The 2nd Edition of LUXE.CO Sports & Outdoor Brands China Power Ranking was released!

The inaugural LUXE.CO Sports & Outdoor Brands China Power Ranking focused on two core dimensions: Store and Communication. Now the ranking introduces three new dimensions: Scene, Product, and ShePower, reflecting our insights into current market trends:

- Scene: Deepening or expanding scenarios enhances brand visibility, broadens audience reach, and strengthens emotional connections.

- Product: Elevates brand appeal, aligns with fashion trends, and drives brand rejuvenation.

- ShePower: Cultivates brand ethos, amplifies cultural influence, and fuels sustainable growth.

The ranking evaluates brands based on activity, innovation, growth, and relevance—key factors shaping customer desirability.

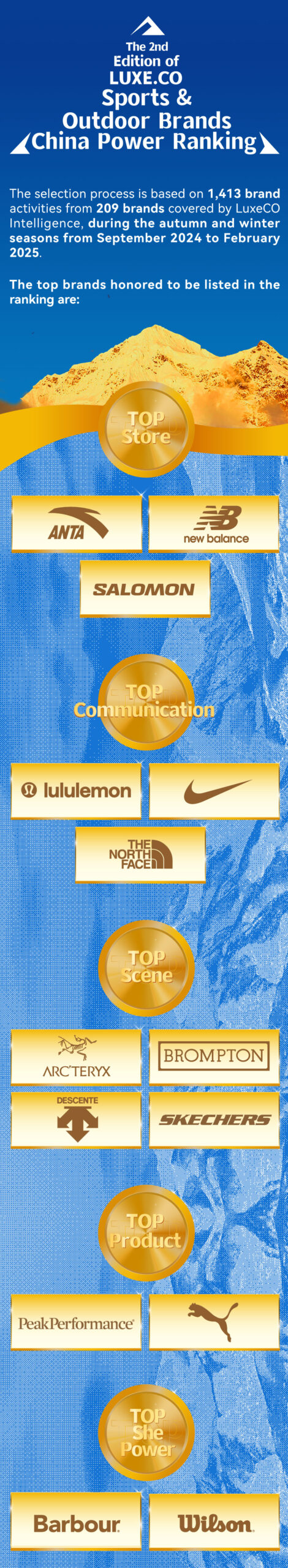

【Store: Who Are the TOP Brands?】

Honored Brands: ANTA, New Balance, SALOMON

Key Trends in Physical Retail

- Premium Demand: Rising appetite for high-end, fashion-forward brands among mid-to-high-end consumers.

- Destination Retail: Large-format “one-stop” stores and mass-market brands with rich SKUs emerge as traffic magnets.

- Global Ambitions: Brands succeeding in China are expanding overseas with confidence and innovative formats.

ANTA

LUXE.CO Insight:

ANTA’s “Super ANTA” stores (avg. 1,000㎡) cover all-season sports scenarios and diverse demographics. Tested across tiered cities, each store features unique innovations in branding, retail logic, and consumer insights.

Top-performing stores thrive in fashion-sensitive urban hubs.

Best-selling products: High-tech, quality-to-price ratio items, reflecting rational consumption in Tier 1/2 cities.

Quote: Founder Ding Shizhong emphasized, “Why does the world need ANTA? The answer is: ANTA must deliver ‘exceptional products,’ which are the reason global consumers choose our brand.”

New Balance

LUXE.CO Insight:

In January 2025, New Balance debuted its global flagship NB Grey R in Shanghai, followed by Shenzhen and Chengdu.

NB Grey R marks the brand’s decade-long shift from performance running to lifestyle leadership.

The store showcases rare UK/US-made 9-collection sneakers, including the iconic 1982 CM990 (first $100 sports shoe) and the Loro Piana x 990v6 collab.

Quote: Arthur Ang, Greater China VP, stated: “Brand stories and experiences must be conveyed in-store through human interaction.”

SALOMON

LUXE.CO Insight:

SALOMON’s Asia flagship in Shanghai and Shenzhen signals strategic upgrades in China.

Expands beyond core outdoor gear to include fashion-forward lines (e.g., SALOMON ADVANCED) and tech-driven S/LAB series.

Parent company Amer Sports reported 72% revenue growth in Greater China (2021–2022), with 2023 sales exceeding $1.3 billion.

Global Moves: Flagships in Paris, London, and Singapore reinforce its shift from niche outdoor player to mainstream lifestyle icon.

【Communication: Who Are the TOP Brands?】

Honored Brands: lululemon, Nike, The North Face

Key Trends in Seasonal Campaigns

- Hyper-localization: City- or landmark-specific activations amplify relevance.

- Balancing Elite & Mass Appeal: Merging professional sports with public participation.

- Women-Centric Narratives: Leveraging emotional resonance to drive cultural impact.

lululemon

LUXE.CO Insight:

Pre-snow season, lululemon staged the “Wunder Puff Dynamic Theater” ice show in Harbin, featuring Olympic skaters and Gen Z influencers.

Expanding beyond Tier 1 cities, it opened a second Harbin store in September 2024.

CNY campaigns like “Return to Spring” focus on everyday stories, resonating deeply.

Performance: 34% and 39% YoY growth in China (Q2/Q3 FY2024), outpacing global markets.

Nike

LUXE.CO Insight:

Under CEO Elliott Hill’s “Win Now” strategy, Nike doubled down on bold storytelling and female engagement.

Shanghai Marathon slogans (e.g., “Winners Love Challenges”) sparked viral conversations.

Women-centric campaigns: Global ad “No Debates, Just Wins” and Nike Women Night Run series.

The North Face

LUXE.CO Insight:

Capitalized on Harbin’s ice tourism boom with “Urban Ride” ski pop-ups and ice sculpture activations.

Consistently uses Minions yellow as a visual anchor across campaigns.

Upgraded Guangzhou Taikoo Hui flagship blends outdoor functionality with urban aesthetics.

Performance: APAC sales surged 35% YoY (Q1 FY2025).

【Scene: Who Are the TOP Brands?】

Honored Brands:ARC’TERYX (Climbing),BROMPTON (Cycling),DESCENTE (Kids’ Skiing),Skechers (Pickleball)

ARC’TERYX

LUXE.CO Insight:

Launched alpine-inspired Cliff House retail spaces and advanced climbing programs (e.g., ice climbing in Beijing).

Revived China’s elite mountaineering training and “World-Class Crags” initiative.

Performance: Parent company Amer Sports reported 36% growth in outdoor apparel (2024).

BROMPTON

LUXE.CO Insight:

Hosted China’s first BROMPTON World Championship in Beijing, blending races with fashion (e.g., “Best Dressed” contests).

Cultivates urban bicycle lifestyle through themed rides (coffee, architecture tours).

21 JUNCTION stores in China fuse retail with community.

DESCENTE

LUXE.CO Insight:

Leveraged 70-year ski heritage to launch Kids’ Ski Series, showcased at the Great Wall by child prodigy Zhou Yizhu.

Opened flagship kids’ store in Chengdu IFS, themed “Ice & Snow.”

Skechers

LUXE.CO Insight:

Pioneered pickleball in China with tournaments and dedicated centers (e.g., Shanghai Expo’s Pickleball Hub).

Upgraded Viper Court Pro shoes debuted at 2023 CIIE.

【Product: Who Are the TOP Brands?】

Honored Brands: Peak Performance, Puma

Peak Performance

LUXE.CO Insight:

Disrupted monochrome winter wear with the Helium Puffer’s Nordic color-blocking.

“PP Toast Tour” pop-ups and collabs with bakery FASCINO reinforced playful branding.

Puma

LUXE.CO Insight:

Revived retro Speedcat sneakers (originally for F1 drivers), now a runway staple via collabs with Balenciaga and Coperni.

Quote: Arne Freundt, CEO of Puma said, “Our archives are a goldmine. We refresh classics to lead trends.”

【ShePower: Who Are the TOP Brands?】

Honored Brands: Barbour, Wilson

Barbour

LUXE.CO Insight:

Barnfit aesthetics (waxed jackets) gained traction via Hailey Bieber and Gigi Hadid.

Collaborations with Ganni and Alexa Chung infused femininity into British heritage.

Strategy: APAC-focused growth, with new Singapore logistics hub.

Wilson

LUXE.CO Insight:

Intrigue™ Tour: First women-specific tennis shoe, addressing anatomical needs.

Women’s tennis skirts became global bestsellers.

Quote: Gordon Devin of Wilson said, “We never expected Gen Z girls to embrace Wilson—now they’re our core audience.”

About LUXE.CO Brands China Power Ranking

Launched in 2013, LUXE.CO has delivered comprehensive, in-depth coverage of global mid-to-high-end brands across luxury goods, active outdoor, fashion, beauty/fragrance, and lifestyle sectors, tracking over 6,000 brands to date.

In February 2022, LUXE.CO launched the industry’s first and only Luxury Brands China Power Ranking, an authoritative ranking focused on the luxury market in China, now released annually for four consecutive years. Building on this success, October 2024 saw the debut of the inaugural Sports & Outdoor Brands China Power Ranking.

The Brands China Power Ranking embodies LUXE.CO’s decade-long commitment to brand research, offering actionable insights for brand-building and elevation. Since its launch, the index has earned widespread acclaim from global industry leaders. Across luxury, active outdoor, and commercial real estate sectors, LUXE.CO will continue leveraging this IP to document best practices, champion innovation, and ignite market activity.

.jpg)