On August 5th, Citi Research released its latest report titled “Chinese Tourists’ Return Should Benefit Luxury Brands.”

This report explores how the return of Chinese tourists, who are the world’s largest group of travel consumers, is expected to reignite the global travel market. After conducting extensive research through its global network and innovation lab, Citi Research concluded that strong demand for leisure travel, the premiumization of beauty products, and luxury shopping will continue to reshape the global travel retail market.

Specifically, the report notes that despite facing macroeconomic uncertainties, Chinese consumers still prioritize spending on experiential consumption, such as leisure travel.

Citi Research’s innovation lab surveyed 2,502 Chinese consumers to understand their outbound travel plans, spending patterns, preferred destinations, luxury shopping habits, and brand preferences. The results indicate a significant demand for travel among this group in the next three to six months.

The report states that travel brings more satisfaction to Chinese travelers, making them willing to spend money and explore diverse activities. Chinese consumers’ spending tendencies have been evolving, gradually shifting towards experiences and emotional value. While the appeal of shopping is diminishing (though it remains a primary consideration), the attractiveness of overseas experiential consumption, including activities, accommodation, and dining, is on the rise.

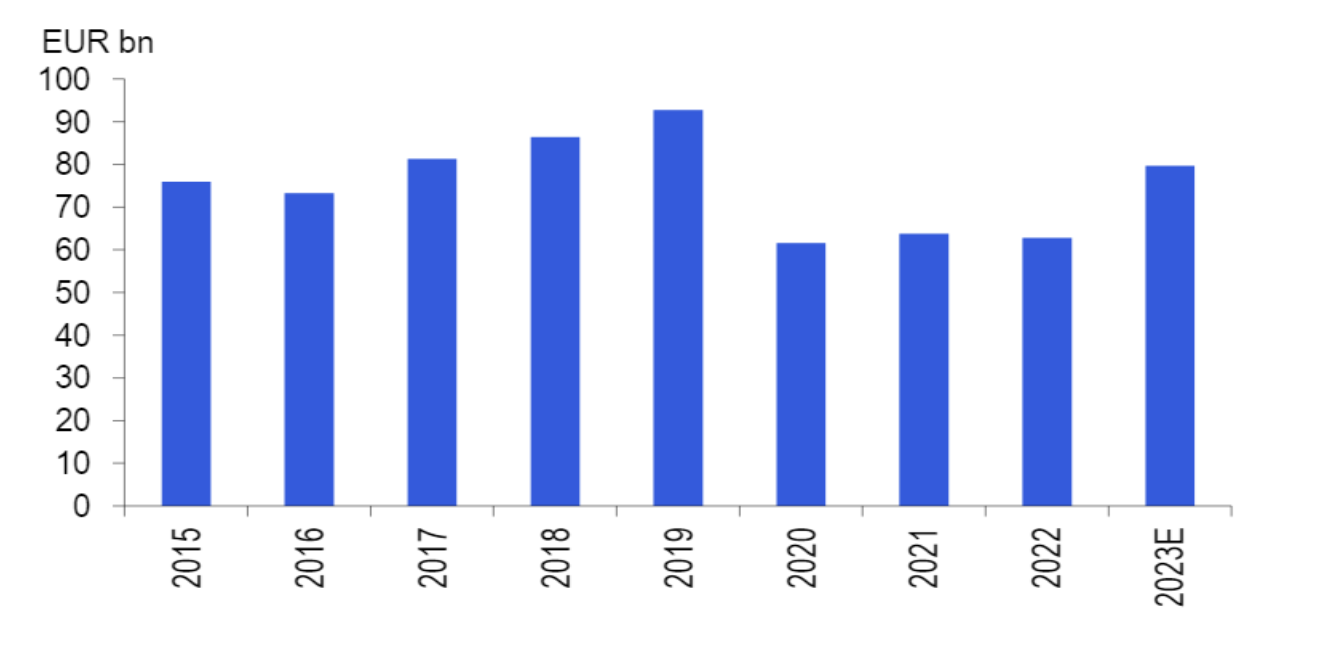

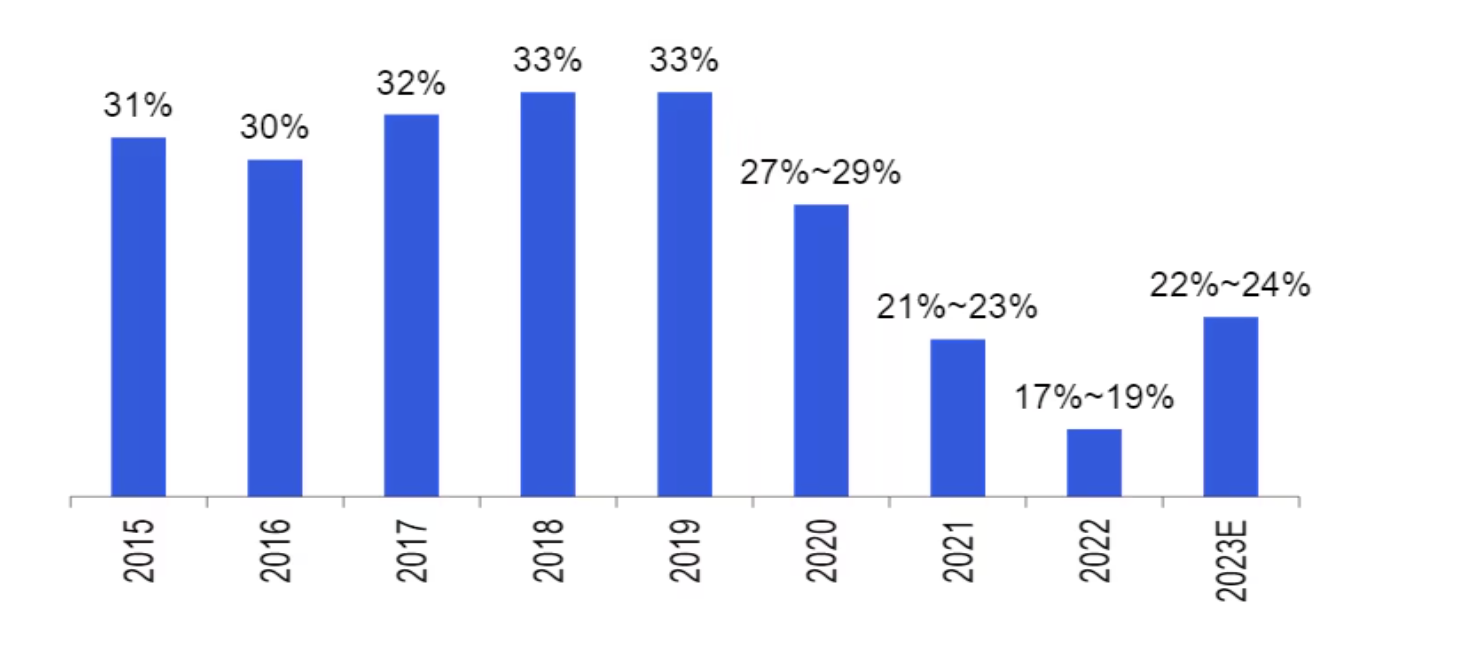

Current Chinese citizens’ luxury spending remains below pre-pandemic levels.

However, despite the shift towards experiential spending among Chinese outbound tourists and the repatriation of luxury consumption to China, Chinese outbound tourists remain a long-term driving force for global luxury spending. Citi Research estimates that by the end of 2024, Chinese consumers’ contribution to global luxury spending will return to around 35%, consistent with pre-pandemic levels. This resurgence will be a key driver for the ongoing recovery of the global travel retail market.

Additionally, the report suggests that by then, the ratio of Chinese consumers’ luxury spending domestically versus internationally will be approximately 70%/30%, due to improvements in the variety and pricing of luxury goods within China and concerns about taxation when returning to China after shopping abroad.

In 2019, Chinese consumers were the largest luxury spenders, accounting for 33% of the market, but this proportion is estimated to have dropped to around 22% to 24% in 2023.

Furthermore, the Citi report analyzed 66 luxury items popular among Chinese consumers, comparing their prices in France, Japan, South Korea, Hong Kong, and the duty-free zone in Hainan, China, to assess how much cheaper they are compared to official prices in the Chinese Mainland.

The study found that Japan has become the most attractive destination for Chinese consumers to purchase luxury goods due to the depreciation of the yen, while Hong Kong is the least attractive for Mainland Chinese consumers. However, as brands gradually adjust their pricing in Japan, this price gap may narrow.

In addition, France’s bags, clothing, and footwear are more appealing to Chinese tourists. In Hainan, the post-promotion prices are more competitive for Chinese consumers. The report notes that although Hainan still needs to expand its range of luxury brands, its appeal to luxury consumers is growing as more luxury brands enter the market.

Photographed by Luxe.CO on the streets of Tokyo

|Source: Citi Group official website

|Image Source: Citi Group official website, Luxe.CO photography

|Editor: Liu Jun