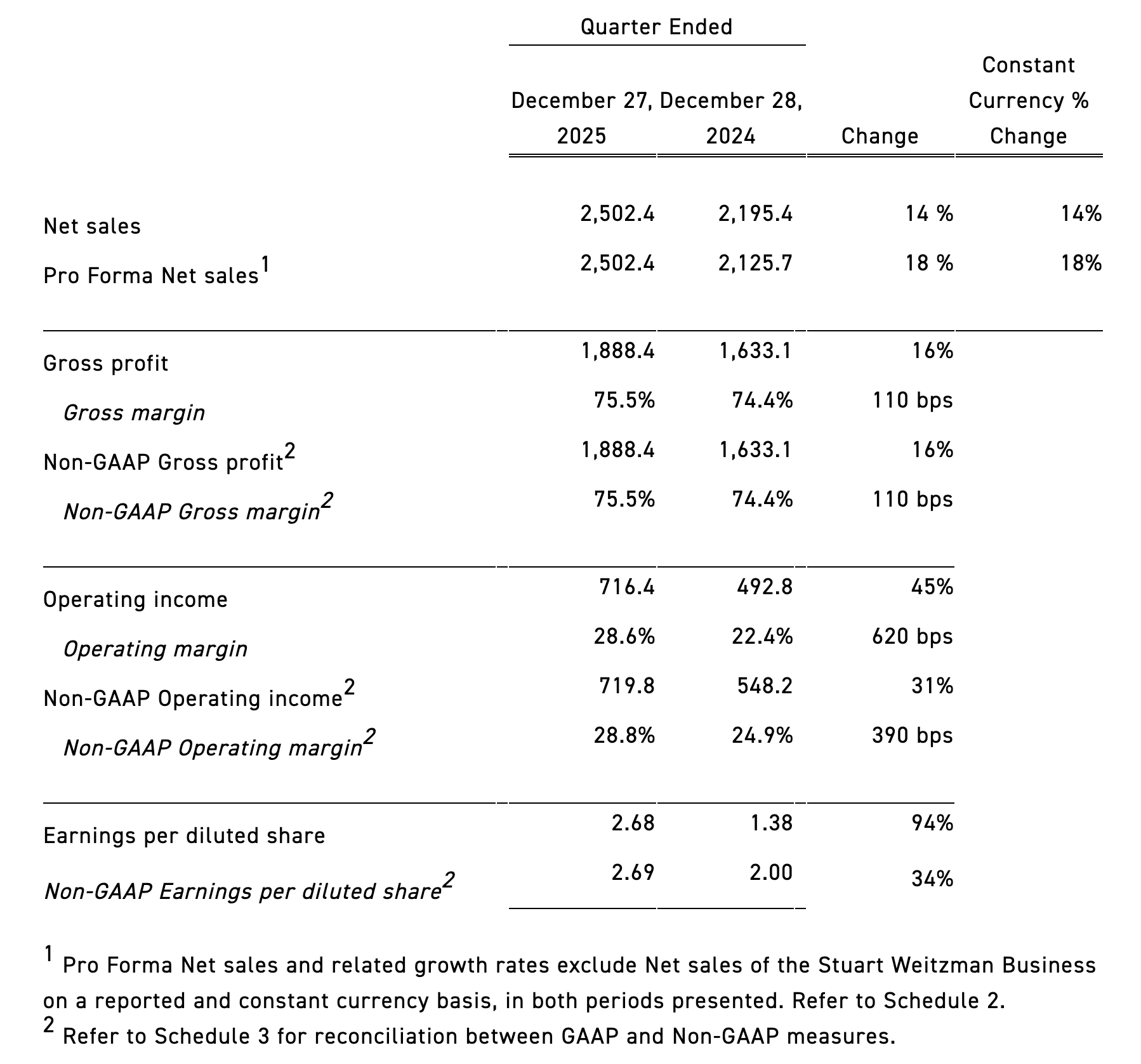

Before the market opened on February 5, US accessible luxury group Tapestry (NYSE: TPR), which owns Coach and Kate Spade, released its financial results for the second quarter of fiscal year 2026, ended December 27, 2025. Net sales increased 14% year on year to USD 2.502 billion (+14% on a constant currency basis). Among them, the Greater China region rose 35% to USD 343 million (+34% on a constant currency basis), marking the highest growth rate across all markets.

Tapestry CEO Joanne Crevoiserat commented: “Our second quarter outperformance reflects the compounding impact of our Amplify strategy, driving deeper consumer engagement, accelerated growth, and record results.”

“This holiday season, our talented teams brought creativity, craftsmanship, and value to consumers around the world, building new and lasting connections that fuel enduring brand desire and demand. As we move forward, we do so with momentum and confidence. By harnessing our proven strategies and structural advantages, we are raising our outlook for the fiscal year, reinforcing our commitment to driving durable growth and long-term value creation.”

In view of Tapestry’s strong operating performance, solid balance sheet, robust free cash flow generation and growth outlook, the group now expects to return USD 1.5 billion to shareholders through dividends and share repurchases in fiscal year 2026, equivalent to approximately 100% of expected adjusted free cash flow, up from the previous forecast of USD 1.3 billion.

The group also plans to repurchase approximately USD 1.2 billion of common stock in fiscal year 2026 under its existing share repurchase authorization, an increase from the prior expectation of USD 1.0 billion. In the second quarter, the group repurchased approximately 3.6 million shares for around USD 400 million, at an average price of about USD 112 per share. Year to date, the company has repurchased approximately 8.3 million shares, with total spending of about USD 900 million, at an average price of around USD 109 per share.

Following the earnings release, as of market close on February 5, the group’s share price rose 10.21% from the previous trading day to USD 143.19 per share. Over the past 12 months, the stock has gained 95.13%, and the company’s current market capitalisation stands at approximately USD 29.304 billion.

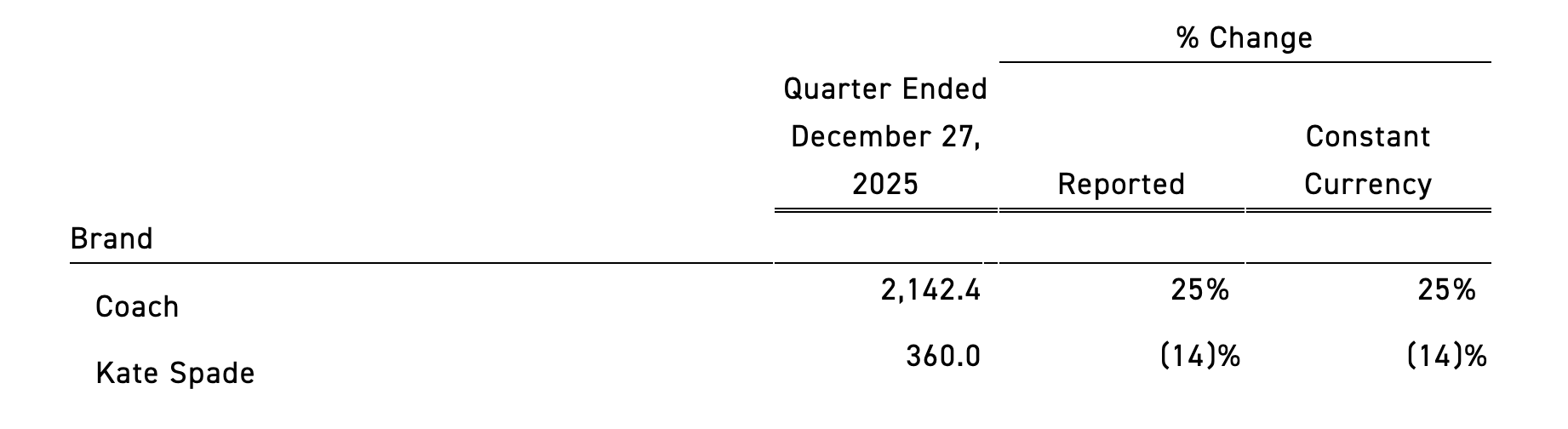

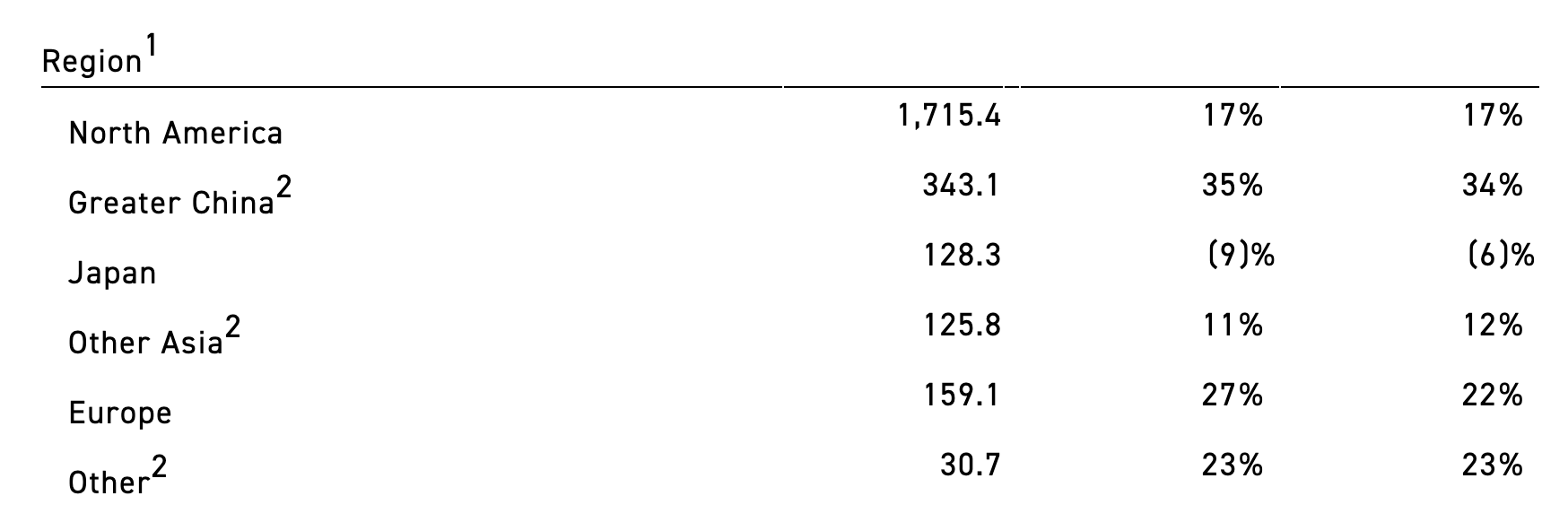

Key operating highlights for Tapestry Group in the last fiscal quarter are as follows:

- Global net new customers exceeded 3.7 million. The number of Gen Z consumers increased significantly year on year, accounting for about one-third of total new customers. In addition, demand from existing customers also grew, reflecting strong overall business momentum;

- Core leather goods growth continued to accelerate. Coach handbag revenues posted strong growth, driving overall performance. Both the average selling price and unit volume of Coach handbags increased by around 15%, contributing roughly equally to total revenue growth and demonstrating the innovation capabilities of the product portfolio as well as diversified growth drivers;

- Across core markets, growth exceeded expectations, with particularly strong constant-currency increases in North America (+17%), Europe (+22%) and Asia-Pacific (+18%) (including Greater China at +34%), driving 25% growth for the Coach brand during the quarter;

- On a pro forma basis, the DTC channel grew 17%, with digital sales up about 20% and global brick-and-mortar store sales increasing by around 15%.

As of February 5, key financial data for Tapestry Group’s second quarter of fiscal year 2026 are as follows:

— By brand:

— By region:

| Source: Official financial statements

| Image Credit: Group official website

| Editor: LeZhi