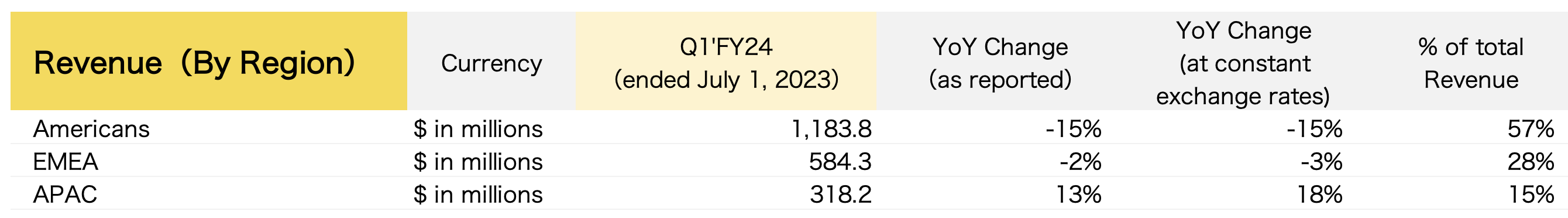

On August 1st, in the Eastern Time of the United States, VF Corporation, the parent company of outdoor and lifestyle brands such as The North Face, Vans, Timberland, and Supreme, and a major American apparel giant, released its key financial data for the first quarter of the 2024 fiscal year, ending on July 1, 2023. The company reported a year-on-year decline of 8% in sales revenue, both on a reported basis and at constant exchange rates, amounting to $2.086 billion. Net losses further expanded to $57.4 million. However, thanks to a remarkable 24% growth in the Greater China region, which led to a 13% overall growth in the Asia-Pacific region, this market was the only one in which the corporation achieved growth.

Bracken Darrell, VF’s newly appointed President and CEO, stated, “I am honored to lead this great company into the next chapter of its history. I am passionate about building brands through a design-and-innovation lens and creating unique and differentiated products, immersive storytelling and elevated experiences for consumers. VF has a portfolio of globally recognized, iconic brands, a deeply embedded purpose and impressive talent, all of which gives me every confidence we have all the necessary ingredients to unlock the company’s significant potential and return to delivering strong, sustainable and profitable growth which will translate to elevated shareholder returns.”

Darrell officially assumed his role last month, bringing with him extensive experience in business leadership, product innovation, and brand management at blue-chip companies. Prior to joining VF, Darrell served as President and CEO of Logitech International S.A for over ten years, leading the company to expand into over 20 new product categories, double its revenue, and achieve a tenfold increase in market value.

After the financial report was released, VF Corporation’s stock price declined by 1.91% in after-hours trading, settling at $19.02 per share. The current market capitalization of the corporation stands at approximately $7.537 billion, with a year-to-date decline of 31.11% in its stock price.

During a conference call, VF’s Chief Financial Officer, Matt Puckett, highlighted the ongoing emphasis on two key recent priorities for the group: the supply chain and the Vans brand.

- Regarding the supply chain, VF made further progress this quarter as the industry conditions continued to improve, and the executed actions showed results. Delivery times were at normal levels this quarter, and the group’s on-time delivery performance and inventory percentage have returned to track.

- Regarding the Vans brand, its sales revenue declined by 22% this quarter, mainly due to the negative impact of the Americas’ wholesale business. This decline was also associated with the group’s inventory adjustments ahead of the crucial back-to-school season. However, the Vans brand demonstrated significant improvements in performance in the Chinese market and digital business compared to the previous quarter and the same period last year. While the overall performance of the brand was largely as expected, Matt Puckett noted that it was not the target they aimed to achieve, and the group will continue to focus on turning around the brand’s performance.

With the growth of Vans in the Greater China region, Puckett expressed, “We are cautiously optimistic that we’re in a place where we’ll continue to see good results coming out of that region as we move forward across the year.”

Martino Scabbia Guerrini, President and Executive Vice President of VF’s EMEA region, Asia-Pacific region, and Emerging Brands, stated, “First of all, we see China in a positive, right. So Q1 was up in the high single digits for Vans in China, which is good news. And I think when I was there a couple of weeks ago, what I started to see is really, as China reopens, a very strong engagement from consumers in stores beyond online. And don’t forget that we’re still underpenetrated in China. We targeted a growth consumer demographic there, so with the growing emerging middle class, and that’s a big opportunity.”

VF Corporation brand portfolio

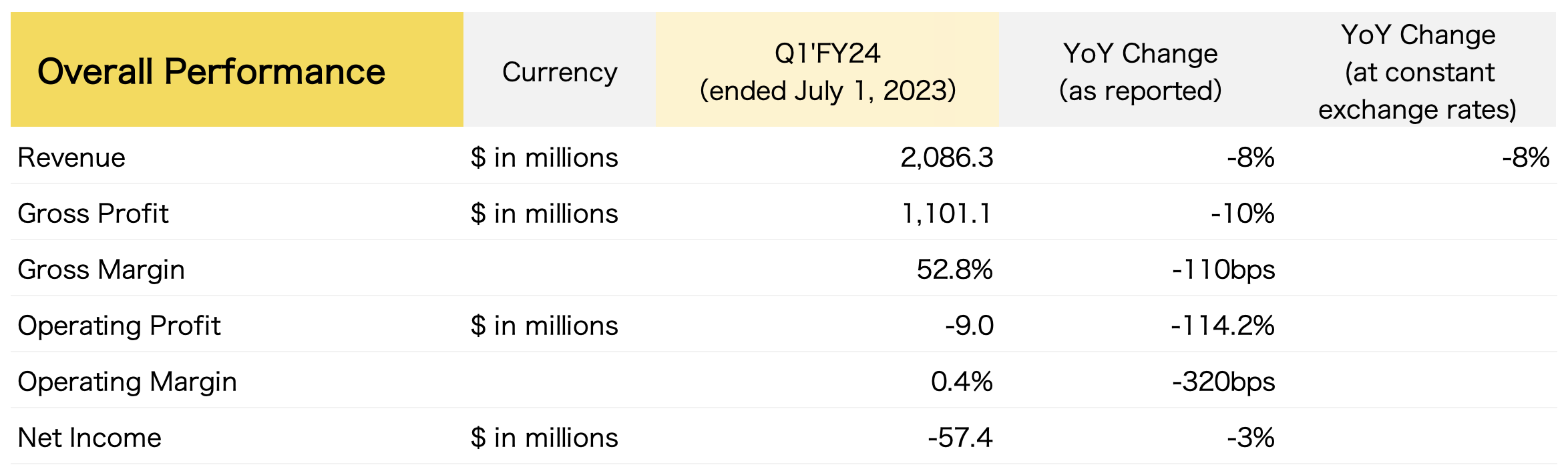

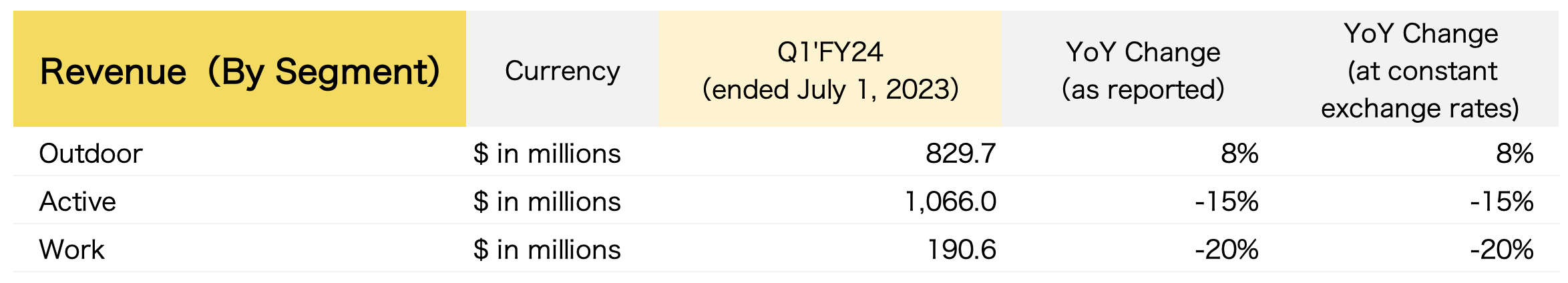

As of July 1, VF Corporation’s key financial data is as follows:

- Gross margin decreased by 110 basis points to 52.8%, primarily due to increased promotions.

- Operating profit margin declined by 320 basis points to -0.4%, mainly attributed to the decline in gross margin and deleveraging.

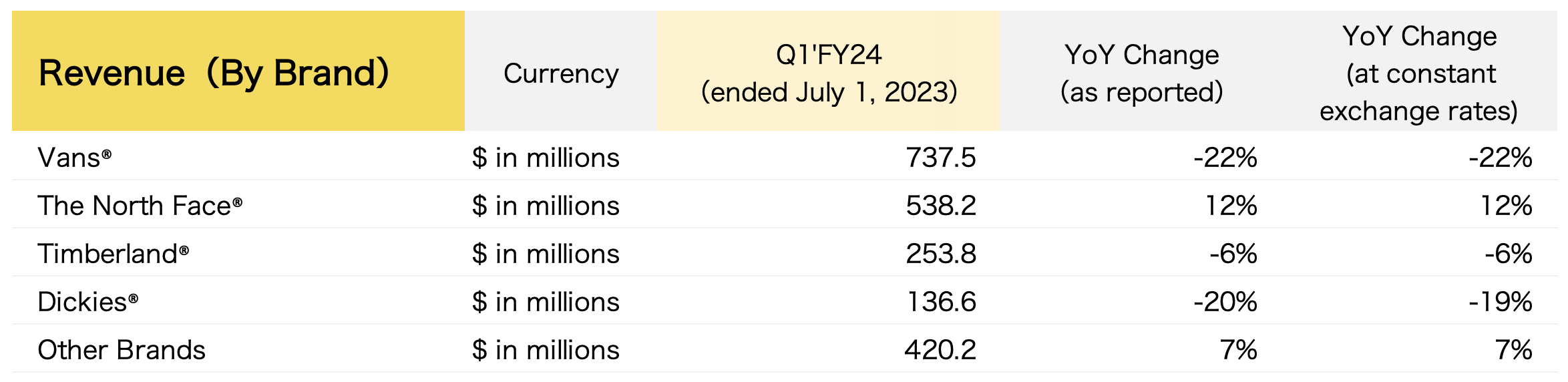

Brand-wise

- The North Face® achieved double-digit growth for the tenth consecutive quarter, with a remarkable increase of 12% on a constant currency basis. Notably, The North Face remains a major driver of growth for the group in the Asia-Pacific region, benefiting from the tailwinds in the outdoor market and the recovery of domestic tourism, leading to over 50% growth in the Greater China region.

- Vans® faced a decline of 22% in sales revenue on both constant and actual exchange rates, influenced by the negative impact of the Americas’ wholesale business (39% decrease on a reported basis and 40% on a constant currency basis). However, efforts to turn the brand around are still ongoing.

Channel-wise

- Direct-to-Consumer (DTC) channel declined by 3%, but excluding the Vans® business, this channel recorded growth of 6% on a constant currency basis.

Market-wise

International markets achieved 3% growth, increasing by 4% on a constant currency basis, with the following highlights:

- Greater China region experienced a remarkable 24% year-on-year growth, rising by 31% on a constant currency basis, leading to a further 13% growth in the Asia-Pacific region (18% on a constant currency basis).

- EMEA region (Europe, Middle East, and Africa) witnessed a revenue decline of 2%, or 3% on a constant currency basis, mainly due to the ongoing growth of DTC channel but a decline in the wholesale channel.

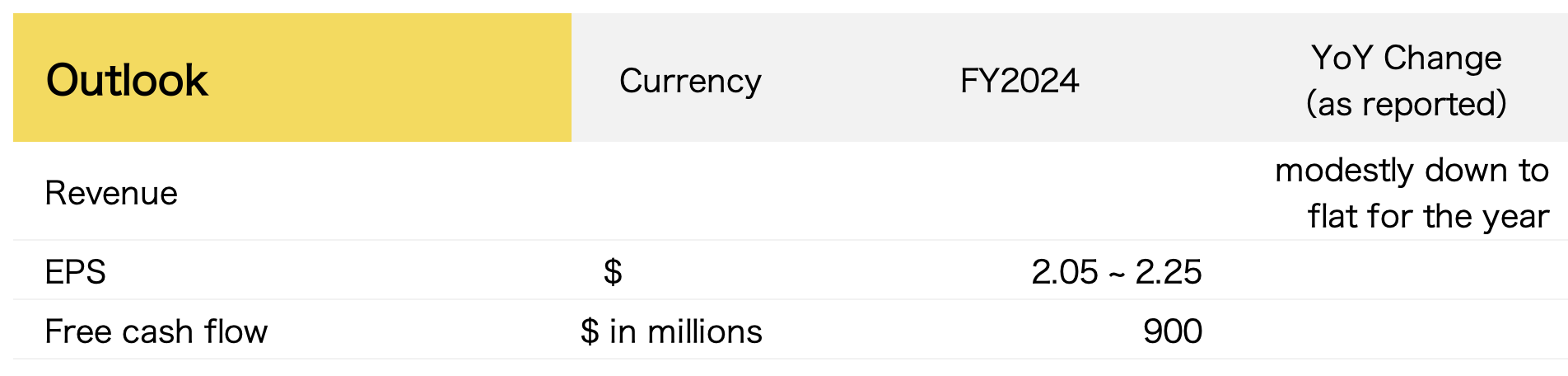

Based on these results, VF Corporation provided its performance outlook for the 2024 fiscal year, expecting revenue to slightly decrease or remain flat. The primary reasons for this expectation are the continuing weakness in the group’s wholesale business and the longer-than-expected recovery time for Vans:

Puckett commented, “While our Q1 performance is not reflective of our standards, we achieved our earnings target in the quarter. We remain focused on improving our operational execution, although it will take time for our revenue performance to benefit from actions that are underway. We are well positioned to advance our key priorities this year with an emphasis on increasing operating earnings through improved gross margins, generating healthy cash flow and reducing debt, all of which lead to a strengthened financial position.”

| Source: Official Financial Report, Conference Call

| Image Credit: VF Corporation Website

| Editor: Wang Jiaqi