On December 16, after the market closed, Xinao (SH: 603889), a leading wool yarn company in the Chinese Mainland, announced that its wholly-owned subsidiary, Todd & Duncan Limited (referred to as “Duncan Ltd.”), plans to introduce an investor, Barrie Knitwear Limited (“Barrie”), through a capital increase and equity expansion.

Xinao will first inject £9.562 million in cash into Duncan Ltd., increasing its registered capital from £6.5 million to £16.062 million. Following this internal capital increase, Barrie will become a new shareholder in Duncan Ltd. by subscribing for 10,708,170 shares at a subscription price of £1.76 per share, amounting to £18.8 million. Payment will be made in cash. Xinao, as the original shareholder, has waived its preemptive rights to subscribe to this portion of shares.

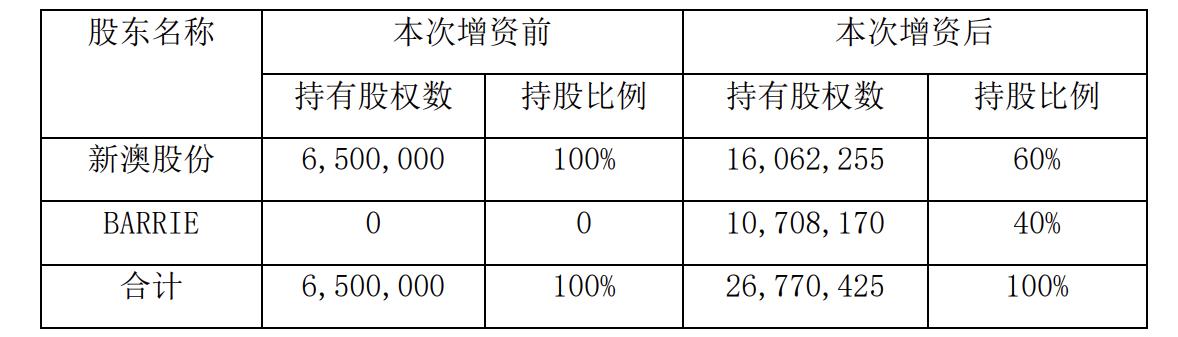

After completing the transaction, Duncan Ltd. will remain a subsidiary of Xinao and will continue to be included in the consolidated financial statements. The shareholding structure of Duncan Ltd. will change as follows: Xinao will hold 60% of shares (reduced from 100%), while Barrie will hold 40%. Xinao will retain its controlling stake in Duncan Ltd., and the transaction will not affect the scope of the company’s consolidated financial statements.

According to the announcement, if Duncan Ltd.’s sales to Barrie or its affiliates account for the vast majority of Duncan Ltd.’s total sales or revenue for three consecutive years, Barrie may (at its discretion but without obligation) exercise an option to increase its stake, allowing it to hold up to 70% of Duncan Ltd.

Barrie, founded in 1903 in the Scottish Borders, is a historic and high-quality cashmere apparel manufacturer. The company is a supplier to prominent luxury brands, including Chanel, and is renowned for its exceptional traditional knitting craftsmanship. Chanel acquired Barrie in 2012, and the brand was relaunched in 2014.

According to the announcement, Barrie achieved revenue of £31.069 million, net profit of £1.089 million, total assets of £23.448 million, and total liabilities of £10.44 million in 2023.

Duncan Ltd., a British producer of cashmere yarn with over a century of history, was acquired by Xinao in 2020 through a public bidding process for RMB 42 million (approximately USD 5.8 million).

In 2023, Duncan Ltd. reported revenue of RMB 267 million (approximately USD 36.5 million) and net profit of RMB 8.24 million (approximately USD 1.13 million). For the first three quarters of 2023, the company recorded revenue of RMB 219 million (approximately USD 30 million) and a net loss of RMB 60,000 (approximately USD 8,200).

Xinao stated that Duncan Ltd., as one of the world’s leading producers of cashmere yarn, has extensive expertise in the research, production, and sales of cashmere yarn and maintains long-standing cooperative relationships with top global brands.

This transaction, which involves a capital increase and the introduction of an external investor, is expected to strengthen Duncan Ltd.’s alignment with the long-term growth value of high-end clients. The move will enhance the company’s financial resources and support upgrades to its premium cashmere spinning production equipment, ultimately improving production efficiency, technical capabilities, and access to customer resources.

For Xinao, the transaction aligns with its strategy of sustainable and diversified growth within the spinning industry. In recent years, the company has expanded its presence in the cashmere yarn market through initiatives such as establishing Ningxia Xinao Cashmere and acquiring Duncan Ltd.

The company has developed a brand portfolio that includes CASHFEEL, NEWCHUWA, Xinao, 38°N, CASHQUEEN, and Todd & Duncan. It offers a wide range of yarn products in the mid-range, high-end, and luxury segments, as well as applications in knitwear, sportswear, home textiles, and more.

| Source: Official Announcement

| Image Credit: Company Website

| Editor: LeZhi