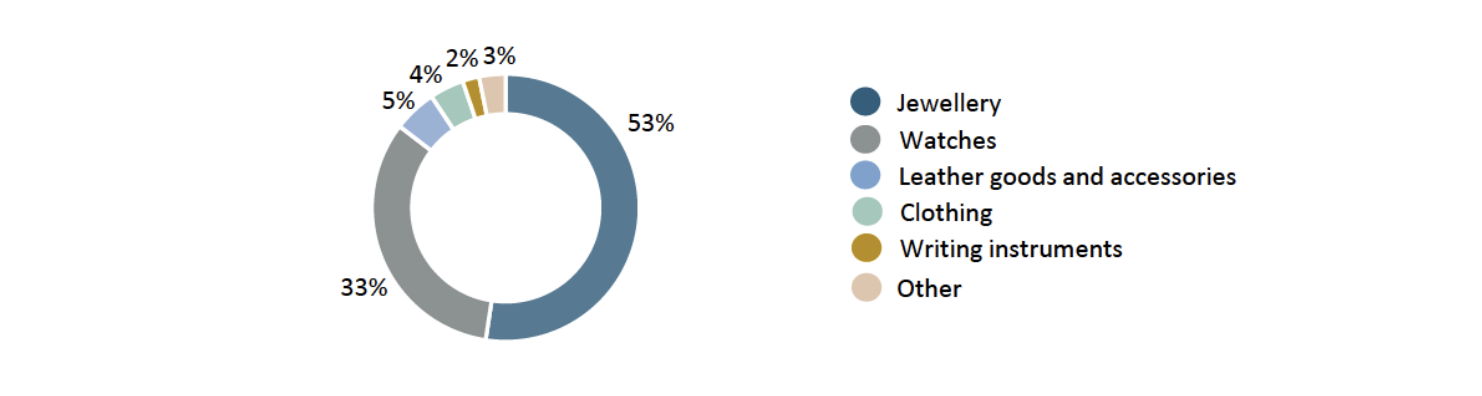

On November 8, Swiss luxury giant Richemont Group released its financial data for the first half of the fiscal year ending September 30, 2024. Thanks to the Group’s balanced geographic distribution and the sustained strong growth of its jewelry brands, sales from continuing operations held steady year-on-year at €10.1 billion (a 1% decline at current exchange rates). Operating profit reached €2.2 billion, reflecting a 12% decline at constant exchange rates (and 17% at current exchange rates), primarily due to a drop in sales in the specialist watchmaking division, a slight decrease in gross margin, and ongoing investments for the long-term growth of its brands.

During the reporting period, Richemont Group’s sales in the Chinese Mainland, Hong Kong, and Macau saw a combined year-on-year decline of 27%.

As of the market close on November 8, Richemont’s stock price fell 6.61% from the previous day to CHF 119.3 per share, with a current market capitalization of CHF 69.8 billion. Over the past 12 months, the Group’s stock price has risen by 6.76%.

Commenting on the results, Richemont Chairman Johann Rupert stated, “In the first half of this fiscal year, we continued to deliver sustained resilience in a world where uncertainty has become the norm. We saw solid sales growth across most of our regions offsetting continued weakness in Chinese demand, which, as I had predicted, will take longer to recover and is particularly affecting our Specialist Watchmakers.”

“The first half of our fiscal year was also marked by a series of notable achievements. We welcomed Vhernier to our family of leading Jewellery Maisons, shareholders adopted our first Non-Financial Report, and we found a great home for YNAP (YOOX NET-A-PORTER) in Mytheresa where their combined strengths will contribute to delighting even more customers and brand partners. Importantly, we also further strengthened the Group’s leadership and governance with the appointments of Nicolas (Nicolas Bos) as CEO, Bram Schot as Deputy Chairman of the Board, and those of Catherine (Catherine Rénier) and Louis (Louis Ferla), two highly experienced leaders with strong track records at the helm of Van Cleef & Arpels and Cartier respectively.”

Johann Rupert added, “What we are seeing in the world today is not unprecedented. It illustrates just how important it is to have strong leadership with a long-term vision, to continue to invest in our Maisons’ excellence in crafting and marketing distinctive and timeless creations, to manage our offer with discipline, and to have an agile structure and a solid balance sheet. Looking ahead, whilst I remain cautious in this uncertain context, I am therefore confident in our ability to navigate the current as well as future cycles and to deliver sustained value over the long term for all stakeholders.”

By Region

Europe

At constant exchange rates, sales in Europe grew by 5% year-on-year for the six months ending September 30, 2024, primarily driven by increased local demand and spending by North American tourists. Growth in Europe was mainly attributed to sales increases in the jewelry segment and the retail channel. Overall, Europe contributed 23% to the Group’s sales, slightly above last year’s 22%.

Asia-Pacific

Sales in the Asia-Pacific region declined by 18% at constant exchange rates. While some markets, including South Korea and Malaysia, saw growth, combined sales in the Chinese Mainland, Hong Kong, and Macau dropped by 27% year-on-year, partially due to a high base from the previous year (which had seen a growth rate of +34% year-on-year). Sales declines were observed across all channels and business areas, though to varying extents. The Asia-Pacific region’s contribution to the Group’s sales fell from 42% last year to 34%.

Americas

In the Americas, sales increased by 11% year-on-year at constant exchange rates, supported by robust local demand across all distribution channels. Growth was primarily led by the jewelry segment and other business areas, while specialist watch sales remained flat compared to the same period last year. The Americas contributed 23% to the Group’s sales, up from 21% last year. Notably, the United States further solidified its position as the Group’s largest single market.

Japan

Japan saw the highest growth rate during the reporting period, with sales up 42% year-on-year at constant exchange rates. The region benefited from double-digit growth in both local demand and tourist spending, the latter partly due to a weaker yen. Japan accounted for 11% of total sales, up from 8% last year.

Middle East and Africa

Sales in the Middle East and Africa grew by 11% at constant exchange rates, with all business areas seeing growth except for the specialist watch division. The increase in sales was primarily driven by higher local demand. The Middle East and Africa contributed 9% to the Group’s sales, slightly higher than in the prior year.

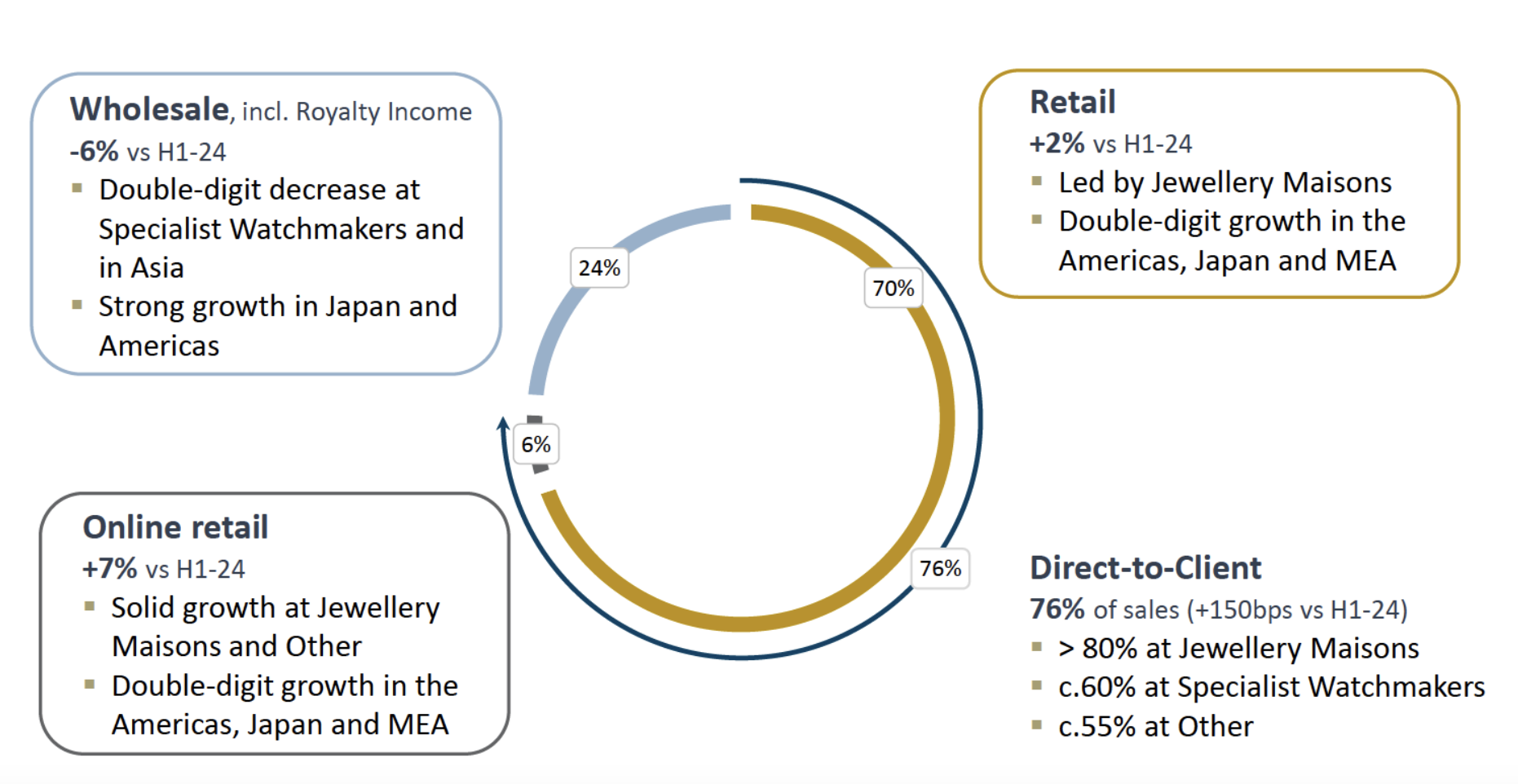

By Channel

Retail

The retail channel, which includes sales from the Group’s directly operated boutiques, saw a 2% increase in sales year-on-year, reflecting double-digit growth in the Americas, Japan, and the Middle East and Africa, mainly within the jewelry segment. The retail channel remains the largest contributor to the Group’s sales, with the Group’s 1,400 directly operated boutiques (including eight Vhernier boutiques integrated into the Group as of September 30) contributing 70% of the Group’s sales, up from 69% last year.

Online Retail

Online retail sales (excluding sales from YNAP) grew by 7% year-on-year, mainly driven by the jewelry segment and strong growth in other business areas, including Watchfinder, an e-commerce platform for watches. Online retail contributed 6% to the Group’s sales, slightly higher than in the previous year.

Wholesale and Licensing

This distribution channel includes sales to single-brand franchise partners, third-party multi-brand retail partners, agents, and licensing revenue. Wholesale sales declined by 6% year-on-year, with sales decreasing across all business areas except other business segments. Growth in wholesale sales in Japan, the Americas, the Middle East, and Africa was insufficient to offset declines in other regions, particularly in the Asia-Pacific region. Wholesale’s share of the Group’s total sales fell to 24% from 26% last year.

By Segment

Jewelry

The jewelry segment—which includes the three major brands Cartier, Van Cleef & Arpels, and Buccellati—achieved sales of €7.1 billion in the first half of this year, marking a 2% increase year-on-year, with a 4% increase at constant exchange rates. This growth was achieved on top of a high base from the previous year (16% year-on-year growth), with solid growth in all regions except Asia-Pacific, primarily driven by direct-to-consumer sales. The Americas and Japan were the main contributors to growth.

Jewelry and watch sales benefited from the continued strong performance of a range of iconic collections celebrated for their creativity and craftsmanship, including Buccellati’s Opera Tulle and Macri collections, Cartier’s Trinity, Clash, Panthère, and Santos collections, and Van Cleef & Arpels’ Alhambra, Perlée, and Flora collections. High jewelry sales remained strong even against a high base from last year, bolstered by successful launches of Cartier’s Nature Sauvage collection and Van Cleef & Arpels’ Heritage and Signature collections.

The jewelry brands continued selective network expansion, such as Buccellati‘s relocation of its Osaka boutique, Cartier‘s renovation of its Miami boutique and expansion of its South Coast Plaza store, and Van Cleef & Arpels’ new store opening in Beijing’s WF Central. Simultaneously, the jewelry brands continued investing in manufacturing capabilities, including Cartier’s new site in Valenza, Italy, and Van Cleef & Arpels’ acquisition of multiple workshops.

Operating profit for the jewelry segment declined by 5% year-on-year, down 1% at constant exchange rates. Rising raw material costs, particularly for gold, were only partially offset by limited price increases. Additionally, the jewelry brands continued to invest in distribution to support current and future demand while maintaining comparable marketing expenses to last year. The operating profit margin was 32.9%.

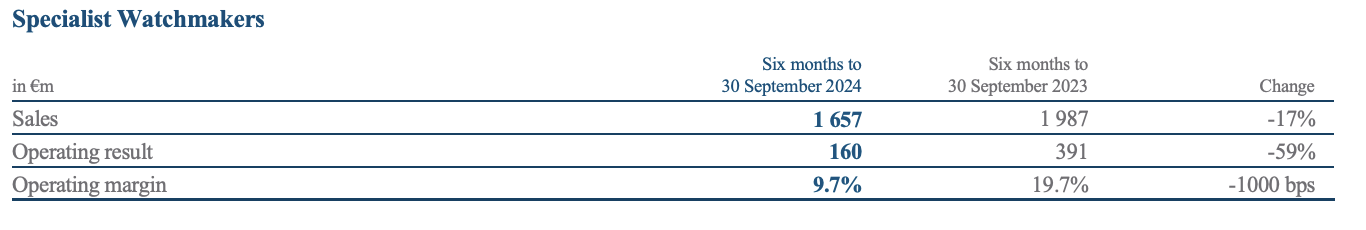

Specialist Watchmaking

The specialist watchmaking division, which includes brands such as A. Lange & Söhne, Baume & Mercier, IWC Schaffhausen, Jaeger-LeCoultre, Panerai, Piaget, Roger Dubuis, and Vacheron Constantin, saw sales decline by 17% year-on-year, with a 16% decline at constant exchange rates. This was primarily due to a 28% drop in sales in the Asia-Pacific region, particularly in the Chinese Mainland, Hong Kong, and Macau, which collectively accounted for over 50% of the division’s sales in the prior year. In comparison, sales in the Americas remained steady, while Japan experienced double-digit growth.

Despite varying resilience levels in market exposure and product mix across regions, all brands continued to focus on innovation, upholding brand heritage and craftsmanship. Noteworthy examples include IWC’s Perpetual Calendar from the Portugieser series, Vacheron Constantin’s ultra-complex Berkley Grand Complication from the Les Cabinotiers collection, and Piaget’s ultra-thin Altiplano Ultimate Concept tourbillon.

Performance across retail and wholesale channels was largely consistent, with direct-to-client sales holding steady year-on-year at 59% of total sales, consolidating the progress made in recent years. Channel network expansion was focused on key locations, including new flagship stores for IWC on Madison Avenue in New York and the Champs-Élysées in Paris, as well as a new Vacheron Constantin boutique in Munich.

Operating profit for this division amounted to €160 million, marking a 59% year-on-year decline, mainly reflecting the impact of lower sales on fixed operating costs. Additional factors impacting profitability included a stronger Swiss franc and timing adjustments for the Watches & Wonders event (held in April this year, compared to March in 2023). The operating profit margin was 9.7% of sales.

For the specialist watchmaking division, Johann Rupert commented, “As we noted at the annual shareholders’ meeting in September, the global watch market is slowing, particularly in China, which has affected all watch brands globally. However, the high-end watch market has shown greater resilience. This highlights the importance of disciplined production and caution, as well as adapting to changing market conditions, which ultimately helps maintain product appeal.”

Other Businesses

Other businesses include fashion and accessories brands, Watchfinder, and the Group’s watch component manufacturing and real estate activities. Sales in this division reached €1.3 billion, with growth of 4% year-on-year at both actual and constant exchange rates. This growth was driven by double-digit growth at Watchfinder and a 2% increase in the Group’s fashion and accessories brands, which included contributions from Italian footwear brand Gianvito Rossi, incorporated into the Group as of February 1, 2024. Sales grew in all regions except Asia-Pacific.

The sustained momentum of the Alaïa brand (notably with the La Ballerine and Le Teckel bags) and Peter Millar (particularly the Crown Crafted line and enhanced direct-to-consumer experience) largely offset declines in other brands. Alaïa’s Fall-Winter 2025 collection was especially well received, and the Fall-Winter 2024 collection by Chloé designer Chemena Kamali achieved promising results.

Noteworthy new store openings included Peter Millar‘s location in Tampa, Florida, Gianvito Rossi‘s store in Nanjing, China, and Villa Serapian‘s boutique in Tokyo’s Ginza district.

The division reported an operating loss of €52 million, with fashion and accessories brands contributing a €23 million loss, reflecting performance differences across brands and continued strategic investments aimed at enhancing brand appeal and recognition.

Key Strategic Developments During the Reporting Period:

- On September 12, 2024, after fulfilling customary conditions and receiving necessary regulatory approvals, the Group completed the acquisition of 100% of Italian jewelry brand Vhernier SpA in a private transaction. Richemont expressed its eagerness to leverage its infrastructure and expertise to unlock Vhernier’s potential in the international jewelry market.

- On June 1, 2024, former Van Cleef & Arpels CEO Nicolas Bos took on the role of Richemont Group CEO and joined the Senior Executive Committee, overseeing all brands, functions, and regions under the Group. With a remarkable 32-year career in the Group, Nicolas led Van Cleef & Arpels to become a high-end jewelry powerhouse. Johann Rupert noted that, with the support of a strong leadership team across the Group, Nicolas is well-positioned to lead Richemont into its next phase of development.

- On September 1, 2024, Richemont appointed Louis Ferla as President and CEO of Cartier, succeeding Cyrille Vigneron, who decided to retire after eight successful years in the role. With a 23-year career at Richemont, primarily with Cartier, and serving as CEO of Vacheron Constantin since 2017, Louis is joined by Catherine Rénier, who succeeds Nicolas Bos as CEO of Van Cleef & Arpels. Catherine has a 25-year career within the Group, with roles at Cartier, Van Cleef & Arpels, and Jaeger-LeCoultre, where she served as CEO since 2018.

- During the Annual General Meeting held on September 11, 2024, two new members were elected to Richemont’s Board of Directors: Gary Saage as a non-executive director and Nicolas Bos as an executive director. Shareholders also re-elected Wendy Luhabe as the representative of “A” shareholders and approved all board members for an additional one-year term.

- On October 7, 2024, Richemont announced an agreement with German luxury e-commerce company Mytheresa, which acquired a 33% equity stake in Richemont’s luxury e-commerce platform YOOX NET-A-PORTER (YNAP). The transaction, expected to close in the first half of 2025, is subject to customary conditions, including regular approvals. Richemont will provide a €100 million revolving credit facility to fund YNAP’s corporate needs.

| Source: Richemont Group Official Website and Financial Report |

| Image Credit: Richemont Group Official Website |

| Editor: LeZhi |