On July 16, before the local stock market opened, Swiss luxury giant Richemont released its financial data for the first quarter of fiscal year 2025, ending June 30. Despite ongoing macroeconomic and geopolitical instability, and a high comparison base from the same period last year, the group’s sales increased by 1% year-on-year at constant exchange rates to EUR 5.268 billion, while declining by 1% at current exchange rates.

*The following growth rates are at constant exchange rates:

In the first quarter of fiscal year 2025, Richemont achieved positive sales growth in all markets except the Asia-Pacific. Japan led with a 59% increase, followed by the Americas with an 11% rise.

Sales in the Asia-Pacific market fell by 18% year-on-year in the first quarter. Growth in South Korea and Malaysia partially offset declines in Mainland China, Hong Kong, and Macau (down 27% year-on-year). The weak performance in Mainland China and Hong Kong-Macau was due to low consumer confidence and a strong comparison base from the previous year (last year, Mainland China sales benefited significantly from the lifting of pandemic restrictions, with double-digit growth, and Hong Kong and Macau saw triple-digit growth).

– By Market: Positive Sales Growth Outside Asia-Pacific

- European sales growth was driven by recovering local demand and increased tourist spending.

- In the Americas, domestic demand grew across all distribution channels.

- Japan continued to perform strongly despite a high comparison base (14% growth last year), thanks to robust domestic demand and increased tourist spending from China, Korea, Southeast Asia, and the US, boosted by yen depreciation.

- Growth in the Middle East and Africa was supported by increased domestic and tourist spending in the UAE and Saudi Arabia.

– By Business Segment: Steady Jewelry, Decline in Specialist Watchmaking

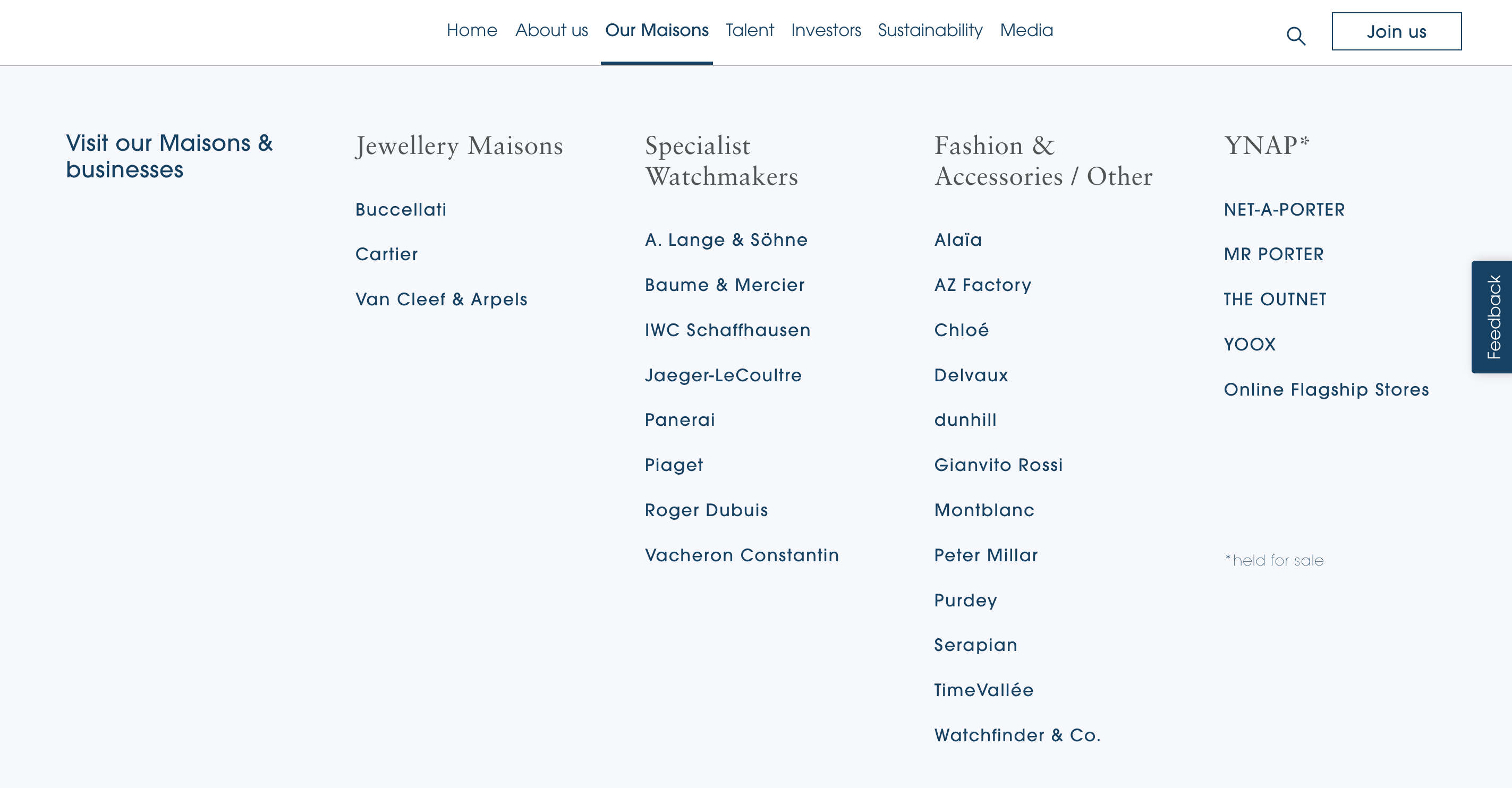

- Sales in the jewelry segment grew by 4% year-on-year, building on a strong comparison base (24% growth last year), driven by Buccellati, Cartier, and Van Cleef & Arpels.

- Sales in specialist watchmaking declined, mainly due to significant drops in Mainland China and Hong Kong-Macau. Strong performance in Japan partially offset declines in Europe and the Asia-Pacific. A. Lange & Söhne and Vacheron Constantin remained resilient.

- Sales in other businesses, including fashion and accessories, grew, driven by double-digit growth at luxury watch retailer Watchfinder and a 4% increase in the fashion and accessories segment, including Gianvito Rossi (acquired 70% by Richemont in February 2024). Steady growth in brands like Alaïa and Peter Millar offset weaknesses in other brands, including Chloé, whose new creative director Chemena Kamali’s first collection launched at the end of the quarter.

– By Channel: Retail and Online Sales Growth Offset Wholesale Decline

- Retail sales growth was driven by mid-single-digit growth in the jewelry segment.

- Online retail sales growth was driven by Watchfinder, jewelry, and fashion and accessories segments.

- Wholesale sales declined, mainly due to weak performance in the Asia-Pacific.

YNAP, Richemont’s luxury e-commerce group, is classified as a “non-continuing business,” with sales down 15% year-on-year at both constant and current exchange rates. Last December, Richemont terminated the agreement to sell the majority stake in YNAP to Farfetch and Symphony Global. After parting ways with Farfetch, YNAP continues to operate on its own platform. Richemont is seeking a new majority shareholder for YNAP to best realize its potential and is also considering alternative plans to achieve its luxury new retail vision. Discussions with potential buyers are ongoing, with more information expected by the end of the year.

As of June 30, 2024, excluding YNAP’s EUR 200 million net cash position, Richemont’s net cash position was EUR 7.3 billion (compared to EUR 6.6 billion last year).

On the day the financial report was released (July 16), Richemont’s stock price rose by 0.73% to CHF 138.05 by 1:38 PM Zurich local time, with a current market value of approximately CHF 74.2 billion.

Year-to-date, Richemont’s stock price has increased by 19% on the Swiss Zurich exchange.

At point of writing, the exchange rate stands at: 1 Swiss Franc ≈ 1.12 USD

| Sources: Company financial report, Yahoo Finance

| Image Credit: Richemont official website

| Editor: Wang Jiaqi