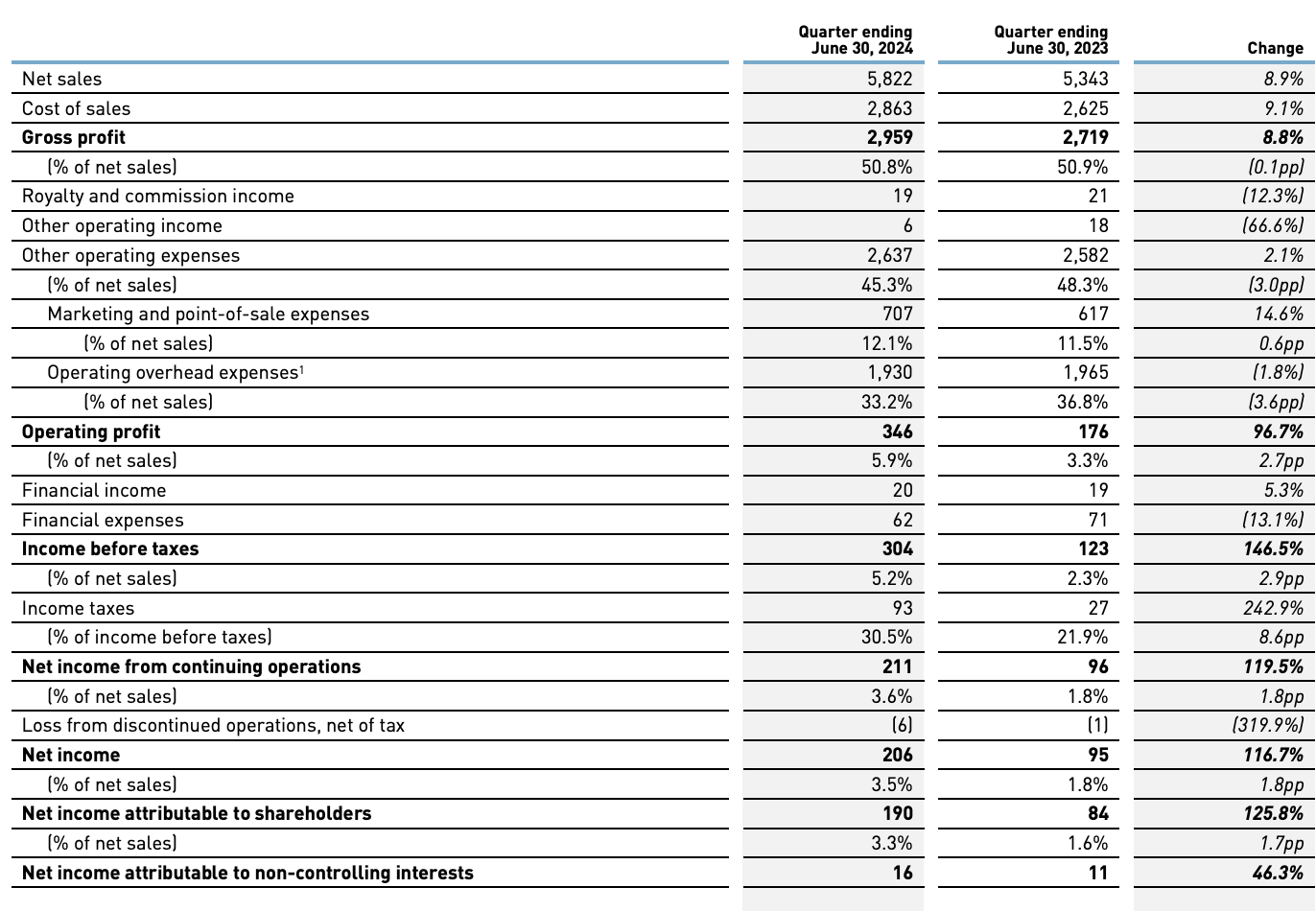

On July 31, German sportswear giant Adidas announced key performance data for the second quarter of the 2024 fiscal year: net sales increased by 8.9% year-on-year to €5.822 billion, and by 11% when excluding currency effects. The Adidas brand saw accelerated growth of 16% during this period. (Sales of remaining Yeezy inventory generated approximately €200 million in revenue this quarter, significantly lower than the roughly €400 million in sales during the same period last year.)

Adidas Group CEO Bjørn Gulden stated: “Q2 was another quarter confirming that we are improving and on the way of again becoming a good and healthy company. The consumers are reacting positively to both our marketing and to our product launches. We see improved sentiment for the adidas brand globally and we continue to see improved sell-out numbers, both for lifestyle and performance products. New in the quarter was to see a positive development also for apparel.

Both the consumers and our retail partners continue to show a strong and increased interest in our brand and our products. This was clearly reflected in the 16% growth for the underlying adidas business in the quarter and in growth across all channels and all markets.”

In terms of categories, footwear led revenue growth with strong product supply. Excluding currency effects, footwear sales revenue increased by 17% year-on-year this quarter. Strong products in the Originals and Football series drove double-digit growth. Apparel sales increased by 6% in the second quarter, driven by double-digit growth in football products. Accessory sales declined by 8% this quarter.

By channel, both wholesale and own retail achieved double-digit growth. Excluding currency effects, wholesale recorded a 17% growth. DTC (direct-to-consumer) business grew by 4% year-on-year, and excluding the Yeezy series, DTC business grew by 21%. During the reporting period, Adidas’ own retail store growth accelerated further (+15%), thanks to strong sales at brand concept stores. Due to the significant reduction in Yeezy business scale, e-commerce revenue decreased by 6% this quarter. Excluding Yeezy, e-commerce revenue grew by over 30% in the second quarter.

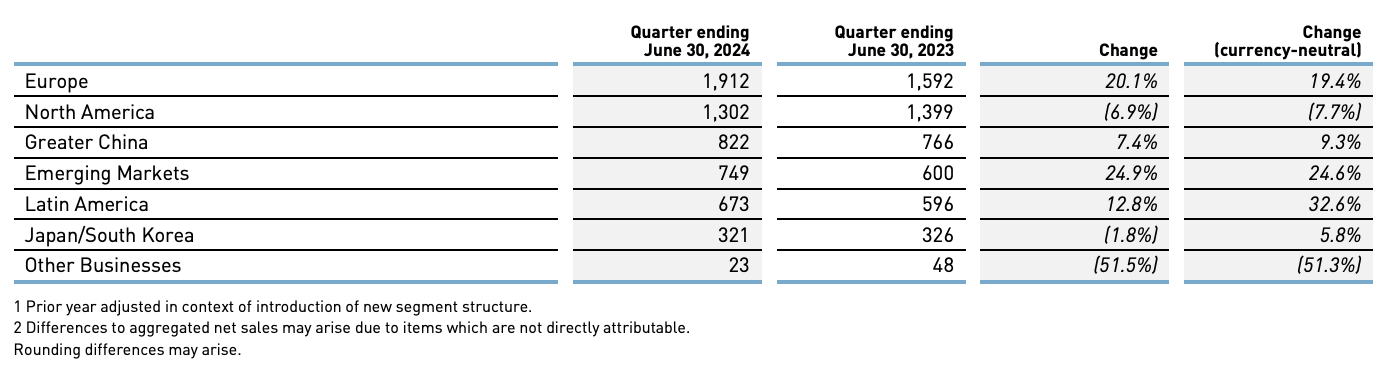

By market, Europe, Emerging Markets, and Latin America achieved strong double-digit growth. Excluding currency effects, European sales increased by 19% year-on-year, while revenue in Emerging Markets and Latin America also achieved double-digit growth (up 25% and 33% year-on-year, respectively). Sales in Greater China increased by 9% year-on-year. Revenue in Japan and Korea grew by 6%. North American revenue declined by 8%, entirely due to the significant reduction in Yeezy business scale. Excluding Yeezy, North American revenue increased year-on-year, driven by growth in wholesale and own retail.

As of June 30, the main financial data for the second quarter of Adidas’ 2024 fiscal year are as follows:

– By market:

Bjørn Gulden commented: “Given the improved business in Q2 we continue to raise our expectations and are now guiding for a full-year revenue increase in the high single digits and an operating profit of around € 1.0 billion.”

Two weeks before the earnings report was released, Adidas Group had already raised its full-year revenue and profit expectations in light of the better-than-expected second-quarter performance: at constant exchange rates, full-year 2024 revenue is expected to grow by high single digits year-on-year (previously guided to grow by mid-to-high single digits year-on-year), and operating profit is raised to €1 billion (previously guided to €700 million).

| Source: Official financial report

| Image Credit: Official website

| Editor: Liu Jun