U.S. outdoor apparel group Columbia Sportswear has successfully reversed its decline in the Chinese market over the past three years. While net sales in China declined year-over-year in 2022, recovery began in 2023, and by 2024, China had become the brand’s fastest-growing single market.

According to Columbia Sportswear’s full-year 2024 earnings report released in early February, the group’s net sales decreased 3% year-over-year to $3.3686 billion on a constant currency basis. However, sales in Latin America and the Asia-Pacific region, driven by growth in China, saw the strongest performance with an 11% increase, followed by the EMEA region (Europe, the Middle East, and Africa) with an 8% rise. These gains helped offset declines in the U.S. (-8%) and Canada (-10%).

During the earnings call following the report’s release, Columbia Sportswear’s Chairman, President, and CEO Timothy Boyle specifically praised the Chinese market. In the fourth quarter, net sales in China achieved double-digit growth, with both wholesale and direct-to-consumer (DTC) channels demonstrating healthy momentum. For the full year, the Chinese market grew by over 20%, making it the best-performing single market.

Boyle noted that the outdoor industry in China is experiencing a strong growth trend, driven by increasing consumer interest in outdoor activities and brands. “By engaging with consumers through meaningful brand campaigns, localized product collections, and a strong digital strategy, we have successfully capitalized on this trend,” he said.

“We expect China to once again be our fastest-growing market in 2025,” Boyle added.

During the meeting, Tim Boyle candidly acknowledged, “We have always been aware that in certain markets, particularly China, our past performance was not ideal.” He then provided further insights into the key factors driving the brand’s growth in the Chinese market.

1. Strong Digital Strategy

In 2024, e-commerce was the fastest-growing channel for Columbia in China. The brand expanded its presence on Douyin (China’s version of TikTok), launching new stores focused on women’s apparel and footwear. During major sales events like Singles’ Day (Double 11), Columbia executed successful brand campaigns and participated in Tmall and Douyin’s Super Brand Day, achieving significant results.

2. Localized Product Collections

Columbia’s Transit Collection, designed specifically for Chinese consumers, performed exceptionally well. To maintain this momentum, the brand plans to further expand its localized product offerings in China this year.

The Columbia Transit Collection was first launched in early 2023 to cater to the rising demand for outdoor gear in the Chinese market.

3. Retail Strategy Adjustments

From an operational standpoint, Columbia’s leadership in China has prioritized the performance of high-efficiency stores. Previously, the brand relied more on a bi-quarterly assessment strategy. Now, the leadership team closely monitors the monthly performance of each store, a shift that has yielded substantial success.

According to Luxe.CO Intelligence, in 2024, Columbia opened stores in key cities such as Hefei MixC, Beijing Changying Paradise Walk, Wuhan MixC, Nanjing Central Mall, Chongqing Raffles City, Kunming Hang Lung Plaza, Guangzhou Grandview Mall, and Fuzhou MixC. Additionally, stores in Beijing Scitech Premium Outlet Mall, Zhengzhou Dennis David City, and Shanghai Nanxiang Impression City underwent renovations and reopened.

4. Outstanding Leadership Team

Boyle emphasized that Columbia’s success is ultimately driven by its people. “This is a people-centric business. We have exceptional leadership teams in these markets, and as we encourage them to focus on products that resonate with their specific markets, we are seeing better results.”

Through strategic product offerings, marketing initiatives, and market strategies, Columbia is committed to delivering a more premium brand experience for Chinese consumers.

| Source: Columbia Sportswear earnings call

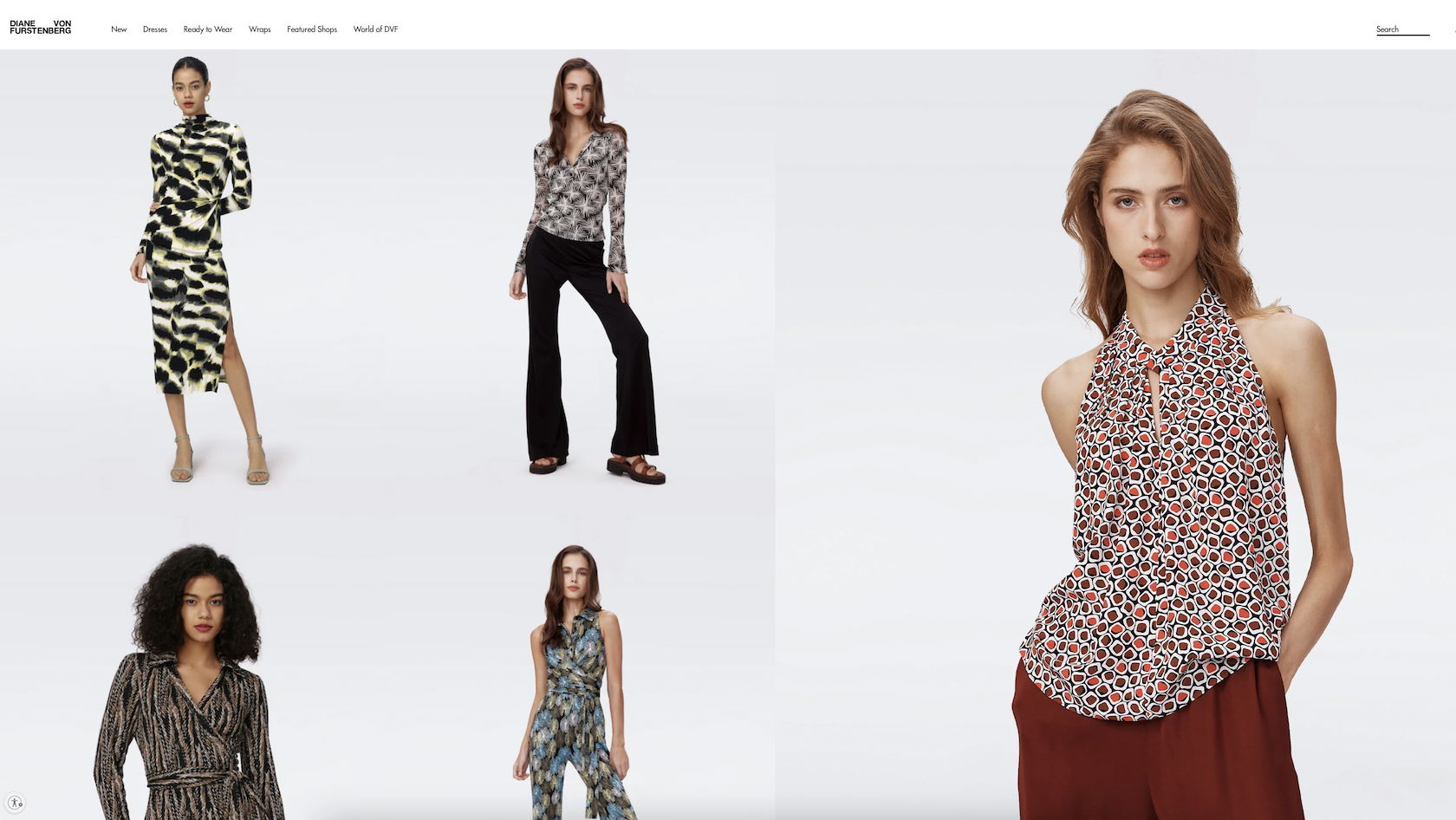

| Image Credit: Columbia Sportswear official website

| Editor: LeZhi