Next year, Giorgio Armani, the Italian fashion designer, will turn 90. He remains the sole owner of his namesake luxury brand to this day. Armani’s succession plan has been a subject of much interest due to his lack of children. Recent revelations about the Armani Group’s inheritance plan have reignited discussions on how luxury family businesses can transition smoothly.

Each luxury brand’s founding family prides itself on long-termism and independence. However, for those without direct descendants or whose descendants are unwilling or unable to take over, ensuring a smooth transition of control and management as the older generation ages is a pressing and challenging task.

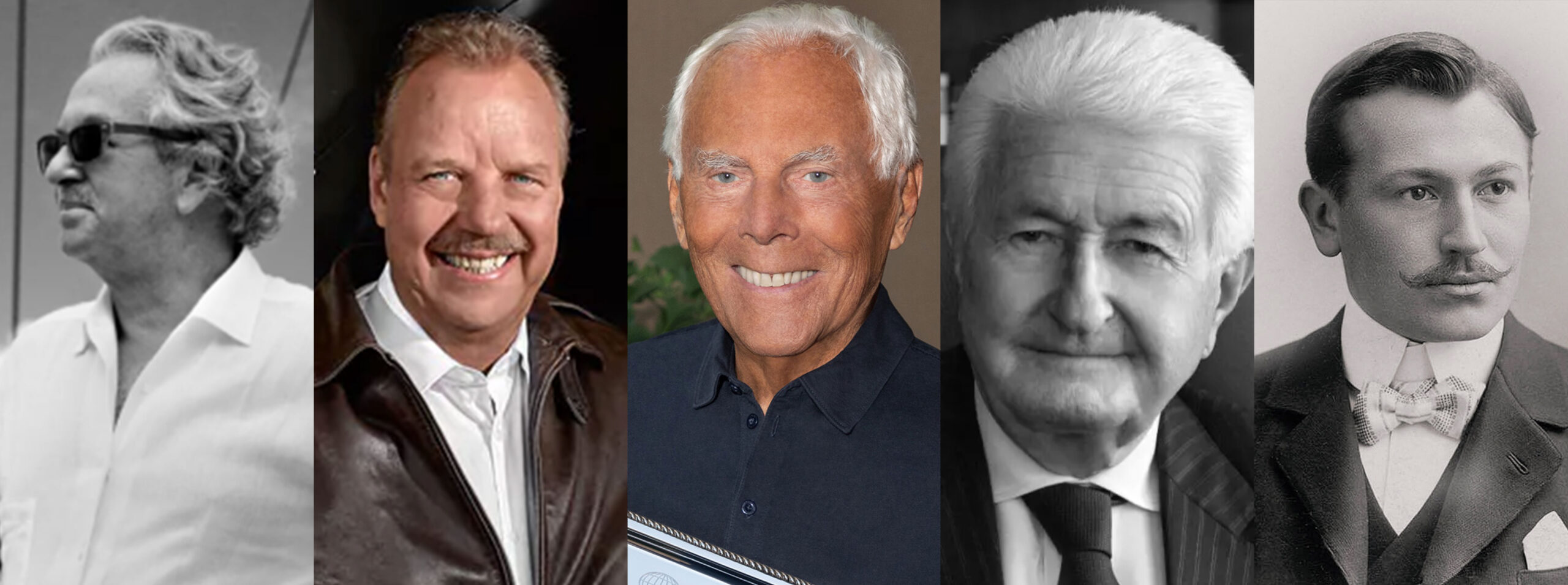

Not just Armani, but many luxury brands have faced this issue. Luxeplace.com analyzes the experiences of Rolex, Bucherer, Loro Piana, and Rimowa, outlining three approaches:

1. Establishing foundations to extend the founder’s personal influence.

2. Entrusting long-term partners for mutual benefit.

3. Joining multi-brand groups to transition to contemporary management styles.

Foundations Extend Founder’s Personal Influence

While the initial intentions and operating methods of family-established foundations vary, in general, these foundations perpetuate the founder’s values and mission. They also promote a balance of power among various parties, preventing drastic changes or disintegration of the company after the founder’s death.

For many years, Giorgio Armani has tightly held the management and ownership of the Italian luxury group Armani, which he founded. Currently, he is still the CEO, Creative Director, and the sole actual shareholder.

In 2016, Giorgio Armani laid out a clear plan for the company’s operations after his passing. Recently, the Italian newspaper Corriere della Sera and Reuters disclosed some details of this succession plan. This document outlines the future governance principles, successor arrangements, share distribution, and potential public listings or mergers and acquisitions of the company, to be enacted after Giorgio Armani’s death.

Giorgio Armani

Giorgio Armani has no direct heirs. Armani Group shares will be transferred to his sister Rosanna Armani and three members of the younger generation in his family: Silvana Armani, Roberta Armani, Andrea Camerana, his long-time assistant Pantaleo Dell’Orco, and the Giorgio Armani Foundation.

All the aforementioned successors are members of the Armani Group’s board, and except for Rosanna Armani, all are employed within the group.

The Giorgio Armani Foundation was established in 2016. At that time, Luca Solca, the head of luxury goods analysis at BNP Paribas, speculated that the Armani Group might adopt a model similar to the Swiss luxury watchmaker Rolex, with the foundation taking complete control of the company. According to Reuters, the Giorgio Armani Foundation currently holds only a symbolic share in the Armani Group.

Reuters states that the Giorgio Armani Foundation will play a key role in preserving his legacy, aiming to reinvest funds into charitable causes (maintaining the number of company positions) and extending his personal influence on the group.

The Armani Group’s official website quotes Giorgio Armani: “I decided to create the Giorgio Armani Foundation in order to implement projects of public and social interest. The Foundation will also safeguard the governance assets of the Armani Group and ensure that these assets are kept stable over time, in respect of and consistent with some principles that are particularly important to me and that have always inspired my activities as a Designer and an Entrepreneur.“

Reuters quotes corporate governance experts, suggesting the foundation will ensure a relatively smooth transition by empowering the board of directors. Guido Corbetta, a professor of corporate strategy at Bocconi University in Milan, told Reuters, “It is an organization that reduces the margins for disagreement between the heirs.”

As for Rolex’s approach, it may offer more insights if Armani’s succession plan remains somewhat unclear.

Rolex’s founder, Hans Wilsdorf, and his two wives had no children. After his first wife’s death, Hans Wilsdorf established the Hans Wilsdorf Foundation in 1945, initially to advance scientific research, education, and charitable activities. After his death in 1960, the Hans Wilsdorf Foundation has continuously held 100% of Rolex Group’s shares.

Hans Wildorf

Since the company is not publicly listed, the foundation’s control means that Rolex cannot be sold or split into different companies, nor will it distribute dividends to external shareholders.

The Hans Wilsdorf Foundation describes its primary function: “The foundation’s assets are allocated to resources to help protect the company’s normal development,” “The remaining funds are given to charitable organizations and sponsors.”

Originally, Wilsdorf’s numerous family members were also eligible for funding, but this provision was removed in 2006. Currently, no living members of the Wilsdorf family are involved in watchmaking.

Hans Wilsdorf had envisioned a wide range of charitable themes for the foundation, currently selected by its 8 board members. For instance, the foundation supports Servette FC (a football club), HC Geneva-Servette (an ice hockey club), HEAD School of Art and Design, the Geneva State Archives, the Red Cross, etc.

Marc Maugué, the secretary-general of the Hans Wilsdorf Foundation, recently revealed to the Swiss newspaper NZZ that the foundation allocates about 300 million Swiss francs to charitable causes each year.

| Image Credit: Official websites of the respective companies/brands

丨Reporter:Jin Daixi

| Editor: Zhu Ruoyu