Japanese sports giant Asics Group announces the sale of its Swedish outdoor sportswear and equipment manufacturer Haglöfs AB to Hong Kong Investment Company LionRock Capital Aspire (HK) Limited. The deal was completed on December 18, with the specific amount yet to be disclosed.

Founded in 2011, LionRock Capital manages assets exceeding HK$9 billion, focusing on investments in the consumer sector and operating offices in Hong Kong, Shenzhen, and Zurich. Its founding partner, Jiang Jiaqiang, serves as co-CEO, CFO, and executive director. Renowned Chinese athlete and entrepreneur Li Ning serves as the non-executive chairman of LionRock Capital, and Li Ning Company is a limited partner in one of LionRock Capital’s funds. On March 15, 2021, LionRock Capital acquired the majority stake in the British traditional footwear brand Clarks for £100 million.

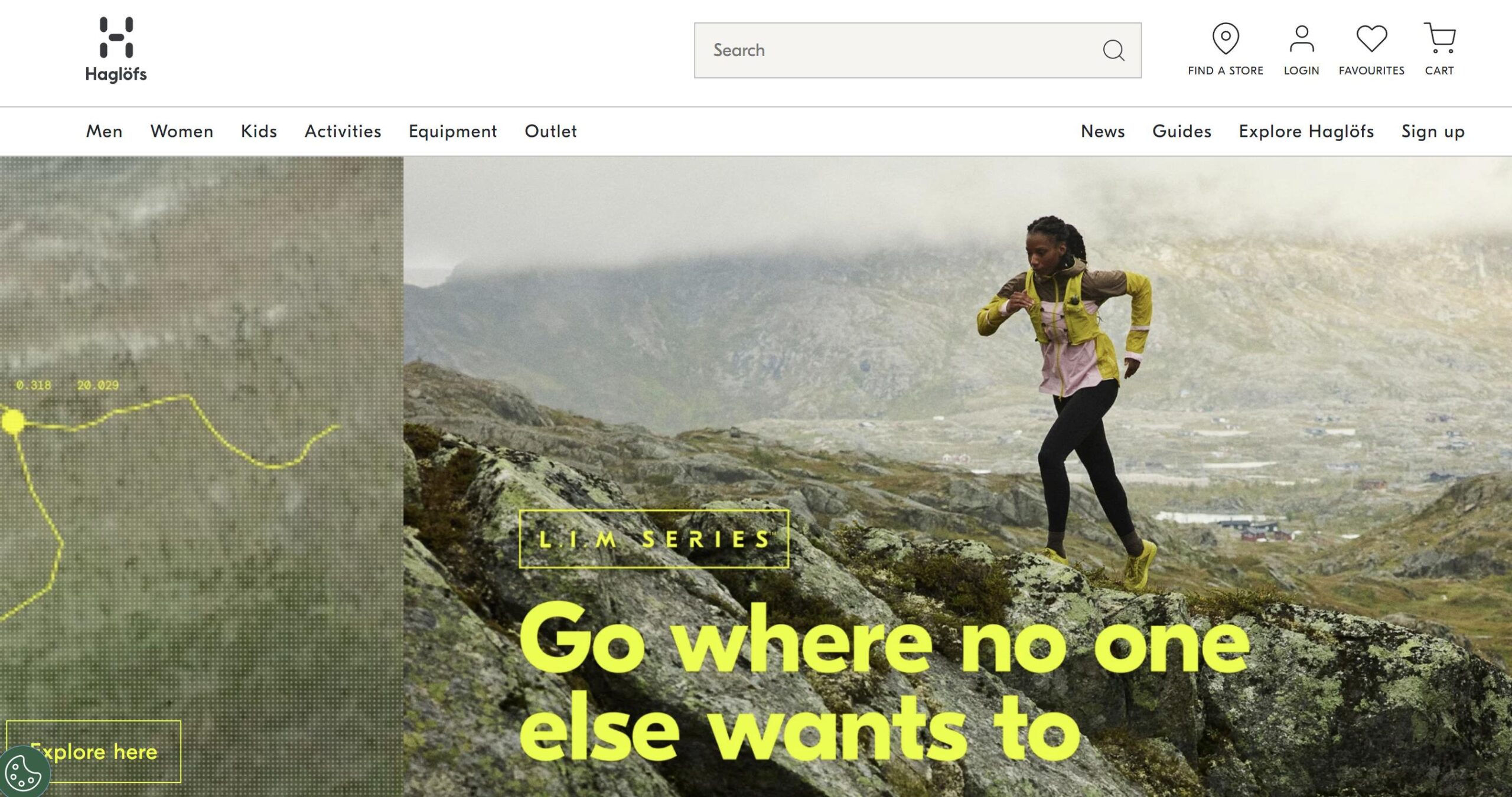

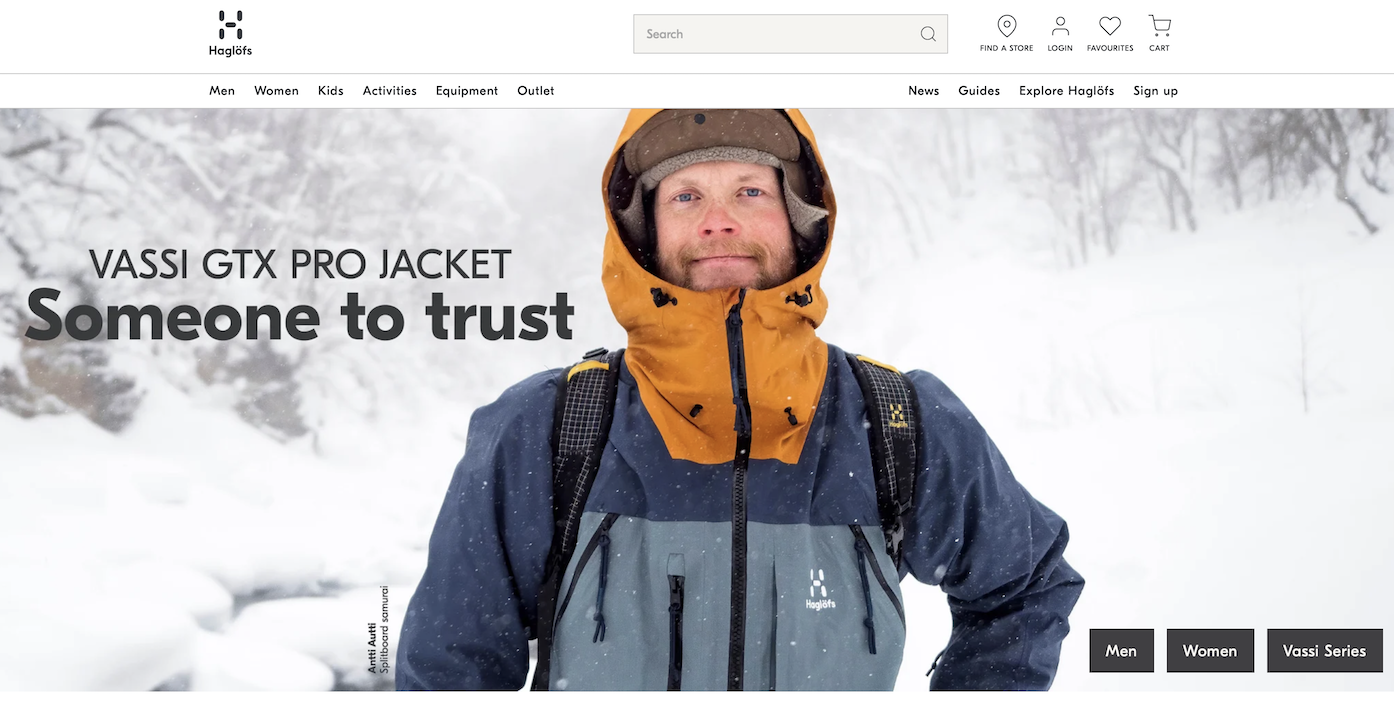

Established in 1914 and headquartered in Avesta, Sweden, Haglöfs specializes in the design, production, and sale of outdoor apparel and equipment, including backpacks, sleeping bags, clothing, and footwear. The brand is highly regarded in European and Japanese markets for its high-value, high-performance outdoor products.

In 2010, Asics acquired Haglöfs for 11.3 billion yen (1 billion Swedish krona) from the Nordic Ratos Group, aiming to enhance corporate value through the integration of group management resources, technology, craftsmanship, production facilities, and sales networks. In 2016, Asics further integrated the Haglöfs brand and promoted its expansion into the lifestyle sector.

Since its acquisition by Asics, Haglöfs has expanded its market share in Northern Europe and Europe and improved profitability through strengthened marketing efforts.

Asics stated that the transaction aims to find a new partner for Haglöfs to achieve new growth and development under their support, “and is also a significant decision made by the group’s shareholders. After the completion of the transaction, the Asics Group will focus its resources on core running and related businesses, accelerating investments to achieve its goals by 2026.”

LionRock Capital’s founding partner, Daniel Tseung, said, “Haglöfs fits seamlessly into our portfolio and evidences our commitment to acquire well understood heritage brands with best-in-class products. We are excited to embark on a new journey with the company to expedite its growth both in the European market and beyond.“

Tom Pitts, Head of LionRock Capital Europe, added: “We have long admired Haglöfs as a brand which shares our commitment to sustainability and is embodied by its passion for the environment and the natural world and to tackling the climate issues we face. An unwavering consideration of the next generation drives Haglöfs to produce quality products which are made to last and shapes its entire business approach. Haglöfs thinks differently, takes action and is willing to stand apart from others.”

| Source: Official Press Release, Fashionsnap

| Image Credit: Haglöfs Official Website

| Editor: Wang Jiaqi, LeZhi