“Chantecaille will embark on a global expansion plan this year. China is one of the most promising and dynamic prestige beauty markets in the world, and we have unwavering confidence and a long-term vision.”

— Patricia Ho, General Manager of Chantecaille Asia Pacific

At the end of September, the prestige beauty brand Chantecaille held its first offline pop-up event in the Chinese Mainland at Shanghai Xintiandi One. The event also marked the brand’s official entry into the Chinese Mainland market through direct operations.

Taking this opportunity, Patricia Ho, General Manager of Chantecaille Asia Pacific, gave an exclusive interview to Luxe.CO. WiOth 20 years of experience in the beauty industry in Asia, she shared her first-hand insights into the current competitive landscape of the Chinese high-end beauty market and the brand’s positioning.

Founded in 1998, Chantecaille has established itself as a brand with a unique focus on high concentrations of natural botanical extracts, building a solid user base in North America and Asia over the past 20 years. In 2022, it was acquired by Germany’s Beiersdorf Group and became part of the company’s luxury division alongside the Swiss brand La Prairie. After two years of preparation, Chantecaille has begun its international expansion, with the Chinese Mainland as its first strategic market.

A Reshaped Chinese Prestige Beauty Market

“In the past, international luxury brands dominated the minds of consumers due to their strong brand awareness. However, following the pandemic, with the rise of new marketing methods such as livestreaming, many high-end Chinese beauty brands have emerged. On some e-commerce platforms, domestic brands now make up nearly half of the top 10 beauty brand rankings. For a newcomer like Chantecaille, our competitors are no longer just international brands but also local Chinese brands,” Patricia Ho explained to Luxe.CO.

The Chinese high-end beauty market, once monopolized by international brands, has undergone a significant reshuffle over the past two years. The rise of local brands has made premiumization a key battleground for both international and domestic players. This trend can be seen in the Chinese brand dynamics tracked by Luxe.CO Intelligence: for instance, Shanghai Jahwa’s relaunch of its legacy brand Twin Lotus as a high-end line, the high-end makeup brand Mao Geping’s IPO attempt in Hong Kong, and the new ultra-premium brand AOXMED launched by the Betain Group.

When discussing competition from emerging local brands, Patricia Ho emphasized that for overseas brands like Chantecaille, entering the Chinese market presents both opportunities and challenges. The immediate priorities are clear:

“First is product strategy. We need to accelerate our R&D process. Domestic brands have an advantage in product launch speed because they don’t need to go through complex import registration procedures, allowing them to launch new products in 1-2 months. Second is communication strategy. As an international brand, we have accumulated extensive experience in addressing various skin concerns across different customer profiles, giving us an advantage when catering to local consumers.”

When Beiersdorf announced the acquisition of Chantecaille, CEO Vincent Warnery highlighted the brand’s strategic importance in Asia. He said, “This acquisition strengthens our investment in the high-end beauty sector and solidifies our market position, particularly in the key C.A.R.E.+ markets: the U.S., China, and South Korea.”

According to Beiersdorf’s half-year report for the 2024 fiscal year, Chantecaille achieved growth against the backdrop of a generally sluggish high-end beauty market. Notably, the Greater China region, representing Asia, contributed significantly to this growth, with a double-digit increase.

![]()

Beyond Hero Products: What Else is Needed to Succeed in China?

In the Chinese market, new entrants still rely heavily on “hero products.” These products serve as a brand’s business card and, to some extent, determine local consumers’ awareness of the brand.

However, for a “hero product” to maintain its vitality and even evolve into a “classic product” representing a category, it requires continuous investment and innovation from the brand.

In the interview, Patricia Ho repeatedly emphasized the critical role of “hero products” when entering a new market.

“In 2024, we launched Chantecaille’s second-generation sunscreen with a new shade—Opaline—designed specifically for the Asian market to meet the demand for fairer complexions. Upon launch, this product achieved double-digit growth in the first half of the year, which drove overall brand growth and exceeded our expectations.”

Patricia Ho explained that in North Asia, sunscreen is an absolute bestseller. With the younger and more dynamic consumer base in China, she highlighted that the makeup category, especially sunscreens, is a primary focus of Chantecaille’s initial marketing efforts in the Chinese market. To strengthen its position, Chantecaille announced Chinese actress Bai Lu as its makeup spokesperson for Greater China.

Following makeup, skincare is the long-term demand for beauty brands in mature markets. The global focus on wellness post-pandemic has further boosted demand for high-end skincare.

In this interview, Patricia Ho provided details on Chantecaille’s key product lines. We noted that the premium skincare products in the Gold and Diamond series are priced on par with the top luxury skincare brands in China.

This price point reflects the purchasing power of China’s high-end skincare market, as confirmed by Luxe.CO Intelligence’s 2023 China Luxury Brands Power Rankings White Paper, which found that over 70% of respondents had purchased high-end skincare products priced above 1,000 RMB, and 31.5% had made purchases exceeding 3,000 RMB.

To meet the growing demand for premium skincare, Patricia Ho shared that Chantecaille plans to first introduce its best-selling Diamond Mask to build brand awareness. Starting next year, the full product range will be gradually launched in the Chinese market.

Uncovering Chantecaille’s Untapped Potential in China

Since its founding in 1998, Chantecaille has adhered to the philosophy of “Beauty with Impact,” as its founder Sylvie Chantecaille expressed: “When I created Chantecaille, I was certain we would become the first skincare brand based on the concepts of flowers, botanicals, and luxury.”

Chantecaille’s first pop-up event in the Chinese Mainland, Maison Chantecaille, was held at Xintiandi One in Shanghai, a historic building constructed in 1925. This hidden gem in the heart of the city perfectly complements the brand’s French luxury beauty positioning.

The space featured multiple interactive experience areas, allowing existing and potential customers to fully engage with the Chantecaille brand, especially through its three key brand attributes: “pure botanical ingredients,” “results through scientific innovation,” and “beauty that gives back to conservation.”

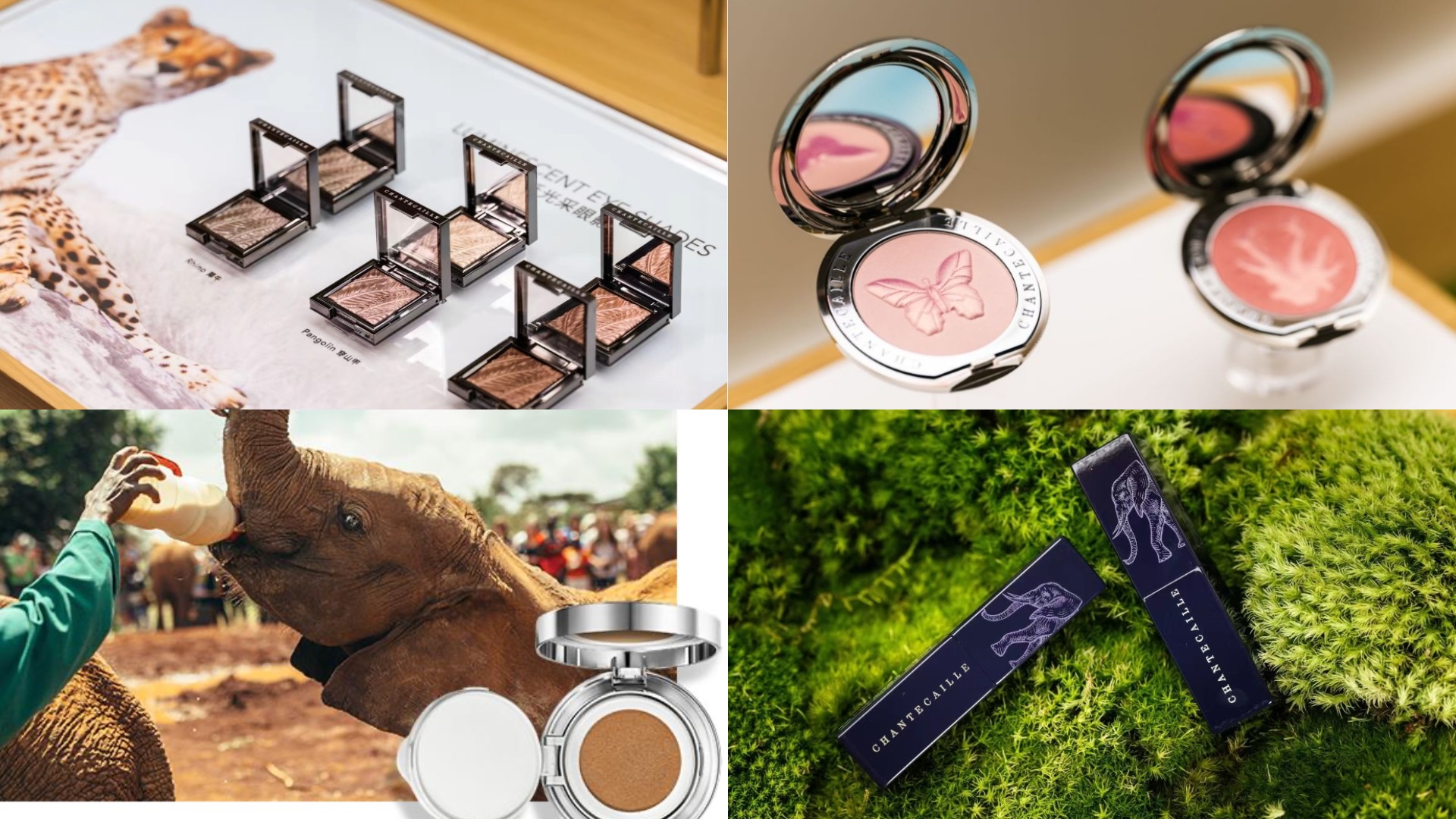

The makeup section offered a chance to try Chantecaille’s second-generation sunscreen, translucent powders, blushes, eyeshadows, and lipsticks, all providing flawless “botanical beauty” looks. Meanwhile, the skincare section showcased the Rose de Mai series, the Diamond series with plant peptides, and the Gold series with 24K gold-infused plant peptides, providing luxurious cutting-edge skincare experiences.

It’s worth noting that for decades, Chantecaille has been committed to environmental conservation efforts, protecting endangered animals and ecosystems through charitable initiatives. This commitment has set a precedent for sustainable beauty in the industry and is increasingly influencing emerging brands.

The animal-themed designs on the makeup packaging tell the stories of Chantecaille’s support for orphaned elephants in Kenya, endangered wildlife in Africa, and the protection of plant and animal ecosystems.

These rich details, which reflect the brand’s innovative vitality and core values, are difficult for customers to perceive during online shopping, highlighting the power of in-person experiences.

The Chantecaille Shanghai Xintiandi Experience Store

Steadily Expanding Chantecaille’s Presence in China

According to Beiersdorf’s new strategy, “Win with Care,” in 2024 and 2025, the company will expand its business in India, China, Nigeria, and the U.S. with different brand portfolios. Focusing on the Chinese market, Beiersdorf will further accelerate Chantecaille’s expansion in the third quarter of 2024.

Patricia Ho introduced that “since Chantecaille was acquired by Beiersdorf in 2022, we have observed stronger consumer confidence in brands backed by large beauty groups, especially in terms of efficacy, development, and investment. In 2023, we went through a resource allocation planning phase and established a team for the Chinese Mainland market. This year, we officially launched direct operations in the Chinese Mainland.”

Looking ahead, Patricia Ho outlined Chantecaille’s investment plan for the Chinese Mainland market:

- Online, in addition to the Tmall flagship store opened in August, the brand will gradually expand its direct operations to JD.com and Douyin (TikTok in China);

- Offline, the brand will take a steady approach to further penetrate the Chinese Mainland market.

Notably, during the Golden Week holiday in October, Chantecaille will open a three-month-long pop-up store at Shanghai Xintiandi and plans to launch its flagship store by mid-2025.

In the reshaped Chinese high-end beauty market, the influx of new brands will significantly enrich the product choices and service experiences available to local consumers, injecting fresh vitality into market innovation and transformation.

| Image Credit: Chantecaille, Beiersdorf 2024 H1 Financial Report PPT

| Editor: Alicia