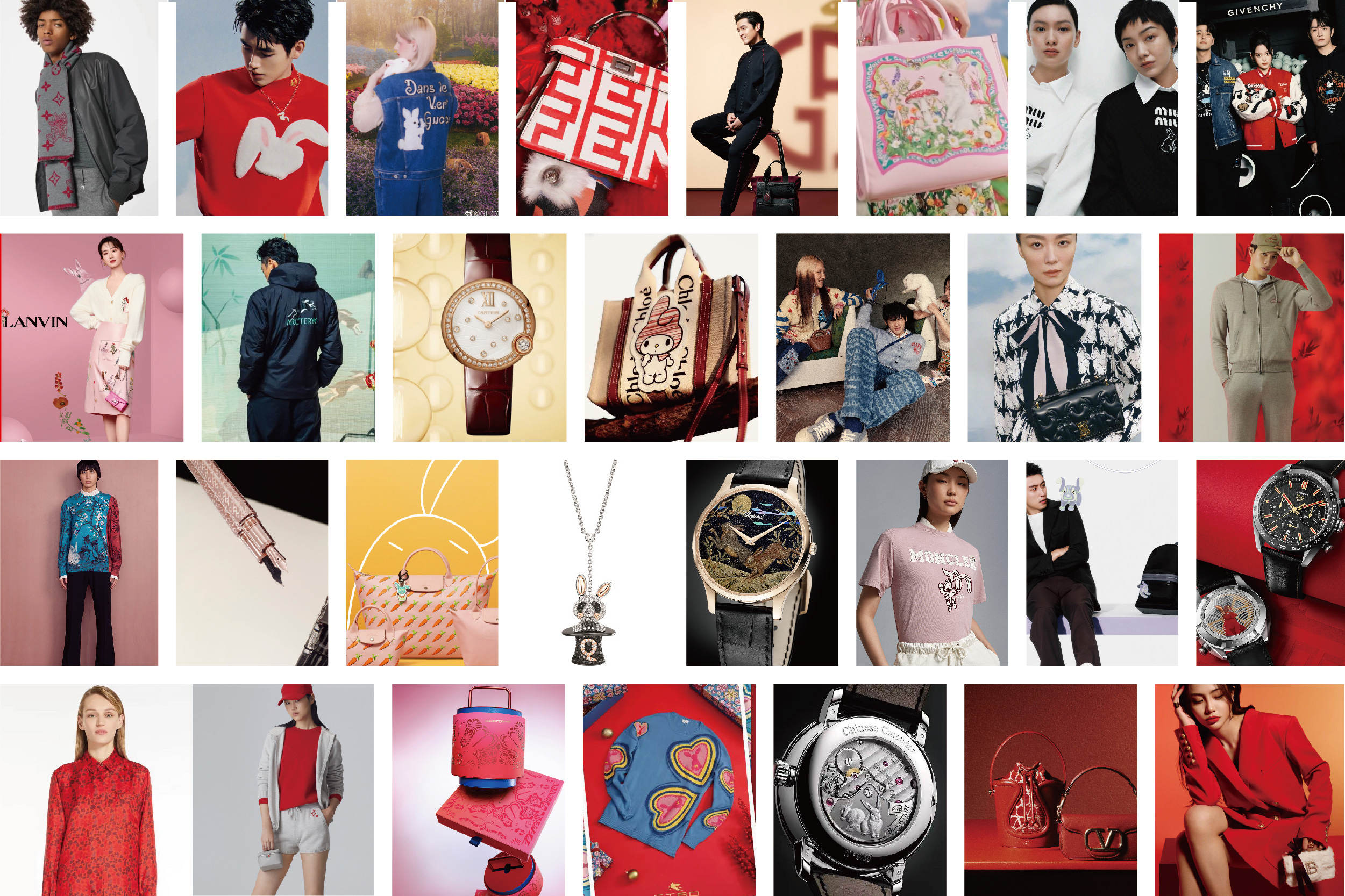

The latest luxury market research report jointly released by Bain & Company and the Italian luxury goods industry association Altagamma indicates that the personal luxury goods market is expected to remain stable overall in 2025. However, the Chinese market is projected to contract by 3–5% compared to last year, with fourth-quarter performance set to be the key determinant of full-year results.

Since October, Luxe.CO has observed a significant increase in luxury brand activity in the Chinese market. From the opening of large-scale flagship stores and exclusive VIP/VIC spaces to brand exhibitions and immersive experiences, major events have followed one after another.

Major Store Openings One After Another

According to market data monitored by LuxeCO Intelligence since October, more than 38 luxury brands have opened or renovated stores in the Chinese market, including several high-profile flagship locations.

On November 21, Chanel reopened its newly renovated boutique at Plaza 66 in Shanghai (pictured above). The three-level store spans 2,973 square meters and includes new dedicated areas for watches and high jewelry. It is the brand’s first space globally to fully present the “Chanel ecosystem,” sending a clear signal to the market about the future direction of luxury retail.

Bruno Pavlovsky, President of Fashion at Chanel, emphasized the importance of this store in an interview with international media, calling it “one of our core flagship stores worldwide.” The main goal of the renovation was to optimize the customer journey, aligning with the post-pandemic trend of consumers returning to high-engagement physical retail environments.

Together, Chanel’s three core locations in Shanghai—Plaza 66, IFC Mall, and The Peninsula Hotel—form a comprehensive client coverage strategy. Plaza 66 and IFC serve as high-traffic hubs hosting the majority of the brand’s clientele, while the Peninsula boutique is positioned as a unique destination store, designed for traveling VICs seeking private and personalized experiences.

On November 17, ALAÏA, part of Swiss luxury conglomerate Richemont, opened its first flagship store in the Chinese Mainland at Taikoo Li Sanlitun, Beijing.

Also in November, Boucheron opened its first flagship store in China at Shanghai Xintiandi. This marks the brand’s third flagship store globally, following Place Vendôme in Paris and Ginza in Tokyo.

On November 6, Audemars Piguet unveiled its first-ever global flagship under a new boutique concept at Taikoo Li Chengdu. The new design pays tribute to the brand’s birthplace in Le Brassus. Following its debut in Chengdu, the concept will gradually be rolled out to select global boutiques starting in 2026.

In October, Ralph Lauren launched its first flagship store in the Chinese Mainland at Chengdu International Finance Square (IFS), which also houses the first Ralph’s Coffee in western China.

Also in October, Blancpain opened its first new-concept boutique globally at WF Central in Beijing. The 435-square-meter store draws design inspiration from the Jura Valley and the deep blue sea.

In Beijing’s Taikoo Li Sanlitun, several luxury brand flagship stores are set to make their debut. Among them, Dior has confirmed its opening date as December 11.

Innovative Spaces and Immersive Experiences Strengthen Customer Loyalty

International luxury brands are increasingly launching offline events such as private dinners, large-scale fashion shows, exhibitions, and previews, while also creating private shopping areas and VIP-only elevator access within their stores. These initiatives aim to deepen engagement with Chinese consumers, particularly high-end clientele.

James Macdonald, Head of Research for Greater China at Savills, noted that luxury companies have shifted from rapid expansion to focusing on increasing per-store sales and strengthening customer loyalty. “Brands are no longer passively waiting for an economic rebound to drive demand. Instead, they are proactively creating opportunities for recovery by emphasizing value and offering more enriched, immersive experiences,” he said.

— Innovative Retail Spaces

In the Chinese market, luxury brands are reconstructing their retail systems around personalized customer needs.

The most representative example is “The Louis,” an innovative retail space by Louis Vuitton, the flagship brand of LVMH Group, located in Shanghai. The unexpected success of The Louis has been repeatedly cited by LVMH’s leadership as a prime example of how the company has actively pursued innovation to drive growth amid a sluggish luxury market.

Zino Helmlinger, Head of Retail Services for Greater China at CBRE, commented that The Louis combines high-end retail with dining and exhibitions. Not only does it generate significantly higher daily sales than other Louis Vuitton flagship stores, but 60% of its revenue comes from new customers. “Executives from many luxury brands have visited The Louis to gain insights. Everyone is hoping to create their own version. Brands must transform—or risk being left behind by the market,” he said.

In its Q3 earnings analyst call, LVMH executives stated that the group’s success in the Chinese market hinges on building emotional connections with consumers through innovation and creating moments of excitement. The Louis is not only a commercial success but also generates a powerful “halo effect” for the brand. This model is expected to be replicated in different forms across other cities in the future.

— Format Innovation and VIP/VIC Exclusive Spaces

Innovations in store formats, particularly those that align with brand lifestyle concepts and spatial storytelling, have become another focal point for luxury brands.

Many of the recently opened flagship stores have created exclusive areas for VIPs and VICs:

-

At Chanel’s Plaza 66 store in Shanghai, the ground floor features dedicated areas for watches and high jewelry, with two curated jewelry pieces from the brand’s heritage department displayed in the salon space. The third floor includes a private VIP lounge and the CHANEL & moi – Les Ateliers service atelier.

-

Blancpain’s store at WF Central in Beijing (pictured below) includes an exclusive salon offering personalized VIP services.

On October 28, La Maison de Famille Longchamp opened on Wukang Road, Shanghai. As the brand’s first independent experiential space globally, it is designed around the concept of “home.” The first floor features a living room, dining area, and café, while the second floor includes a game room, library, and dressing room. A lush outdoor courtyard completes the space.

The soon-to-open Louis Vuitton flagship at Taikoo Li Sanlitun in Beijing will include the city’s first Café Louis Vuitton, marking the brand’s third food & beverage-enabled store in the Chinese Mainland, following The Hall in Chengdu and The Louis in Shanghai.

— A Surge of Brand Exhibitions

Leveraging major exhibitions to showcase heritage and craftsmanship, and to amplify cultural resonance with Chinese consumers, has become a growing trend among luxury brands. These exhibitions aim to build aesthetic connections and raise cultural awareness in the Chinese market. Major brand exhibitions in the fourth quarter include:

-

On October 24, French luxury fashion house BALMAIN presented its exclusive Beijing exhibition “Eight Decades in One Night” at Pudu Temple. The showcase featured key archival pieces, historical treasures, haute couture creations, and the brand-new 2026 Resort collection. Global CEO Matteo Sgarbossa, Global CMO Bruna Scognamiglio, and APAC President Shi Ning attended the event.

-

From November 13 to 16, Dior hosted the “Dior Lady Art #10” artist collaboration exhibition at the Shanghai Exhibition Center, presenting a curated selection of the past decade’s masterpieces.

-

From November 21 to 30, Panerai held its “Depths of Time” historical exhibition at Tianhou Temple in Shanghai, featuring antique instruments such as depth gauges and compasses, iconic timepieces, and never-before-seen historical documents that chronicle the brand’s journey in underwater readability.

-

From December 7 to January 5, 2026, Italian high jewelry brand Buccellati will host its “Masters of Time” archival exhibition at the Shanghai Exhibition Center.

— Curated Immersive Experiences

Luxury brands are thoughtfully designing immersive experiences that bring together brand executives, celebrity ambassadors, VIP customers, media, and KOLs. These events present brand stories and products up close, while also connecting deeply with local Chinese culture.

In early November, Canada Goose hosted the “Winter in Qing” immersive experience at Mount Qingcheng in Chengdu. The event showcased the brand’s iconic Chilliwack series and the upcoming Fall/Winter 2025 collection. Guests were treated to a three-day immersive journey featuring a welcome dinner, Qingcheng Mountain hike, and a sustainability forum. The dinner also featured performances such as long-spout tea art and Sichuan opera face-changing, offering a vibrant taste of Chengdu culture and lifestyle.

| Source: LuxeCO Intelligence, Luxe.CO historical coverage, Reuters

| Images: Official brand social media accounts

| Editor: LeZhi