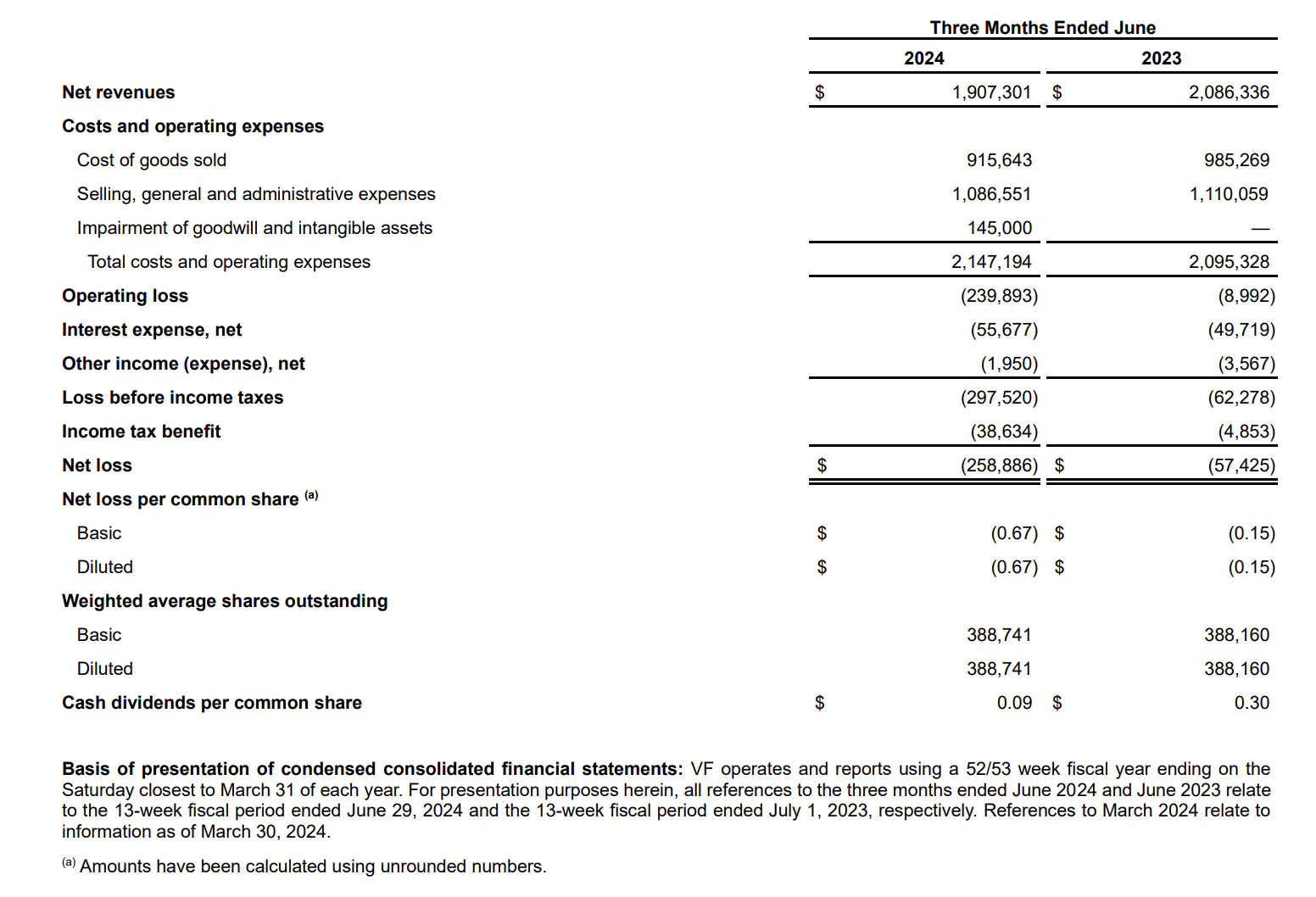

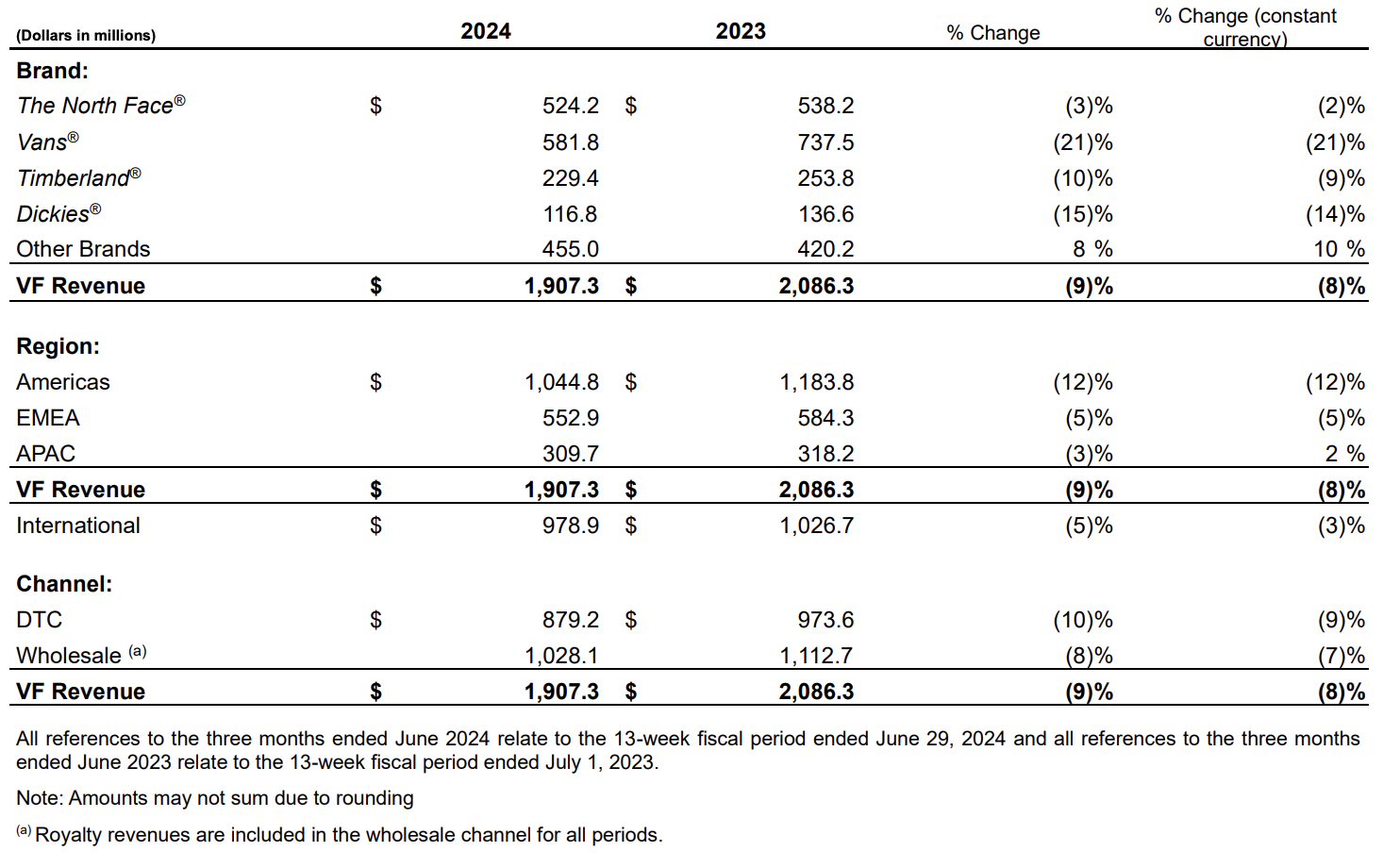

On August 6, Eastern Time, after the market closed, VF Corporation (NYSE: VFC), the American apparel giant and parent company of outdoor and streetwear brands such as The North Face, Vans, Timberland, and Supreme, announced its key financial data for the first quarter of fiscal year 2025, ending on June 29, 2024. The company reported a 9% year-over-year decline in revenue to $1.91 billion (a decrease of 8% at constant exchange rates). Operating loss and net loss further widened to $240 million and $259 million, respectively (compared to $9 million and $57.43 million in Q1 fiscal year 2024).

By region, the Asia-Pacific region achieved steady growth with revenue increasing by 2% year-over-year at constant exchange rates. Notably, the Greater China region showed strong overall performance, with revenue growing 4% year-over-year at constant exchange rates, making it one of the best-performing major markets. Among the brands, The North Face had particularly strong performance in the Asia-Pacific region, recording a 35% year-over-year growth.

Marvin, President of VF Corporation Asia-Pacific, stated, “China has long been an important market in VF Corporation’s global strategic landscape. Despite the changing external environment, the Chinese market continues to demonstrate strong resilience and immense potential. We remain confident in the robust growth of the Group and its brands in China.“

Bracken Darrell, President and CEO of VF Corporation, commented, “As I complete my first year at VF, I feel more energized than ever. While the business is still down, the rate of decline moderated quarter-over-quarter versus Q4 and across almost all our brands. We advanced further on the Reinvent transformation plan. We are on track to deliver our targeted cost savings and we have addressed one of our top financial priorities to strengthen the balance sheet with the announced sale of Supreme. Together with the first-class leadership team I have built, we are confident we will continue to make progress to return to growth and drive strong, sustainable value creation at VF.”

Last month, VF Corporation announced the sale of its iconic New York streetwear brand Supreme to European eyewear giant EssilorLuxottica for $1.5 billion. The transaction is expected to be completed by the end of fiscal year 2024. Supreme is expected to cease operations by the second quarter of this fiscal year.

On the day following the earnings release, as of the close on August 7, VF Corporation’s stock price rose 7.1% from the previous trading day to $17.6 per share, with a current market capitalization of approximately $6.847 billion.

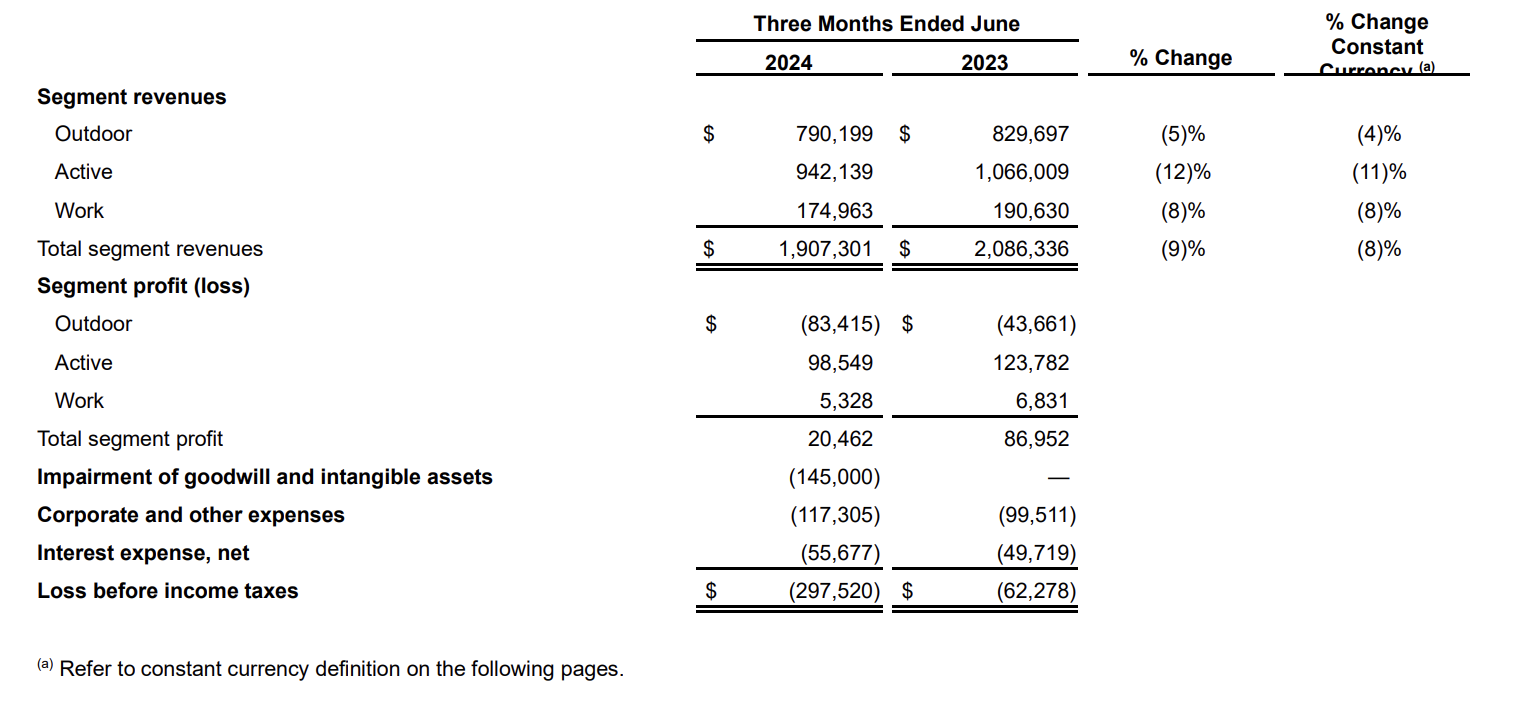

As of June 29, the key financial data for the first quarter of VF Corporation’s fiscal year 2025 are as follows:

— By brand, region, and channel:

— By Business Line:

|Source: Official Financial Report, VF China WeChat Account

|Image Credit: Official Website

|Editor: Wang Jiaqi